Speeding the Drug Discovery Pipeline with Open Innovation

Can open innovation speed the drug discovery pipeline?

INTRODUCTION

Drug discovery is more expensive than ever – the cost to bring a new drug to market is approximately $2B, and the odds of any project making it from inception to marketed drug are approximately 24 to 1 [1,2]. Between 85-90% percent of drugs fail in clinical trials, which are exceptionally costly failures for companies and patients [3]. To bring a new drug to market, pharmaceutical firms must typically 1) identify a disease of interest to treat 2) determine which protein or processes in a cell to target to treat that disease 3) perform high throughput screening (HTS) to test thousands, sometimes millions of chemicals, to identify which chemicals can modulate that target and 4) iteratively optimize that chemical for superior pharmacokinetic and pharmacodynamic properties that will make it an ideal drug for clinical trials [ 5,6]. This is a costly and time-consuming pursuit, that involves safety and efficacy trials in mice and men, and there are pain points and compound attrition at every step in the process.

As a result of these challenges, many pharmaceutical companies are looking to open innovation as a platform to speed discovery, reduce costs, and identify new market opportunities [6,7]. Perhaps the most prominent example of open innovation in the pharmaceutical industry is Eli Lilly’s Open Innovation Drug Discovery (OIDD) platform. Launched in 2009, the OIDD was designed to bridge the gap between academic, small biotech, and industrial drug discovery to de-risk the discovery pipeline for Eli Lilly, and speed treatments to patients. This benefits Eli Lilly because it complements their own scientific discovery and screening teams by providing them access to a greater pool of talent, ideas, and compounds for high throughput screening and drug testing [8]. Conversely, if projects or compounds submitted by academic researchers were deemed promising by Lilly, it would open the door to potential funding partnerships, royalty opportunities, and sponsored research [9].

OPEN INNOVATION AT ELI LILLY

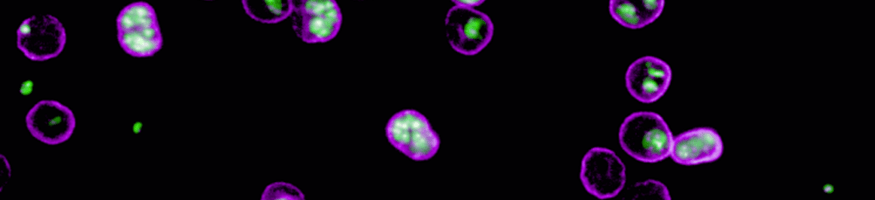

The OIDD provides external researchers seven areas of engagement with Eli Lilly in: Emerging biology, design, screening, animal health, compound acquisition, synthesis and neglected and tropical diseases [9]. Through their web-based portal system, external investigators are given access to Lilly’s vast screening and chemistry capabilities. In one area of engagement, known as OIDD Screening, external scientists can submit their chemical compounds for testing in a battery of Lilly’s biological assays to look for any potential compound “hits”, which may indicate activity against a disease [10]. These “hits” form the basis for new drugs and are vital to the pipeline, so the more chemical diversity the better. These compounds are run in Lilly’s assays in a structure-blind fashion to protect the intellectual property rights of the investigator. Upon completion of the screening campaign, investigators are provided a data package, which forms the basis for future collaborations with Eli Lilly, should both sides decide to pursue them [8].

Over the course of an 8-year period at OIDD, more than 40,000 submitted compounds have been tested, generating almost 2 million data points in biological assays, at a cost of approximately $7.1M USD, exclusive of FTE and equipment costs [8]. Over 400 affiliated institutions have formed partnerships with the OIDD platform and together published at least 23 papers over the last 7 years. At the time of writing, there were no published reports of successful transitions of submitted compounds to preclinical or clinical programs. This is demonstrative of the time and difficulties in translating early stage “hits” to full-fledged drugs where hit rates in high throughput screens range from 0.1-1% [4].

FUTURE of OIDD

In the short and medium term, the OIDD platform for identifying new chemical matter remains a relatively low-cost solution to expand the breadth and diversity in the Eli Lilly chemical library. Management can continue to maintain this solution utilizing existing infrastructure and maintain it as a fruitful collaborative opportunity for academics and small companies. What remains to be seen will be the effectiveness of the program over time in generating new chemical entities for clinical trials. Due to the long product life cycle (7-10 years from screening to market), it may be some time before compounds from these collaborations can progress to marketed drugs, and the waiting game will continue. In the meantime, the OIDD should continue to aggressively pursue new partnership opportunities to de-risk their pipeline and speed discovery.

Some companies have started sharing portions of their chemical libraries to gain access to more diverse compound scaffolds and increase the chance of meaningful discovery. Given the complexity of drug discovery and associated intellectual property, would it make sense to create bigger open platforms between companies through which they can begin to share more than just compounds? If delayed collaborations mean delayed treatments, should companies be doing more?

(787 words)

References:

1) Paul SM, Mytelka DS, Dunwiddie CT, Persinger CC, Munos BH, Lindborg SR, Schacht AL. “How to improve R&D productivity: the pharmaceutical industry’s grand challenge.” Nature Reviews Drug Discovery 2010. 9(3):203-14.

2) Scannell JW, Blanckley A, Boldon H, Warrington B., “Diagnosing the decline in pharmaceutical R&D efficiency,” Nature Reviews Drug Discovery 2012 Mar 1;11(3):191-200.

