XPO Logistics (XPO): Attempting to Bring the Truckload and Less-than-Truckload (LTL) Industries into the Twenty-First Century

In stark contrast to the airline and auto industries, the trucking industry continues to remain stuck in a time warp. Will XPO Logistics (XPO) – a leading provider of LTL services – be able to successfully harness machine learning and AI to improve its pricing and capacity utilization algorithms? More importantly, can machine learning help to solve the long-term problem of driver shortage that is facing the US trucking industry?

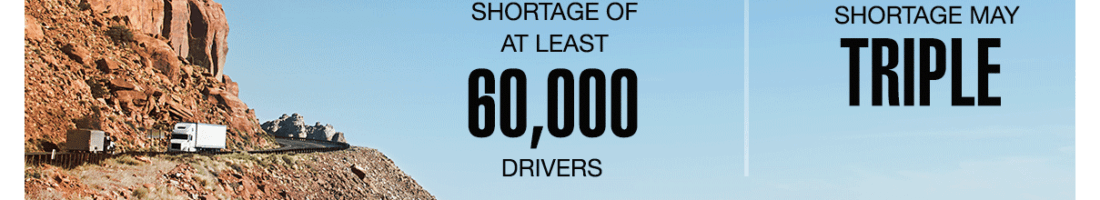

The truckload industry is one of the largest employers in the US, with over 3.5 million professional drivers hauling ~63% of freight (by value) in 2017 [1]. Moreover, the amount of freight transported in the United States is expected to grow by almost 40% over the next decade, with the trucking industry expected to shoulder most of that growth [2].

Source: Bureau of Transportation

Major Challenges Lied Ahead:

Despite the strong growth in demand, the trucking industry faces significant challenges both in the short term and long term:

(1) The trucking industry is one of the most fragmented industries with the vast majority (~90%) of drivers working in mom-and-pop shops that employ fewer than 6 truckers on average [3]. As a result, these companies are price takers (rather than price setters), and their small size and capital constraints precludes them from investing in machine learning to make better pricing and capacity utilization decisions. The usage of stale pricing models in the trucking industry (which often short changes the truckers) stands in stark contrast to the airline industry, which has been using dynamic pricing models to allow flight prices to respond in real-time to fluctuations in demand for years.

(2) Truck driver pay has failed to maintain pace with inflation as low prices for hauling loads suppresses the ability of trucking companies to provide wage increases to the drivers. Wages have fallen by a third in real terms since 1980 [4].

