The Empire Strikes Back – Disney is mobilizing to take on the digital world order

Digitalization has disrupted the entertainment and media supply chain, leading to unprecedented realignment and M&A activity in the industry.

What’s happening?

It is a truth universally acknowledged that Netflix has changed the entertainment business. Additionally, high speed wireless internet and multiple viewing devices mean that viewers don’t consume content the same way they used to; around a TV screen or in the movie theater. They choose what they watch and when and where they watch it. As the conventional delivery model for entertainment becomes antiquated, so do the business models and supply chains associated with it. Companies that saw and adapted to this change (Netflix, Amazon) have seen record growth in share prices, while those that haven’t have struggled [1].

2017/2018 is the year the old guard responds. Disney has pulled all its content from Netflix, is launching its own streaming service and is rumored to be interested in buying 21st Century Fox, an erstwhile rival. Time Warner and AT&T are in the middle of a $85 billion merger in a deal that creates an end-end content and connectivity behemoth. For this discussion, we focus on Disney-Fox.

How did we get here?

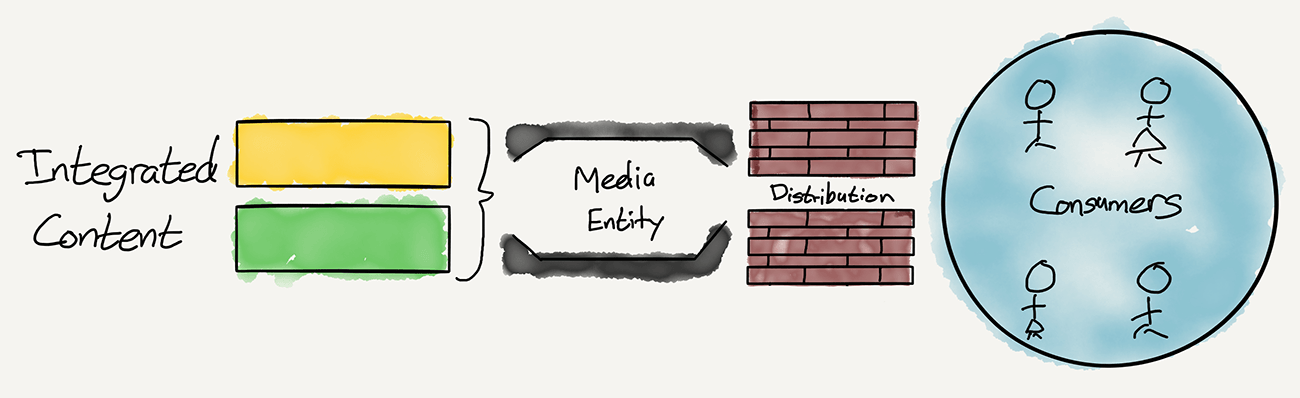

To understand the causes and implications of the changes we are seeing right now, we need to understand the conventional media supply chain. Ben Thompson (of Stratechery) explains this best, “Nearly all media in the pre-Internet era had two parts to the model when it came to making money – distribution and then integration — and the order matters [3].”

The media entity (newspapers, record labels and movie studios) developed and aggregated content which it then sold to distributors.

The distributors, which included cable companies (e.g. Comcast) and ISPs (e.g. AT&T), laid down the “pipes” to deliver the content and charged customers monthly subscription fees to recover the massive upfront, fixed costs that they had invested in the infrastructure.

