Tesla Versus the World: Can Insourcing Beat Outsourcing?

Tesla has chosen to produce their parts and products in-house. Will this start a new manufacturing trend or lead to the demise of the company?

Tesla challenges operational norms through their manufacturing and car-making endeavors. They produce electric vehicles with designs and features that are not found on any other automobiles. Furthermore, Tesla does not even sell its cars through a traditional dealership model. But the biggest difference of all is Tesla’s push against globalization, eschewing global trade and choosing instead to insource their manufacturing needs.

Source: Tesla, Inc. https://www.tesla.com/gigafactory, accessed November 2017 [1]

For decades, the expansion of global trade has spurred the growth of produced goods, under the thought that “trade is the economic glue that connects the world economy” [2]. For manufacturers, trade has not only increased the footprint of finished goods shipment but has also decreased the costs of parts and materials. Analyses of plant-level data in manufacturing have corroborated these findings; a study across electronics manufacturing plants in Ireland demonstrated that outsourcing material inputs had a direct and positive impact on the plants’ profitability, and this impact grew as plant sizes increased [3]. The clear method to success in manufacturing was thought to be continued outsourcing as you grow in scale.

However, two recent changes have hurt the advantages previously observed from outsourcing parts in manufacturing. The first change involves increased regulation and anti-outsourcing provisions by governments around the world. The Global Trade Alert, which monitors these regulations, says there have been “nearly 350 regulations imposed world-wide since November 2008 requiring local sourcing, hiring or operations, including a profusion of Buy America provisions in the Obama administration” [4]. These requirements eliminate the possibilities of outsourcing or make the cost hurdle of doing so far steeper than it would have been in an unregulated market. The second change is the rapidly decreasing cost of producing parts in-house. According to a recent report from The Economist, “As the price of capital goods continues to fall sharply, places with large pools of cheap labour, such as India or Africa, will find it harder to break into global supply chains” [5]. This is because automated production from the low capital costs outweighs the labor benefits of outsourcing, making it cheaper for companies to produce the items in-house.

Tesla is using the changing landscape and recent decline of globalization to their advantage. According to American University’s Made In America Auto Index, Tesla’s Model 3 will have 95% of its parts manufactured in the United States; in comparison, the next two vehicles include the Buick Enclave (90% of parts manufactures in the US) and the Ford F150 (85% of parts manufactured in the US) [6]. What is perhaps even more significant is the fact that Tesla is not only manufacturing these parts in the United States, but that Tesla is manufacturing these parts in-house. Tesla has embraced a “we’ll do it ourselves; we’ll change the mold” philosophy for almost all parts throughout the vehicle, including the vehicle seats [7]. Traditionally, auto manufacturers outsource seat production due to high labor and design costs; in contrast, Tesla created their own seat assembly line in a “commitment to a vertical integration strategy not seen in the auto industry for decades” [7]. Tesla is further pushing away from outsourcing as they set up their Gigafactory, where they have been building and assembling batteries for vehicles and other products.

