Under Armour: Not Just Clothes Anymore

What used to be a performance athletic-wear company is now a data and analytics powerhouse.

“DON’T FORGET TO SELL SHIRTS AND SHOES.”

The message is written in big red letters on the walls of Under Armour CEO Kevin Plank’s office [1]. What started out as a performance athletic-wear company is now becoming one the of the world’s strongest lifestyle brands thanks to, you guessed it, digital transformation (CEO’s words, not mine) [1].

Value Creation

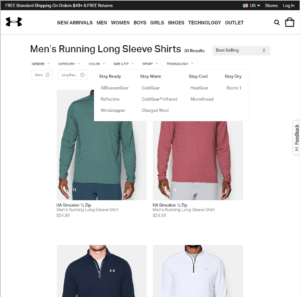

The traditional Under Armour business model was to engineer and sell high quality, innovative athletic wear. The company continues to pride itself on building products that serve a function. Says Plank, “when I tell you it’s an Under Armour T-shirt, your question should be ‘What’s it do?’” [2] The below image highlights how many different types of long-sleeve running shirts Under Armour sells. Gone are the days of throwing on a t-shirt and going for a run; customers are now much more strategic about which type of gear they wear depending on their fitness goals and weather conditions.

Source: UnderArmour.com

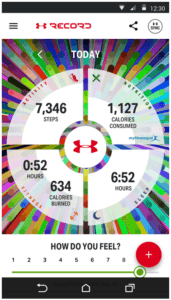

More recently, Under Armour has created value for customers through its UA Record mobile app, which allows for recording and monitoring of activity, fitness, nutrition, sleep, weight, and overall “feeling” [3]. UA Record is the amalgamation of products from two recent acquisitions: MapMyFitness (2013 for $150M) [4] and MyFitnessPal (2015 for $475M) [5] among other added features. Data can be input manually or automatically recorded from supported devices from a range of wearable technology manufacturers. A screenshot from the app is shown below.

Source: UnderArmour.com

The app benefits customers in many ways. By inputting which shoes you have been wearing while running, Under Armour can log how many miles you’ve put on your shoes. Since shoes tend to wear out after 400 miles, after which injury risk increases, the app can send you a notification when necessary informing you to replace your shoes. [6] Sweet.

Another option is to aggregate all of the data from UA Record – how many hours of sleep you got, what you ate for lunch, how many steps you’ve taken today, when you last exercised, etc. – and create a massive database correlating these factors to outcomes, such as weight loss or how you feel. This data, when analyzed, is very powerful. Users can input their current personal information – age, height, weight, location – and fitness goals and the output is a tangible action plan based on what has worked for other people with similar habits who achieved their goals. Oh and by the way, to facilitate your execution of the plan, you’re going to want to buy all of this Under Armour merchandise. Much cooler.

So how do they do it?

Besides effective marketing [7], signing and sponsoring big-name athletes [8], and investing in engineering [9], Under Armour’s key differentiator right now is acquisition and partnership strategy.

A partnership with SAP is enabling the company to more efficiently capture and organize individual user data. For example, if a longtime biker suddenly records five runs in the past two weeks, (s)he might consider buying running shoes based of SAP’s recommendation [6]. An agreement with IBM allows Under Armour to harness the power of Watson to compare single users to many others with similar traits in its user database. Knowing which habits, diet, or exercise regiments worked for others may allow you to achieve your goals [10]. Additionally, Watson can search the published literature to provide peer-reviewed articles supporting the plan. Lastly, a partnership with consumer electronics company HTC will provide Under Armour with more sophisticated wearable technology such as heart rate monitors and scales [11].

What’s next – increase user adoption

One of the critical challenges that Under Armour faces is how to increase user adoption of the UA Record app. While there are currently 175 million registered users on the various Under Armour apps [12], only a fraction of those are actually active. I have been using the app myself over the past week or so and there is a lot of information that needs to constantly be recorded in order to extract the full value from the application. The launch of new hardware to ease adoption is certainly helpful, but at $300 for the Connected Fitness System, the price is still a little steep.