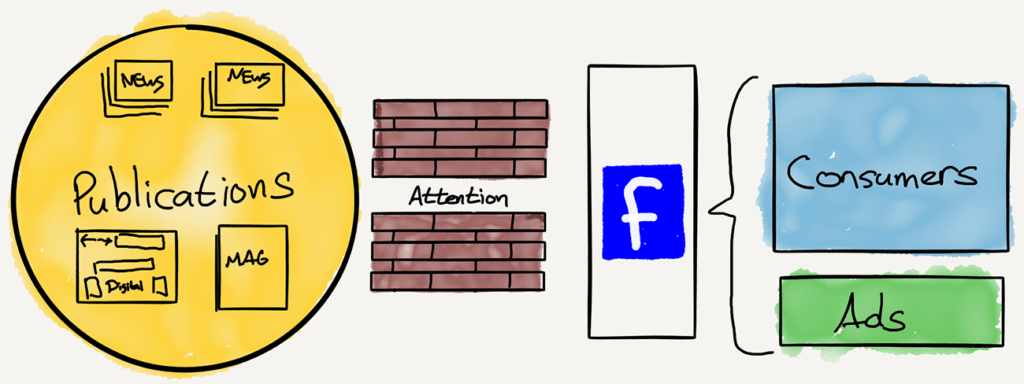

Widespread access to the internet has changed this model in one fundamental way; it has brought the distribution cost close to zero. Consequentially, media entities don’t need to go through distributors to reach their customers anymore and distributors struggle to recover their initial investment. This effect is perhaps clearest in the print industry. The print media model relied heavily on advertising revenue. Advertisers paid for ads in newspapers because it enabled them to reach consumers. Facebook and Google allowed advertisers to skip distributors and go directly to customers [4] and newspapers went out of business.

At its essence, this is a drastic change in the media supply chain and has now spread to the TV industry. Companies are using the internet to directly engage with customers and the “workers” on the old “assembly line” have struggled to get to grips with the new one.

What does the Disney – Fox deal really mean?

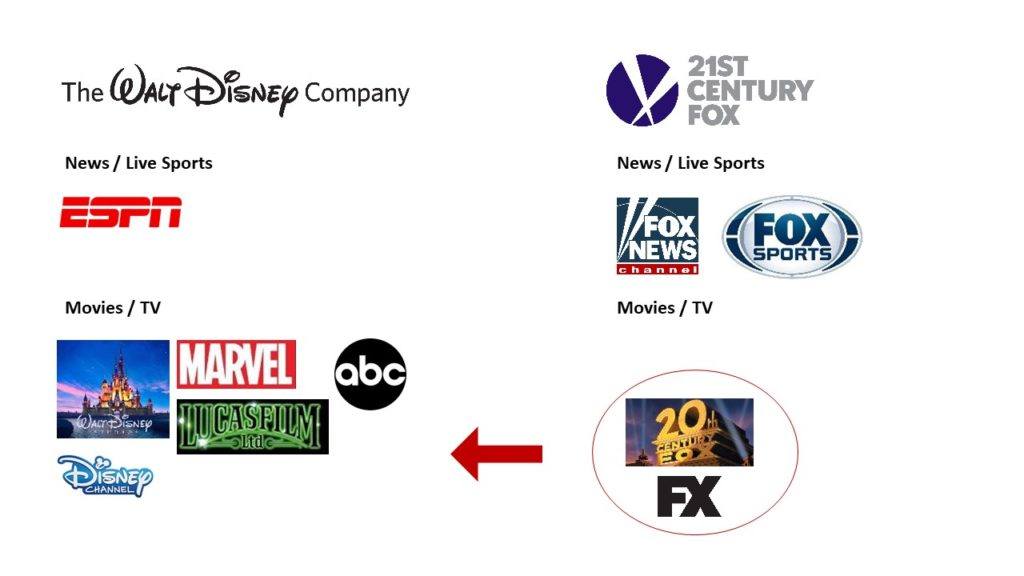

Both Disney and 21st Century Fox (like most other media conglomerates) have two main categories of content, (i) live TV (includes sports and news) and (ii) differentiated content (includes movies, TV shows). While the former is well suited to the conventional cable TV model (at least for the foreseeable future), the latter is best delivered through a video on demand service. As the figure below shows, currently Disney and Fox both have a mix of these two content types.

The proposed deal (said to include 20th Century Fox and FX) would provide Disney with an unrivalled and highly differentiated content library, providing ammunition for its upcoming streaming service [5]. On the other hand, Fox would be a leaner organization focused on its very profitable live news and sports assets. In this scenario, Fox could continue operating its business in the traditional TV model. Interestingly, the deal points to the two different paths media companies could take in the post-Netflix world; live TV like Fox or content on demand like Disney (excluding ESPN).

What now?

This is likely to be the first move in a prolonged game of chess which could see consolidation and mergers across entertainment, connectivity and big tech. Consequentially, it offers us several avenues for further discussion and reflection.