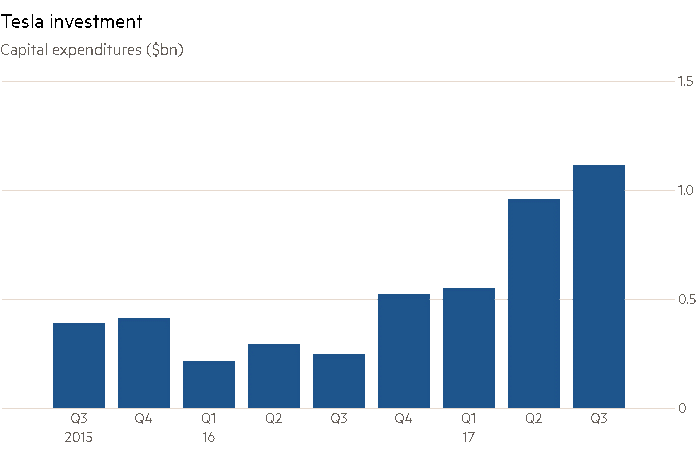

These large moves against globalization put Tesla in a unique position to shrink their supply chain through internal production both in the short- and medium-term, but this has not come without a cost. Tesla has yet to turn a financial profit and continues to spend at a growing rate to build parts internally. Capital expenses were $1.1 billion USD in the 3rd quarter of 2017 and the company to reach out for an additional $4.1 billion USD in financing in 2017 to stay afloat [8]. The chart below shows the rise in spending needed to keep up with Tesla’s strategy. The increasing financial expense of Tesla’s insourcing leads to one very valid question: At what point does Tesla draw a line in the sand on building in-house versus finding strategic partners?

Source: Tesla Company Data compiled by The Financial Times. “Tesla model 3 production target falls further behind schedule”. https://www.ft.com/content/e6fb20b8-bf5a-11e7-b8a3-38a6e068f464 [8]

Additionally, there are limitations to Tesla’s strategy based on greater macroeconomic trends. Externalities such as rising raw material costs or economic trends that decrease consumer demand for their products could disrupt Tesla’s business model. To mitigate these issues, Tesla has a pre-order system for their products and they likely have contracts for their material purchases. These stop-gaps are near-term solutions, so Tesla may need to find more sustainable partnerships to keep costs down and demand up.

Despite the challenges, Tesla is pushing forward— and it is likely that manufacturers across all industries are watching. Will other companies, inspired by Tesla, start producing more in-house? Tesla’s success or failure could set a precedent, but it could also prove once and for all that globalization is needed for financial success in product manufacturing.

(792 words)

References

[1] Tesla, Inc. “Tesla Gigafactory”, Image, https://www.tesla.com/gigafactory, accessed November 2017.

[2] Warsh, K., & Davis, S. (2012, Oct 16). The retreat of globalization. The Wall Street Journal Asia Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1112075637?accountid=11311

[3] Görg, Holger and Hanley, Aoife. (October 2004). Does Outsourcing Increase Profitability? IZA Discussion Paper No. 1372. Available at SSRN: https://ssrn.com/abstract=612228

[4] Mann, Ted and Spegele, Brian. (2017, Jun 29). GE, the ultimate global player, is turning local. Dow Jones Institutional News Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1914715982?accountid=11311

[5] Anonymous. (2016, Oct 01). An open and shut case; the world economy. The Economist, 421, 3. Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1826246599?accountid=11311

[6] Ashton, Dave. (2017, Jan 10). Tesla Praised As The ‘Most American Car’. Torque News. Retrieved from https://www.torquenews.com/3855/tesla-praised-most-american-made-car

[7] Sage, Alexandria. (2017, Oct 26). Tesla’s seat strategy goes against the grain…for now. Reuters Business News Retrieved from https://www.reuters.com/article/us-tesla-seats/teslas-seat-strategy-goes-against-the-grain-for-now-idUSKBN1CV0DS

[8] Waters, R., & Platt, E. (2017). Tesla model 3 production target falls further behind schedule. FT.Com, Retrieved from https://www.ft.com/content/e6fb20b8-bf5a-11e7-b8a3-38a6e068f464

To your questions, I think that companies need to think about insourcing and outsourcing based on their level of confidence in the quality they would achieve through outsourcing and the costs and benefits of being reliant on suppliers.

Two examples come to mind, and one is another Elon Musk company. SpaceX insources about 80% of its own manufacturing [1], while Blue Origin, another big mover in the reusable rocket industry, similarly builds much of its rockets in-house. This allows both companies to have more control over their manufacturing processes, and provides greater oversight in quality. Cars, like rockets, must be up to stringent quality standards, as lives are dependent on the safety of each. From a supplier point of view, in the rocket world, United Launch Alliance, made up of Boeing and Lockheed Martin, use Russian-made engines. Not only does this initiate concerns over quality, but it also brings up concerns over the future political/economic climate between the U.S. and Russia. With the supply chain in mind, taking an isolationist mindset, whether you are Tesla, SpaceX, or Blue Orgin, makes sense in many ways to protect from factors a company may not be able to control. From a bottomline point of view, there is a heavy up-front cost and potentially higher labor costs. But in the space industry, where even the smallest error can cause billions in damages, supply chain control is critical.

