Walmart: Ummm…a tech giant ???

In the race to digitize retail over the next decade – I bet my money on the retail behemoth!

But… what the heck is digitization?

Many companies define this differently. Is it a conversion of information into digital format or a transition from offline to online business? Beyond language, most companies agree- the need to digitize is here, has been for almost a decade and the first ones to transform- will emerge as category winners.

In a recent interview with McKinsey’s strategy leader for Digital[1], he discusses a question that is constantly presented by business leaders: “[What is] the magnitude of the change that digital demands [of us]?” The very fact McKinsey founded a Digital Labs service line (MDL), home to more than 850 recently acquired talent, is in itself proof that the biggest organizations are looking for help in large scale.

The need to adapt the business model and the way the company operates is especially apparent in the retail industry. Enter Walmart – a somewhat late player to the game with just a “minor” advantage – it is the biggest retail entity on the planet, a behemoth.[2]

A giant opportunity for a giant:

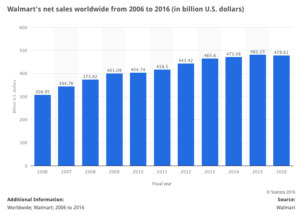

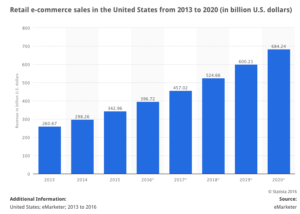

In Walmart’s case the digital strategy was launched to bridge the digital

/physical divide[3] and to combine eCommerce business with best in class physical assets of over 11,000 stores. The opportunity in “going digital back in the early 2000’s was in an emerging market (over $20B), ballooned from $700M since 1996[4]. Last year, the U.S. retail eCommerce market has reached over $340B in sales and is expected to double by 2020.[5] Despite Walmart’s eCommerce being only ~3% of total 2015 revenues, the company is already one of the largest online retailers globally. Walmart is constantly investing (in 2015: reported to invest over $2B over next 2 years[6]) and re-focusing to capture world market growth.

Challenges- are they too late to the game?

Wal-Mart.com (2000) was perceived to be a late joiner and many view Amazon as its greatest eCommerce threat. Amazon was founded 6 years prior and today is valued to have a market cap double that of Walmart.[7]

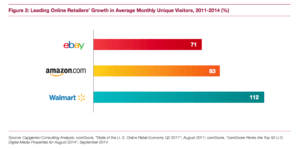

Should Walmart be worried of the “warehouses-innovator-drones-testing-tech-giant?” In fact, Amazon’s revenue has grown X54 in last 15 years while Walmart has only tripled its online sales. Both companies’ financials have been studied by many analysts and most predict – Walmart’s stock over the next decade will outperform Amazon’s. A few key reasons are: Walmart’s position to capture Chinese growth, proven long term profitable growth and robust free cash flow.[7] In fact, between 2011-2014, Walmart has shown a higher growth than Amazon in number of online visitors.[8] One challenge Walmart faces is maintaining leader position on competitive pricing, which seems like has been lost to Amazon on some product baskets.[9] A few others include: talent acquisition, organizational focus and merging brick and mortar and digital culture.

Way of working:

Walmart’s operating model has changed since the early 2000’s- building an internet technology company within Walmart (Global eCommerce), with offices located in Silicon Valley. This organization has its own management team, performance targets and unique talent development. By building a separate organization and setting targets for its unique technology focused talent, they can achieve better delivery on a focused strategy, unrestricted by the legacy organization and culture. Walmart have also established venture groups that invest in companies aligned with the business needs and future aspirations (Jet.com acquisition etc).

All roses from here?

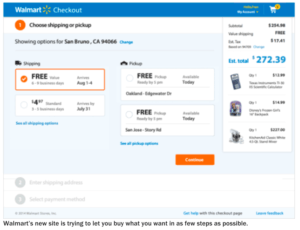

In my opinion, I would focus Walmart on their eCommerce end to end customer experience. I believe the switch to thinking about a different kind of consumer has not been easy for Walmart especially when compared to the SLAs consumers are used to with Amazon. This is apparent in the Walmart.com website UX, return policy, call center quality of service and their online product pricing. All these create an inferior customer experience and lower stickiness. Having said that, who would you bet on long term? Today, Walmart is already winning the talent hiring battle with top tech companies, 70% of the time,[10] so I definitely bet my money on the retail behemoth. (664 words).

[1] How digital is changing strategy, Interview with Jay Scanlan of McKinsey & Co. http://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/how-digital-is-changing-strategy

[2] Walmart ranks 15th on Forbes Global 2000 list of world most powerful public companies, as measured by a composite score of revenues, profits, assets and market value. From: Forbes website: http://www.forbes.com/sites/laurengensler/2016/05/27/global-2000-worlds-largest-retailers/#38123fb329a9

[3] Opening Keynote: “Walmart’s Digital Transformation…” presented by Kelly Thompson, https://vimeo.com/99682654

[4] The Past, Present and Future of E-Commerce, by The University of Kentucky: www.uky.edu/Classes/MKT/390/slides/whatec.ppt

[5] Statista, source: eMarketer, https://www.statista.com/statistics/272391/us-retail-e-commerce-sales-forecast/

[6] The Wall Street Journal, http://blogs.wsj.com/cio/2015/10/14/wal-mart-to-pour-2-billion-into-e-commerce-over-next-two-years/