Firstly, where is this consolidation likely to end? Assuming the Disney and Fox merger goes through, the combined entity is a treasure trove of content for a potential distribution platform with deep pockets. Apple, for instance, with a market cap of $905 billion is bigger than Time Warner, Comcast, Disney, Viacom, Fox, Sony and CBS combined [6]. It also has a close working relationship with Disney (going back to Pixar) and was the subject of speculation regarding a $237 billion acquisition earlier this year [7].

Secondly, what does this type and scale of M&A activity mean for anti-trust regulators? For example, The AT&T / Time Warner merger raises serious questions about the future of net neutrality, especially given AT&T owns DirecTV and could theoretically control access to competing platforms.

What is not in dispute is that this grand old industry is changing rapidly and even its most established captains are having to reassess their core business models to survive.

(798 words)

[1] CNBC, “Comcast plunges the most in 6 years when exec says expect Q3 subscriber loss” https://www.cnbc.com/2017/09/07/comcast-shares-down-on-subscriber-loss-news.html .

[2] New York Times, “Disney Said to Have Held Talks to Acquire 21st Century Fox Assets” https://www.nytimes.com/2017/11/06/business/media/disney-fox-deal.html .

[3] Ben Thompson, “The Great Unbundling” https://stratechery.com/2017/the-great-unbundling/ .

[4] Ibid.

[5] New York Times, “With Disney’s Move to Streaming, a New Era Begins” https://www.nytimes.com/2017/08/09/business/media/with-disneys-move-to-streaming-a-new-era-begins.html

[6] Hollywood Reporter, “What the Heck Is Going on With the Disney-Fox Talks and AT&T-Time Warner Deal?” http://www.hollywoodreporter.com/news/what-heck-is-going-disney-fox-talks-at-t-time-warner-deal-1056455

[7] Fortune, “Wall Street Dreams of Apple-Disney Megamerger” http://fortune.com/2017/04/13/apple-disney-mega-merger/

I agree that the media supply chain has changed drastically as streaming services gain popularity and availability. This does lead to the M&A problem discussed above. These traditional media companies find themselves in trouble and look to innovate and expand their control. However, this can lead to trouble for consumers as anti-trust issues come up and often lines get blurred. However, you assert that Disney removing its content from competitors and launching its own streaming service will give it an unrivaled and differentiated product, but that might not be true if Disney is successful. With Disney’s acquisition of Fox and streaming service launch, I worry it will encourage similar companies to do the same, eliminating the variety services like Amazon and Netflix currently provide. Media entities all moving to providing their own streaming companies could leave consumers required to purchase a variety of different subscriptions to access the variety of content they desire.

Fantastic article Ninad, and I completely agree with Berit’s comment! As a consumer, when Disney-Fox launches its own streaming service, it would mean the consumer would be paying for streaming content that exclusively provides Disney-Fox entertainment. Meaning, consumers will likely still be paying for other streaming platforms and utilize multiple account log-ins for non-Disney-Fox content. Today’s current streaming service model is dominated by online distribution consolidators, like Hulu and Netflix, who package content from many entertainment and media companies and then provide access to consumers on a single platform. A one-stop shop streaming service platform is certainly preferred by consumers and is worth the added convenience for users – a premium, I believe, consumers will be willing to pay for.

Who do you think will win the future of the content streaming wars, will it be Netflix, Hulu, Disney-Fox, Amazon, etc.? My bias tells me Netflix and Hulu have the head start, and newcomers like Disney-Fox and Amazon are trying to play catch-up. Because as consumers continue to cut cords and move online chasing the best streaming experience, they expect to stream all the content they want, when they want it, and how they want to watch it. Will Disney-Fox deliver? The future will show us soon enough.

Ninad, your article certainly raises many questions and potential implications. One question that I am trying to wrap my head around is what does the end game look like? Both Berit and Darrin agree that one platform for distributing all content would be better for consumers. I think we are at a point in the industry where we cannot even imagine what the end game would look like. I think there may be more disruptive technologies that will arise to challenge the fragmented online media content landscape once all the major studios begin to proliferate their own streaming services.