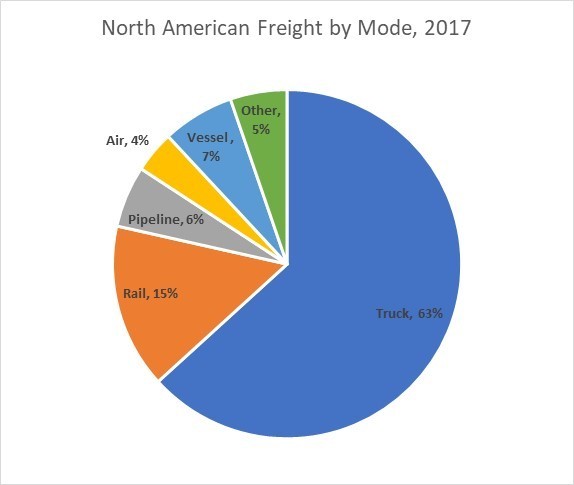

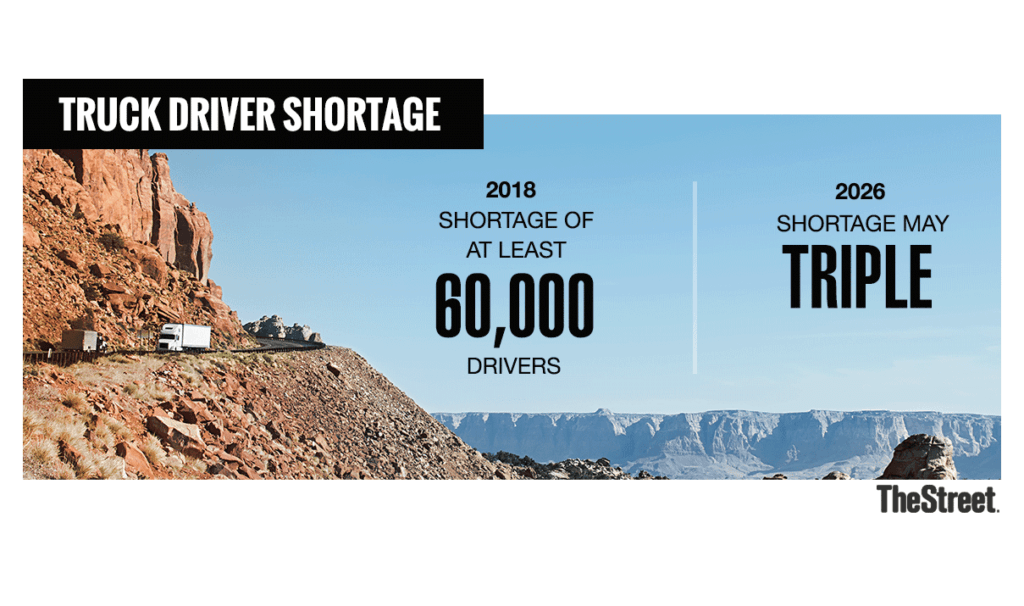

(3) Trucking is an onerous profession, which requires its drivers to often spend long, solitary stretches of time away from home. As a result, few people want to enter trucking, which in combination with a demographic shift (the trucking industry is currently two-thirds white and 94% male) has resulted in a shortage of 50,000-60,000 drivers, which is only expected to rise in the foreseeable future [5].

Source: TheStreet

Can XPO Start a New Trend?

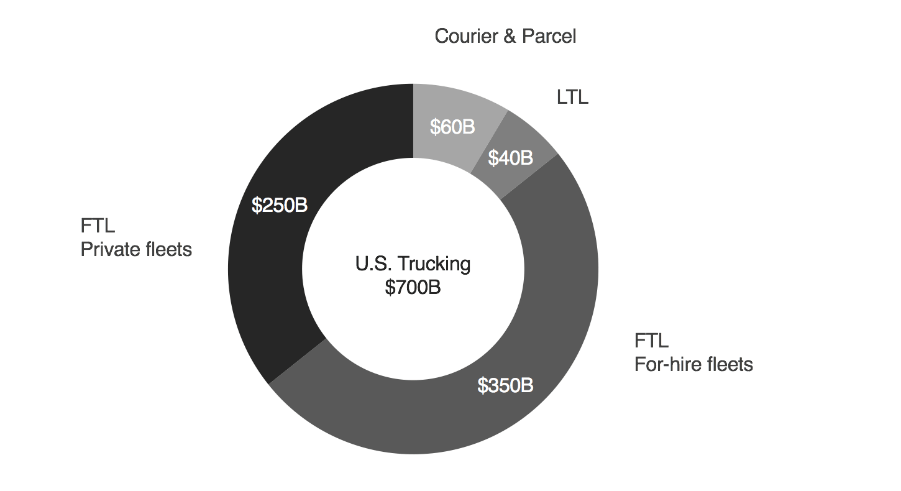

Amidst this gloom, XPO Logistics represents a potential breadth of fresh air. XPO focuses on LTL, which is a niche of the overall trucking industry, and represents ~7% of the $700 billion trucking market [6]. In contrast to the overall truckload industry, the LTL industry requires significant capital investments to set up a hub-and-spoke network. As a result, the LTL industry is more consolidated with the leading players having the resources to invest in technological advancements.

