Zhima Credit – Will Alibaba’s social credit system turn China into a “Black Mirror” episode?

Leveraging machine learning and big data, Alibaba developed the revolutionary consumer finance product Ant CreditPay and Zhima Credit that effectively tapped into the massive lower end consumer market in China. Customers with higher credit scores can have more favorable lending terms and access to better services offline such as not having to pay deposits when renting apartment. But will this turn China into a black mirror episode, where society imposes discrimination based on people's scores?

“Why are you using Ant CreditPay but not credit card?” I asked Selina, my friend who just finished paying for snacks on Taobao with Ant CreditPay, the consumer finance product of Alibaba. “I don’t have a credit card.” She said, “Besides the more I use it, the better my Zhima Credit score will be – You get all the benefits in life like no deposit when renting apartments. Plus, don’t you want to be a trustworthy person with high scores?”

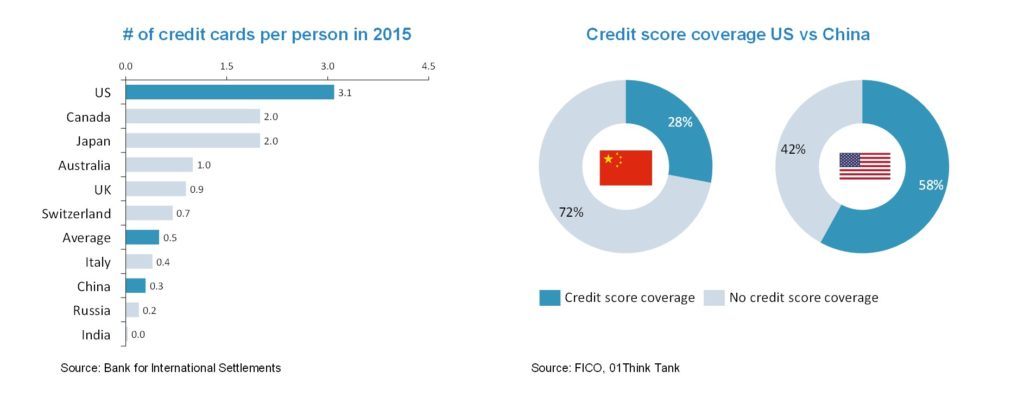

Selina is a typical example of the many financially under-served in China – the average credit card per person in the country in 2015 was only 0.3 compared to 3.1 in US [1]. A major driver behind was the poor retail banking infrastructure – credit score coverage is only 28% [2] vs. 58% in US [3]. As a result, it’s difficult for individuals with lower or unstable earnings to have access to personal financing, as banks don’t have enough data points to make a justified credit decision. The lengthy and burdensome loan application process to obtain data from customer further exacerbated the problem. Many banks even strategically dropped the lower end retail banking segment, leaving huge market blanks to be filled.

Disruption of machine learning (ML) came from Alibaba, the tech giant who had accumulated tons of data through e-commerce and already experienced the power of ML in product recommendation. Leveraging ML to provide consumer financing that banks failed to do was strategically important and represented Alibaba’s next growth engine: tapping into lower-end customer segment on e-commerce by offering credit, generating new revenue streams in lending, collecting customers’ valuable financial data and increasing stickiness of the ecosystem.

To achieve the goal, Alibaba first step out to research and develop a revolutionary credit model. The result was Zhima Credit (ZC), which uses five dimensions to determine a person’s credit-worthiness:

- Identification: education and career background

- Ability to pay back: personal asset e.g. real estate, financial asset, etc.

- Credit history: past credit application and payment info

- Social connections: trustworthiness of friends, etc.

- Behavior: shopping patterns, utility, donation, transfer, etc. [4]

Source: Glotech trends [5]

As can be inferred from above, apart from the few static metrics used in bank models, Alibaba also based its lending decision on large amount of dynamic behavior and social data obtained from its ecosystem and partners. It used deep learning to discover indicators of individual creditworthiness and optimize the model continuously with inputs of actual lending outcome. With this approach, Alibaba was able to address a broader consumer base, not only “the established”, but also “potential winners”- e.g. college graduate without a job but have good social connections. Besides, the credit application is highly automated and efficient: After initial input of information, the credit score and the eligible credit line is calculated automatically, meaning 0 wait time during actual credit application.

The next, relatively long-term step of ZC is to create more scenarios offline and build the credit score ecosystem. Through partnership, ZC allowed users with higher scores to have access to differentiated services e.g. renting bikes/cars/houses without paying deposits and easier visa application for certain countries, e.g. Luxemburg, further increasing the product’s publicity and attractiveness to consumers.