There is also the debate about whether the benefits of the app outweigh the risks of the data getting into the wrong hands. Is Under Armour recording too much information? What if insurance companies got their hands on every aspect of your personal health? How would that affect your rates?

As a self-proclaimed data junkie and (former) runner, I’m a huge fan of the Under Armour digital transformation. While Kevin Plank will keep selling shirts and shoes, I hope that he also continues investing as much time and effort into data collection and analytics as he has been recently.

(795 Words)

References

[1] “Under Armour Annual Report,” Under Armour, 2015.

[2] P. Olson, “Silicon Valley’s Latest Threat: Under Armour,” Forbes, 30 September 2015.

[3] K. Tofel, “UA HealthBox: Connected fitness in a box from Under Armour and HTC,” ZDNet, 5 January 2016. [Online]. Available: http://www.zdnet.com/article/ua-healthbox-scale-band-heart-rate-monitor/. [Accessed 18 November 2016].

[4] M. Chung, “Under Armour Buying MapMyFitness in $150 Million Deal,” Bloomberg, 14 November 2013. [Online]. Available: http://www.bloomberg.com/news/articles/2013-11-14/under-armour-to-buy-fitness-technology-company-for-150-million. [Accessed 18 November 2016].

[5] S. Germano, “Under Armour Acquires MyFitnessPal for $475 Million,” The Wall Street Journal, 4 February 2015. [Online]. Available: http://www.wsj.com/articles/under-armour-to-acquire-myfitnesspal-for-475-million-1423086478. [Accessed 18 November 2016].

[6] D. Trites, “How Under Armour’s Digital Transformation Will Improve Your Health,” SAP, 15 February 2016. [Online]. Available: https://news.sap.com/how-under-armours-digital-transformation-will-improve-your-health/. [Accessed 18 November 2016].

[7] Y. Chen, “How does Under Armour differentiate itself from Nike via digital marketing?,” ClickZ, 30 October 2015. [Online]. Available: https://www.clickz.com/how-does-under-armour-differentiate-itself-from-nike-via-digital-marketing/23871/. [Accessed 18 November 2016].

[8] T. Hobbs, “How Under Armour plans to become the world’s biggest sports brand,” Marketing Week, 4 May 2016. [Online]. Available: https://www.marketingweek.com/2016/05/04/how-under-armour-plans-to-become-the-worlds-biggest-sports-brand/. [Accessed 18 November 2016].

[9] K. Bhasin, “Under Armour Has A ‘Super-Secret’ Lab Protected By A Scanner That Reads The Veins On Your Hand,” Business Insider, 9 July 2012. [Online]. Available: http://www.businessinsider.com/under-armour-has-a-super-secret-lab-with-a-scanner-that-reads-the-veins-on-your-hand-2012-7. [Accessed 17 November 2016].

[10] N. Byrnes, “AI Hits the Mainstream,” MIT Technology Review, 28 March 2016. [Online]. Available: https://www.technologyreview.com/s/600986/ai-hits-the-mainstream/. [Accessed 17 November 2016].

[11] N. Lomas, “HTC And Under Armour Are Doing A Fitness Wearable,” TechCrunch, 1 March 2015. [Online]. Available: https://techcrunch.com/2015/03/01/htc-grip/. [Accessed 18 November 2016].

[12] Under Armour, [Online]. Available: http://advertising.underarmour.com/. [Accessed 17 November 2016].

While I am also a fan of Under Armour and their push into the digital space, I fear that they now have a big problem in packaging and presenting their fitness solution to consumers. There are many…many…options out there to manage your fitness, both actively and passively. While I don’t disagree that Under Armour is a leading company in the wearables space, they don’t stand out amongst the crowd. They also do not have a clearly UA associated line of products (for example, no proprietary wearable tracking device that links to the mobile app). However, excitingly I have heard rumors that they are pushing into integrating biometric sensors into clothing that will achieve higher levels of passivity in tracking activity and providing feedback. I am waiting for the day that I can throw on a running shirt that monitors my heart rate and body temperature along with a pair of shoes that monitors my foot strike and distance while providing real time feedback on an UA wrist device (that also plays my music on a pair of reliable bluetooth headphones). Hopefully if Under Armour continues on their path, they can introduce such technology and truly differentiate themselves in the crowded fitness technology arena.