If we look back at the 1948 United States Supreme Court decision in United States v. Paramount Pictures, Inc., we can draw parallels to what may happen now in the digital age. Prior to that landmark case, major movie studios owned movie theaters chains and had exclusive distribution rights with those movie theaters. The U.S. Supreme Court struck down this vertical integration and distribution scheme as a violation of the anti-trust laws because it essentially allowed the major movie studios to form an oligopoly. As we replace movie theater distribution with exclusive digital distribution via each studio’s online platforms, we may see the same story play out again.

I thought this was a very interesting read, Ninad, and generally really enjoy the Stratechery blog. I think one area that Ben Thompson may have gotten it wrong, though, is that distributors are struggling to recoup their upfront capital — cable companies are earning record profits with +HSD% growth due to advantage on higher margin broadband. With broadband revenue growing so much, the cost of distribution is not really going to zero but rather being re-allocated. I agree that the cost of distribution for media companies themselves is going to zero, but I don’t agree that this is an advantage for companies like Disney.

My prediction is that Disney’s shift to direct-to-consumer will not be non-dilutive. Due to the historically oligopolistic nature of Pay-TV market, distributors, and therefore consumers, have always been forced to push high-priced content (e.g., ESPN) to all consumers regardless of whether they watch it. Consumers had no choice but to eat that in their bill because there was no other way to get video content; however, now they can watch Netflix, Amazon, Hulu etc. For Disney, there is no way that any recapture of distribution costs from ISPs will ever make up for subscription losses in a fragmenting world. They have simply been over-earning from over-distribution today in the legacy bundle.

I really enjoyed reading Ninad’s article and thinking about the opportunities for the media industry as well as the heightened ability to extend the realm in which many of these companies traditionally compete. Overall, I fully agree that consolidation will greatly impact Netflix’s and other stream services’ business models especially when the organizations are pulling their original content from these platforms. However, I do not think that this alone will lead to a replacement of firms like Netflix and Amazon Video because both organizations have shifted their focuses away from pure distribution and on toward creation of original content. As such, I don’t see this market as a winner take all model, but more of a consumer pick and choose model, similar to our discussions on Uber-Lyft-Fasten in our TOM course. Consumers will likely continue to spend money on multiple offerings and my thought is that this will likely do more harm to the traditional distributors offering cable packages than these video on demand services which are continuing to produce more and more valuable content.

With regards to consolidation, I think that we will soon see a new type of bundling model, especially assuming that the Disney – Fox merger goes through, where customers can have an a la carte selection of what services they would like to purchase (similar to how cable companies offer different channels based on how much the customer is willing to spend) rather than being forced to participate in an expensive, all encompassing package. I would challenge Ninad in that the companies will have to decide whether to focus on either movies or live TV and sports, as I think there is an operating model that will fulfill the customer promise that does not currently exist today.

I really enjoyed this article Ninad, and appreciate your last point about this new phenomenon where distributors and creators of content are becoming consolidated. As much as us millennials love to “hate the man” (and the big corporation), it seems like it is just going to be harder and harder to avoid him, especially in an era where internet and connectivity are so important, and regulations protecting net neutrality may be unfortunately pulled back. I think it is super important for us as consumers to realize the extent to which brand names and infrastructure are consolidated in these top players, and do what we can from the consumer perspective to prevent them from dominating.

As Berit, Darrin, and others have brought up – I do wonder how the streaming industry evolves. Clearly there is a consumer preference for a single platform – Netflix, Uber, Amazon, Spotify, Google – but at what point do we as consumers realize the risks of making companies bigger than they potentially should be?

Thank you for an interesting article.

As you have described, with the naissance of OTT players and lower distribution costs media companies and content producers now have the opportunity to face consumers directly and as the platforms on which media content is provided has become a widely accessible commodity what truly matters is how competitive the media houses are in creating content that is attractive and creates stickiness. Players such as Netflix have realized this and shift into increased creation of original content.

Since I believe that the true winners of this industry will be the companies that create the most popular content I agree with you that consolidation such as the one mentioned in your article makes sense. This will allow Disney to widen its content and hence provide a more competitive alternative. From a customer benefit perspective I agree with Berit’s comment: customers want a one-stop shop for their content – or at least a limited amount of providers which once again motivates further consolidation.