[1] Wired.Com, “The Rocket Factory: SpaceX Builds Them From Top to Bottom”,” https://www.wired.com/2012/05/the-rocket-factory-spacex-builds-them-from-top-to-bottom/ Accessed November 27th, 2017.

In response to your question, I think Tesla has centered their strategy of insourcing vs. outsourcing around two main themes: (1) Logistic costs and (2) Control over the value chain. In this case, Tesla might just be able to beat to anticipate the larger changes in economic trends.

In the past isolationist policies have forced global manufacturers to set up shop in different parts of the world in order to not only meet regulatory needs, but also chase low cost centers for production. However with such a strategy, large amount of costs would be wasted in shipping parts back and forth around the world as the product gets assembled. This has been acceptable in the past, but as global wages start to shift towards parity and shipping/logistic costs increase, this might not be the case anymore [1]. This is especially true in the automotive and aerospace industries where multiple tiers of suppliers usually make up the final product.

In the past multiple parties working on a single product also increased the seamlessness of the final product and the customer’s experience. By controlling a larger part of the value chain, Tesla will be able to make changes to it’s product much quicker than any other manufacturer. This will also allow them to iterate through products much faster- where we see a product lifecycle for a typical car ranging from 5-10 years, a Tesla might go through a much faster product cycle (ie. 3-5 years). These changes will also allow Tesla to control it’s Intellectual Property better within manufacturing and also cater to a better buying experience for the customer (in replacing distributors).

Therefore, in radically changing this industry and creating a closed system, Tesla’s control over the value chain may provide them with a stronger foundation in order to accelerate innovation and deliver it to their customers.

[1] https://medium.com/self-driving-cars/the-automotive-supply-chain-explained-d4e74250106f

In his book The Innovator’s Solution, Clayton Christensen explained the integration vs. modularization mental model. Industries, especially those susceptible to disruption, tend to ebb and flow between integration and modularization. We saw this clearly in the computing industry. Apple, led by Steve Jobs, put all their chips in on an integrated software-hardware model. Microsoft, led by Bill Gates, took the opposite approach, modularizing their software to work with the huge variety of computer hardware OEMs.

We know Microsoft made the right decision, until Apple came back in the 2000s with an integrated computer you could hold in your hands (and make phone calls with). Apple, currently with a market of $800b (to Microsoft’s $600b), nailed the customer experience and became the most valuable company in the world.

Will we see the same model play out in the car industry? By integrating Tesla can control the customer experience to a level modular-styled car companies cannot. There are risks to the strategy, as you’ve outlined, but generally I am bullish on companies that find ways to nail the customer experience.

Good analogy between Microsoft and Apple. But because the insular product view is so expensive and capital intensive for vehicle production, will they be around long enough to become an apple or will they go the way of one of the many software. Companies from the 80s and 90s that couldn’t make it to the end? Only time will tell.

Very interesting article.

Tesla’s insourcing strategy is an interesting gamble. However, I feel that it will backfire. Product ideation and marketing – which many other, more traditional car companies are focused on – are still very important for success in this industry. If Tesla has to focus its attention on both manufacturing AND marketing, I feel that it will dilute focus. Given the large amount of improvement that Tesla requires to make its cars cost-efficient for the mass market, diluting its focus in this way may not be the most effective strategy.

I agree, but aren’t they doing a lot on product presentations and marketing? The risk is where to best put the spend vs when you can see the gains. If they follow the same model as other car companies, they risk trying to compete in the same customer promise instead of staying true to their own.