The results were astonishing: About 2 years after initial launch, Ant CreditPay reached 80 Million active users, with 47 % of customers under 30 years old and 60% never used a credit card. [6]

Going forward, I believe the major issue Alibaba faces is how to be more compliant with current standards so that ZC can have broader impact on the society’s financial inclusivity. Recently, under regulators’ coordination, ZC as well as 7 other private credit scoring companies jointly formed an independent credit scoring entity with 36 % government stake and 64% private stake (8% each company). Working with the government in future, ZC needs to apply more strict standards in privacy protection and fairness of the system, as the regulation states that “credit scoring should not be used intentionally to classify people into different classes and status.”[7] ZC’s current approach of offering differentiated services to people with higher scores and tapping into certain data without customer permission may pose regulatory risks in the future.

If ZC is going to fully abide by the regulation, will it lose competitive advantage in its proprietary credit model as certain data can no longer be used? Will this negatively impact the reliability of current model? In terms of fair dealing, will ZC lose attractiveness to customers who see higher score and the associated benefits as a social status? Many questions remain open, but there is one we know for sure: Not turning China into a “Black Mirror” episode and playing by the rules is the only way ZC can have sustainable impact in China.

790 words

Source:

[1] Bank for International Settlements, quoted in Mancy Sun, Piyush Mubayi, Tian Lu, Stanley Tian, “The Rise of China FinTech”, Goldman Sachs, Aug 7, 2017, p38, http://hybg.cebnet.com.cn/upload/gaoshengfintech.pdf, accessed Nov 2018

[2]01Think Tank, “Silicon Valley-Beijing Dialogue 2017”, Sep 25, 2017, http://www.01caijing.com/article/17816.htm, accessed Nov 2018

[3] FICO Company, “ABOUT”, https://ficoscore.com/about/, accessed Nov 2018

[4] Zhima Credit Company, “Zhima Credit”, https://www.xin.xin/#/detail/1-2-0, accessed Nov 2018

[5] Glotech Trend, https://glotechtrends.com/zhima-credit-car-renting-171129/, accessed Nov 2018

[6] cnstock, “Ant CreditPay reached 100M users”, http://news.cnstock.com/industry,cyqb-197001-3940533.htm, accessed Nov 2018

[7]PE daily, “The credibility crisis of Zhima Credit: why did regulator make inquiry on Zhima Credit? What is the root cause of the trouble?”, https://news.pedaily.cn/201801/425941.shtml, accessed Nov 2018

I was really excited to read about what Alibaba is trying with Zhima Credit, but was similarly concerned by the questions of fairness and regulatory compliance that the author raised. It’s a similar challenge that the US credit rating bureaus faced in the wake of the Equifax data leak. I think they can proactively address this in three ways: (1) be transparent with customers about how data is gathered and how scores are formed; (2) work in partnership with government other credit-rating financial institutions to lay out industry-wide ground rules; and (3) create feedback loops for users. If credit scores are both more widely accessible to underbanked individuals AND seem like less of a black box, everyone (including Alibaba) will win.

I suspect people are willing to give up bits of their personal data to gain access to personal credit. As you rightly pointed out, a line needs to be drawn somewhere. Otherwise we run the risk of unfairly penalizing people for behavioural factors that exhibit correlation but not causation to lower credit rating. There needs to be transparency in showing consumers how their Zhima Credit scores are derived and for the industry to establish standards on what are acceptable data inputs to keep it within ethical bounds.

Great contribution.

The government having a stake in the new ‘independent’ credit scoring entity with the 7 other players is very disturbing. Is the government goal to have access to all the financial information of the customers and if so, what will they do with it. The sector is relatively new and the legislator have to write law but there is not need for a government investment to control the capital structure of this entities. A clear line need to be drawn

I really enjoyed reading your take on this.

Clearly, the Zhima Credit system as China’s first credit system has a lot of benefits to both the consumers and businesses. It is essentially a modern day version of the escrow product Alipay, which helps resolve the lack of trust between merchants and customers. ZC does the same thing by backing up individual user’s ability and probability to repay the merchants, and thus facilitating a transaction or an investment that otherwise may not happen. This is an incredibly impactful value-add in China since we don’t have a formal credit system and the traditional lending system is not friendly towards farmers and other unbanked population.

And I share you concern on the collaboration with the government and on whether some of Zhima Credit’s features are discriminatory. It is important for Ant to continue to innovate and demonstrate the value of its system to the government, while protecting data privacy and social equality.