Water Usage in Onshore Oil and Gas: Pioneer Natural Resources Leading the Way

Pioneer Natural Resources: Leading the Way in Onshore Oil and Gas Water Use Responsibility

Increased Water Usage in Onshore Oil and Gas

Since the collapse in oil prices and subsequent oil industry downturn began in late 2014, onshore oil and gas exploration and production companies (“E&Ps”) in the United States have discovered that increasing the amount of water used to hydraulically fracture new oil wells improves oil recovery and investment returns.

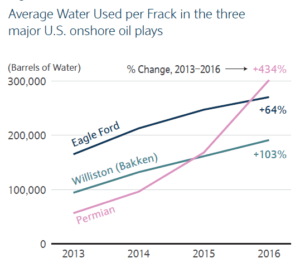

For each new well, E&Ps procure water, mix it with sand and chemicals and then inject it “into the well at high pressures with the intention of creating small cracks in the rock formation of the well. The fissures allow gas and oil to escape from the well and rise to the surface” [1]. In the Permian Basin region of West Texas, which is one of the most prolific onshore oil basins, oil companies using more water has the potential to put pressure on local water supplies. “A combination of multiyear droughts, low groundwater levels and competition with the agriculture industry…means it is highly water stressed” [1][2]. According to data shown in the chart below cited by Barclays in a recent report and gathered by Digital H2O, an oil and gas water data company, the amount of water used per well in the Permian Basin has increased from ~60,000 barrels per well in 2013 to 300,000 barrels per well in 2016 [1].

As one of the largest Permian-focused oil and gas companies, Pioneer Natural Resources has been proactive in its approach to fresh water supply concerns in the region and continues to set an example that other companies should follow. Not only will their constructive approach to the issue be critical to their long-term success operating in the region as a member of the local community but will also allow them to continue attracting capital as institutional investors become increasingly focused on environmental responsibility metrics.

Pioneer Natural Resources Water Strategy

Pioneer Natural Resources (“Pioneer”) is an oil and gas exploration and production (“E&P”) company focused predominantly developing assets in the Permian Basin region of West Texas. In an effort to address the concerns of residents and regulators concerned about local fresh water supplies, the company, through its subsidiary Pioneer Water Management LLC, has focused on securing “supplies of non-potable, non-fresh water”, including “effluent (waste) water, brackish water and recycled produced water” [4].

To minimize the use of fresh water in the short-term, the company has invested in the development of brackish water resources across their acreage and designed their hydraulic fracturing chemistry to allow for the use of brackish water in their operations [4]. While these efforts have resulted in the avoidance of potable water in the company’s operations, the company has taken actions to address this concern over the medium-term as well such as executing agreements with local municipalities to purchase wastewater treatment plant effluent and use it in their operations [3][6]. Recently, Pioneer reached an agreement with the City of Midland, Texas under which the company would fund upgrades to the City’s water infrastructure in exchange for the right to purchase up to 2 billion barrels of wastewater from the City’s treatment system over the next 28 years for $.029 per barrel [1].

Additional Steps

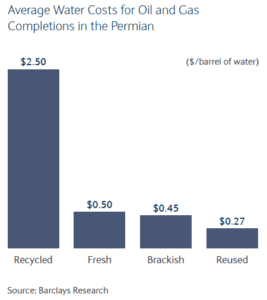

While the use of brackish water and effluent from municipal wastewater systems are steps in the right direction, Pioneer needs to continue focusing on developing water reuse technology and infrastructure as highlighted in the company’s 3Q2017 investor presentation [5]. By focusing internal resources on developing the company’s reuse capabilities, Pioneer not only will eliminate the need to source any incremental water, alleviating pressure on local supplies, but should also be able to further reduce operating expenses. According to research from Barclays and the Columbia Water Center shown in the chart below, reused water is the cheapest source in the Permian Basin at $0.27 per barrel [1][2].

In addition to advancing reuse internally, Pioneer should also form a coalition of industry stakeholders to fund water recycling (taking water to fresh water standards vs. hydraulic fracturing reuse standards) technology research in an effort to lower the cost and promote full recycling across the industry.

Over the last few years, Pioneer has proven its commitment to preserving the water resources of West Texas. However, the company must continue not only to reduce and eventually eliminate the use of fresh water across its operations but also facilitate other companies in the industry to do so.

There are many questions that remain in the industry related to water usage. For example, is it possible for Pioneer to fully eliminate the use of fresh water given their growth plans? Additionally, will water recycling, which would allow for water generated from oil and gas activities to be used in other industries such as agriculture, ever become economical?

(780 words)

[1]Barclays and Columbia Water Center. “The Water Challenge: Preserving a Global Resource”. https://www.investmentbank.barclays.com/content/dam/barclaysmicrosites/ibpublic/documents/our-insights/water-report/ImpactSeries_WaterReport_Final.pdf. March 22, 2017. Accessed November 2017.

[2] Albanese, Nick, Garbaczewski, Bartosz, Goel, Siddharth, LaSalle, Angela, Liu, Chunru, Liu, Qing, Utami, Willa, Wang, Yuanyang. “Water Usage in U.S. Unconventional Drilling”. Masters of International Affairs Graduate Student Capstone Report, SIPA, Columbia University. https://sipa.columbia.edu/academics/capstone-projects/water-and-unconventional-oil-gas-development-exploring-economics. 2016. Accessed November 2017.