Source: https://medium.com/@sambokher/segments-of-u-s-trucking-industry-d872b5fca913

However, despite this greater concentration, the LTL industry has so far continued to lag behind other transportation industries in using data appropriately. The LTL industry currently has a complex methodology for pricing freight, which entails using several classification characteristics, including dimensions, stowability, and density. This is further complicated by company tariffs and rules that often date back decades, with additional discounts layered on [7]. The complexity of this system means that XPO cannot let prices respond in real-time to changes in demand, which prevents the company from capturing potential pricing gains and limits the company’s ability to utilize its capacity efficiently.

In order to fix this issue, XPO is investing in using AI-based load-building tools, linehaul planning algorithms, pricing algorithms, and dynamic route planning for pickup and delivery over the next two years, which will allow it to respond to customer requests for pricing “by the minute” instead of using two-week old data [8]. In the longer term, AI should also improve capacity utilization by informing the company of what sequence to load the truck as well as the most logical schedule for picking up and drooping freight and for moving freight between terminals. XPO expects AI to improve its operating income by more than $100m, which represents a ~20% increase on 2017 adjusted operating income levels [9].

Can Machine Learning Make a Leap from LTL to TL?

Given the significant pricing and cost savings associated with investing in AI, XPO should utilize the knowledge it gains to set a new standard for setting price in the truckload industry as well. The big question continues to remain around the right pathway to achieve this. Given the small size of TL companies and low barriers to entry, I believe XPO should shake up this market through a series of acquisitions which gives it scale in at least certain lanes to start using dynamic pricing. The trucking industry is almost 15x larger than the LTL industry – thus improvements in pricing and capacity utilization will reverberate more loudly by allowing drivers to capture a greater share of the pricing gains, which in turn could attract more drivers thus helping to alleviate the driver shortage.

Open Questions:

(1) What role can autonomous trucks play in alleviating the truck driver shortage?

(2) How does XPO convince other mom-and-pop truckers to invest in machine learning and AI given the capital constraints faced by these firms? How does XPO involve itself more in the TL sector – through organic growth or through acquisitions?

(780 Words) Sources:

[1] Bureau of Transportation Statistics, TransBorder Freight Data, https://www.bts.gov/transborder as of February 2018.

[2] https://blog.marketresearch.com/the-global-trucking-industry-and-the-role-of-artificial-intelligence

[3] https://medium.com/@sambokher/segments-of-u-s-trucking-industry-d872b5fca913

[4] https://www.overdriveonline.com/trucker-pay-has-plummeted-in-the-last-30-years-analyst-stays/

[5] https://www.nytimes.com/2018/07/28/us/politics/trump-truck-driver-shortage.html

[6] https://medium.com/@sambokher/segments-of-u-s-trucking-industry-d872b5fca913

[9] XPO 2017 Financial Reports

Note: Featured image taken from TheStreet

Do you think we need to wait on autonomous vehicles to fix the driver shortage? Some predictions will tell you we are 5 years away from fully autonomous vehicles on the road. Other predictions require infrastructure and legislative updates before we see wide spread adoption of autonomous vehicles; placing adoption of truly driver-less vehicles at 2-3 decades away. Currently, only 11ish states allow testing of autonomous/semi-autonomous vehicles on the road today (I believe the line is drawn at L4/L5 automation). The driver shortage has remained the number 1 issue in the trucking industry for 5-10 years and is ripe for a solution.

I think XPO takes a step towards a possible intermediary solution with their competitive pricing of revenues and wages. I wonder if they could use their dynamic route planning algorithm to plan routes that allow trucks to get home to their families every night and alleviate some of the difficulties of being a long haul truck driver.

Very interesting article! I wish the students were given a bit more room to write about the topics selected. It could be useful to spend a bit more time explaining the main challenges between LTL and TL for example. A few questions that came to my mind while reading your article :

– What is the impact of companies such as Uber on the fragmented trucking industry? (https://www.uberfreight.com/)

– Can we foresee, before deployment of AI and ML, other solutions being considered to improve the situation? (mom-and-pop shops consolidation into a third party player/intermediary to consolidate shipments and set prices?)