Off the cuff, my sense is that UnderArmor’s wearable is actually differentiated from its myriad competitors in that it not only tracks data, but provides insights and personalized coaching. Today, many of the substitutes I’m aware of (Fitbit, Nike+, Apple watch) don’t aggregate data across users, nor analyze data and make recommendations. So when I use Nike+, I as the consumer am left with interesting data with limited specific direction on how to alter my behavior to improve my performance. What I do worry about is the ease of use of this technology for the consumer, and the replicability. As you say, the real value-add of this technology comes when large amounts of data are constantly recorded. And what measures are in place to ensure the data being inputted is accurate? And as for competition, is their partnership with IBM Watson (which I will say is very exciting) exclusive? Even if it is, do large players like Nike necessarily need to access a knowledge base like Watson’s to draw key insights for its wearable users when they can already leverage a large existing customer base?

Thank you for such an interesting post! While having been to Under Armour’s information session few weeks ago, I was not aware of how dedicated it is to integrating digital to its brand. As you pointed out, I also wonder how UA will be able to overcome the challenge of user adoption, or more correctly, user engagement. In this digital world, having sophisticated algorithms and advanced data analytics tool like Watson certainly is a keyword for many companies’ growth, yet the underlying assumption is that there are reliable and enough data to play around with. Relying on users to manually input all the data does not fit with millenial users’ behaviors. Unless UA pushes its technology further to overcome the barrier in datafication (such as taking pictures of food at a restaurant and recognizing what the dish is), I doubt its user adoption will improve. Moreover, the price point of $300 is certainly an issue as this article points out, Fitbit–much more affordable than smart watches–still stays strong in the market. (https://www.wearable-technologies.com/2016/01/the-most-successful-wearables-for-consumers/) Especially given that hardware companies other than HTC have launched much diverse products that encompass the overall lifestyle of consumers, in light of “Internet of Things” and “Smart Home”, UA has little chance in winning the smart wearable battle by itself or just with HTC. I personally believe it may be smarter to collaborate with hardware manufacturers with stronger market presence or create modular products that can adapt to different hardware.

The attempt to create network effects and showing how others achieved their fitness goals is smart. The key issue here in my opinion is accurately tracking the data. People are likely to misrepresent their own behaviors, leading to false success stories. Fitness plans from professionals may be more engaging for users – as we have seen Nike do for teenage football players engaging stars. Given the strong partnerships UnderArmour already established, going after the right sponsor figures may be the right next step.

I think one of the smartest things UA is doing is gaining new capabilities through partnerships and acquisitions. Acknowledging what your knowledge gaps are and proactively filling them is one of the toughest things to do in such a fast-paced and competitive industry. Acquisitions should help with customer conversion – I used to use Map My Fitness but promptly created an Under Armour account when I was redirected there one day. The IBM and SAP partnerships are also really exciting, and in the long run could be differentiating (especially if they are exclusive). I’m bullish on UA’s push towards digitization and I trust they will do it in a way that is true to the brand and the mantra “don’t forget to sell shirts and shoes”.

It’s going to be interesting moving forward to see how powerful UA can get with this. When they unveiled their HealthBox Fitness Tracking System, its primary intent was to understand their customer base to make more relevant products moving forward. Somehow or another, the direct result was the Tom Brady Athlete Recovery Portfolio for sleeping that UA believed to be a key differentiator.

Much of this is in response to what Nike has done since the Fuel Band in 2012. After releasing two versions of that band and a GPS watch, Nike made the decision to exit hardware, and focus on their Nike+ while utilizing Apple as their hardware partner. At this point Nike seems like it would have much of the power on information here with the Apple collaboration (Tim Cook being on Nike’s Board), but if UA can make itself loud enough, there’s a potential to disrupt Nike.