[3] Anna Drivers. “In Downturn Frackers Turn to Toilet Water in Drought Prone Texas”. https://www.reuters.com/article/us-pioneer-natl-rsc-fracking-water/in-downturn-frackers-turn-to-toilet-water-in-drought-prone-texas-idUSKCN0QQ0CA20150821. August 2015. Accessed November 2017.

[4] Pioneer Water Management Website. http://www.pxd.com/operations/water-management. Accessed November 2017.

[5] Pioneer Natural Resources Investor Relations Website. “November 2017 Investor Presentation”. November 2017. http://investors.pxd.com/phoenix.zhtml?c=90959&p=irol-presentations. Accessed November 2017.

[6] Cory Paul. “Pioneer Taps City Wastewater”. http://www.oaoa.com/news/government/city_of_odessa/article_3477e9ae-c04b-11e5-87f5-d3dfa6dd7a5a.html. January 2016. Accessed November 2017.

This is an interesting article on an industry attempting to find a solution to what seems the inevitable circumstance that many of these water strapped areas eventually run out of fresh water. While I would be surprised to find that you could ever make fracking water potable again, at least they are out striking deals with other producers of water that is extremely difficult to make potable again (waste water plants).

In any case, I think that this is a somewhat rosy view of an industry that have serious concerns is creating an ecological disaster via fracking. The idea that we are injecting a chemical slurry cocktail into the ground to fracture rocks, while not contaminating the ground water supply, simply does not pass the sniff test, at least for me. It is also likely that I would maintain this stance regardless of any evidence collected by even the purest of investigators and essentially zero chance that I will ever believe research funded by these companies.

Really interesting read. It’s a very serious challenge these companies face. It’s great to see that Pioneer is making attempts at sustainability by using water from waste plants, but if they continue to grow they will inevitably outstrip that supply. Furthermore, it doesn’t seem like there’s enough waste water to go around to feed the industry as a whole, so depending on how important sustainability really is to investors and communities, we may actually see sustainability as a key differentiator in this industry given the limited supply of more eco-friendly water sources.

I’m so torn on this topic. On the one hand, it is so promising to see a company thinking up creative ways to solve a natural resource problem like a shortage of water. They have found a solution that works for the community they are in. That being said, I agree with Richard’s points that there is much more than can be done on this front like finding ways to fully reduce the need for fresh water in their operations.

While I’m impressed with the steps this company has taken, the reason I’m torn is that this company is using a resource (water) to get at another natural resource (gas) that is having a damaging effect on the environment. In effect, this seems to be doubly harming. I think that in addition to reducing their use of fresh water, this company should also be looking at other ways they can counter effect the negative impacts of oil and gas on the environment. Or better yet, invest in renewable energy sources and advocate for a shift in that direction.

Agreeing with a point raised already, I think that the net impact of this initiative might not necessarily reduce the amount of water required to frack new oil & gas reserves. While Pioneer is focusing their water use away from fresh water sources, they will simply go around the problem by buying cheaper “effluent” water. Given that Pioneer has a higher ability to afford untreated water, Pioneer would be moving interest away from water treatment options for the city of Midland, Texas.

In my opinion, a better way to treat this issue is to incentivize the company to invest in fracking technologies that require less water resources, or better yet, waterless extraction technologies. I’m not an expert in this engineering field, but if we have achieved superior extraction in deep waters through the benefit of incremental technologies, why can’t we develop new ways of extracting sublayer resources?

I think the best way how to solve the problem of wasting fresh or recycled water for the purpose of fracking would, in this case, be to stop fracking. As much as I appreciate that Pioneer is trying to lower their costs by using brackish or reused water, I think they should question the environmental damage their operations are causing (e.g. green house gases emitted to the atmosphere, contaminated drinking water).

However, I am realistic and realize this is not going to happen until fracking becomes unprofitable. Until then, I hope they will try to lower their costs as much as possible (along with their competitors) and will try to figure out how to recycle the water used in their production.

I’d like to address two question from this article:

Is it possible for Pioneer to fully eliminate the use of fresh water given their growth plans?

–I’d actually like to re-pose this question as follows: “Is it safe for Pioneer to replace the use of fresh water in its operations with non-potable, brackish, and effluent sources?” My (albeit largely uninformed) understanding here is that the jury is still out on the safety of fracking in general (e.g. reports of flammable tap water on properties allowing fracking abound). Consequently, I’m concerned that such safety concerns could be exacerbated by the use of non-freshwater liquids by Pioneer. Thus, is there really an ecological benefit to employing “lower-quality” or dirty water in these operations? Might the risks of such practices exceed those of depleting freshwater supplies?

Additionally, will water recycling, which would allow for water generated from oil and gas activities to be used in other industries such as agriculture, ever become economical?

–I think this ultimately depends on the futures markets for both petroleum, agricultural products, and water itself. Essentially, I think freshwater would need to become scarce enough to justify high prices of recycled water (while agriculture remains profitable enough, if at all, to be able to afford such prices). The margins on recycled water would also need to be high enough for oil and gas companies to invest resources in said recycling, and I don’t think this is likely should oil prices fall to a point where energy firms cut back on capital expenditures (such as investments in water recycling programs).