[7] Walmart vs Amazon, Economist 2016 Investment Case Competition, http://www.economist.com/sites/default/files/shidler_college_of_business_ws.pdf

[8] Capgemini Consulting Analysis; comScore, “State of the U. S. Online Retail Economy Q2 2011”, August 2011; comScore, “comScore Ranks the Top 50 U.S. Digital Media Properties for August 2014”, September 2014

[9] The New York Times: Walmart Plays Catch-Up With Amazon, Oct 2015, http://www.nytimes.com/2015/10/23/business/walmart-plays-catch-up-with-amazon.html?_r=0

[10] Forbes, Mar 2016, http://www.forbes.com/sites/alexkonrad/2016/03/07/walmart-cto-talks-winning-hires-and-tech-in-silicon-valley/#3864507f46d0

In the fully digitized world, there must still be a place for traditional retailers with traditional models. If anything they still offer an experience to consumers that digital marketplaces cannot offer. With that said, Walmart will still head into the digital world in full force, building out their ecommerce capabilities and perhaps extending into other aspects of the digital economy, such as investing in marketplace models or social media. Many retailers are facing this digitalization pressure and determining how to best respond. It will be interesting to see whether the pendulum swings too far in one direction, where retailers over-invest in ecommerce strategies despite their lack of competitive advantage in that arena.

One major challenge I see with Walmart is its retail footprint (and associated labor costs) as consumer preferences shift toward e-commerce. I would be curious to see how they deal with their brick and mortar business going forward – a significant challenge Amazon will not be faced with.

My initial concern upon reading this post was that Walmart seemed to be consolidating all their Walmart.com work under their new Silicon Valley-based team. I worried that as the online and in-store experiences were developed by separate teams in different locations, the customer experiences delivered by those two channels might lack cohesion. However, it appears Walmart has already anticipated and addressed that concern. Early this year, Walmart integrated the tech team at their Arkansas headquarters with the Silicon Valley-based tech team (1). That move increases my confidence that Walmart will be able to deliver an increasingly relevant online/mobile experience that remains true to the company’s overall brand.

(1) Phil Wahba, “Walmart Merging Arkansas, Silicon Valley Teams to Speed Up New Tech,” Fortune, January 16, 2016, http://fortune.com/2016/01/16/walmart-tech-siliconvalley/, accessed November 20, 2016.

Thanks for posting. I am concerned that Walmart will not be able to transition into the digital world fast enough and may very well be too late. In 2016, Walmart will close 269 stores which will affect roughly 16,000 employees. In addition, Walmart’s share price decreased by 30% last year (http://money.cnn.com/2016/01/15/news/companies/walmart-store-closings/). I believe this can be attributed to Walmart’s less than appealing online platform and competitors such as Amazon. Although, Walmart is investing in some digital platforms such as online grocery shopping (http://grocery.walmart.com/usd-estore/m/home/anonymouslanding.jsp) they need to improve their existing eCommerce platform and increase investment in transformative technology asap if they are to have any chance of setting themselves apart from competitors.

I really like the most recent (Jet.com) acquisition by Walmart. Jet is a company that has been built on 2 pillars – customer experience and data analytics to ensure every customer pays only for his/her costs. Walmart has historically found it difficult to do both things. This acquisition could prove really fruitful provided Walmart successfully pulls off the integration of Walmart’s stock centers with Jet’s logistics. It also needs to let the Jet team drive all its online efforts because, unlike Walmart, Jet is an online first company which understands the consumer ecosystem. If these things happen, Walmart could soon become a force to be reckoned with in the online world.

http://www.forbes.com/sites/steveolenski/2016/08/16/is-this-the-reason-walmart-bought-jet-com/#311cda529510

I too think that Walmart has a lot of potential in the digital space, but my biggest concern is around logistics: retail + online = difficult logistics. One of Amazon’s greatest assets is its logistics know-how (http://www.joc.com/international-logistics/logistics-providers/e-tailer-amazon-reshaping-logistics-we-know-it_20160329.html), and I wonder how long it would take Walmart to catch up, assuming that is even possible.

A second major challenge I see prevent Walmart from growing its E-Commerce business is the fact that the majority of existing Walmart customers currently do their online shopping at Amazon.com (53%!) as opposed to just 19% that shop online at Walmart.com (http://blogs.marketwatch.com/behindthestorefront/2014/04/04/wal-marts-in-store-shoppers-prefer-amazon-com-not-walmart-com/). An inability to convert existing customers is a concerning leading indicator that leads me to believe it may be more fruitful for Walmart to market and sell their products on Amazon.com, leveraging Amazon’s B2C logistics, rather than try to compete.

I think it would be shortsighted and foolish to underestimate Amazon as the pace of technological change continues to accelerate. As Cookie Monster outlined, a majority of Walmart’s existing customers already do their online shopping at Amazon.com, and as the NY Times revealed to us below, the trend towards online shopping will only continue to accelerate. 51% of consumers made the majority of their purchases online as of summer 2016, the first time over 50% in history. With Walmart’s asset their large retail presence and economies of scale, this places their business at an extreme structural disadvantage. WMT needs to reverse this trend, and aggressively.

http://www.wsj.com/articles/survey-shows-rapid-growth-in-online-shopping-1465358582