3) Wong CH, Siah KW, Lo AW. “Estimation of clinical trial success rates and related parameters.” Biostatistics. 2018 Jan 31. doi: 10.1093/biostatistics/kxx069

4) Hughes JP, Rees S, Kalindjian SB , Philpott KL. “Principles of early drug discovery”. British Journal of Pharmacology. 2011 Mar; 162(6): 1239–1249.

5) Gronde TV, Uyl-de Groot CA, Pieters T. “Addressing the challenge of high-priced prescription drugs in the era of precision medicine: A systematic review of drug life cycles, therapeutic drug markets and regulatory frameworks.” PLoS One. 2017 Aug 16;12(8):e0182613.

6) Mignani, S, Huber S, Tomás H, Rodrigues J, Majoral JP. “Why and how have drug discovery strategies in pharma changed? What are the new mindsets?” Drug Discovery Today. 2016 Feb;21(2):239-49.

7) Nilsson N, Minssen T. “Unlocking the full potential of open innovation in the life sciences through a classification system.” Drug Discovery Today. 2018 Apr;23(4):771-775.

8) Carrol GP, Srivastava S, Volini AS, Piñeiro-Núñez MM, Vetman T. “Measuring the effectiveness and impact of an open innovation platform,” Drug Discovery Today. 2017 May;22(5):776-785.

9) Making life better together. Eli Lilly corporate brochure, from Eli Lilly website, https://openinnovation.lilly.com/dd/includes/pdf/OIDD_Brochure.pdf, accessed November 2018.

10) Alvim-Gaston M, Grese T, Mahoui A, Palkowitz AD, Pineiro-Nunez M, Watson I. “Open innovation drug discovery (OIDD): a potential path to novel therapeutic chemical space.” Current Topics Medicinal Chemistry. 2014;14(3):294-303.

Thank you for sharing this article, Patrick. While not a perfect analogy, this open innovation approach at Eli reminds me of NASA’s Exoplanet Explorer program. NASA’s program works by crowdsourcing the search for habitable planets to citizen scientists (link below). In NASA’s case, the data is provided from one source, the Kepler space telescope. From my understanding, NASA’s cititizen scientist program is one of the better known programs due to the news following big finds in Kepler’s data. NASA has also devoted a large volume of resources to simplify participation in the exoplanet exploration program, which further encourages participation. I imagine that the academic institutions you mentioned are mostly universities, right? Is there a way to make this research more accessible for younger and aspiring scientists? By breaking the process into smaller steps, could high school students take on research projects to contribute to this?

https://exoplanets.nasa.gov/exep/

This is a terrific look into Big Pharma’s strategy of leaning on Open Innovation to forestall the rapid collapse of their R&D model. My concern, however, is that this is not a sustainable source of competitive advantage for an undiversified pharmaceutical company. Why can’t other pharma companies set richer incentive schemes, spurring a race to the bottom? When payers, providers, and pharma — e.g., the government — set higher monetary rewards with implicit guarantees of FDA approval and CMS reimbursemnt, open innovation looks less appealing.

This is a fascinating look at a crossroads in drug development. To your question about the complexity of drug development and IP, my worry is that larger open innovation platforms from big pharma could stunt growth of biotechnology companies, who could potentially be squeezed out of a system where big pharma wields more control (and earlier control) over the drug development process. My sense is that biotechs are a key driver of innovation in pharma today, and I worry about the implications of open innovation on their role in the drug development process.

Patrick, great job highlighting the gap that private-public partnerships can fill and the importance of this call to action by open innovation!

My main concerns are that this type of open innovation may skew in favor of pharmaceutical companies’ interests. I worry academic researchers would be incentivized to shift their research to target drug development at the expense of academic basic science research. As this article below outlines well (1), some of our most effective drug and therapeutic discoveries (crispr, ACE inhibitors, etc) have been because of exploratory science mostly through researching biological pathways. Already, there is a lot of pressure for deliverables in academic medicine, and a private pharmaceutical partnership may skew that pressure even further at the expense of exploratory science. In addition, if private pharmaceutical companies have vested financial interests in certain types of drug development (certain rare diseases, etc), I worry that all academic partners would then be incentivized to shift their research to those fields, directly at the expense of research in other areas. My main question is how can we encourage these partnerships/open innovation while being careful not to hinder scientific discoveries outside of pure drug development?

1. https://news.harvard.edu/gazette/story/2018/04/most-transformative-meds-originate-in-curiosity-driven-science-evidence-says/

This is really fascinating. Would this process be applicable to biologics or is it really limited to small molecule products?

I think the competitive advantage concerns that you raise and that others reiterate here are real. One idea is creating a tax or additional exclusivity incentive for drugs that are developed out of this open innovation process would provide the boost needed to spur other larger drug and biotech companies to participate. This would function similar to current exclusivity or tax credits, and could even be extended to a priority review voucher (though I tend to favor these less given the potential safety concerns that using them on blockbuster drugs creates).

Thanks for the great read Patrick! The astronomical cost to bring a new drug to market is truly astounding, so I applaud Eli Lilly for sharing their compound library in an attempt to bring down development costs and encourage new innovations. I continue to wrestle with how to answer your first question. There seems to be a direct relationship between the size of a chemical library and the chance for innovation and saving lives, but given the fierce competition in the industry, I struggle to see the vision of a shared database come to fruition. However, I wonder if passing control of a common chemical library to a central authority (e.g. a regulatory body) would encourage more industry participants to leverage the platform. By doing so, I could envision the significant increase in scale exponentially reducing drug development costs and speeding up the product development lifecycle. Given your prior experiences, do you think a centralized, open chemical library would ever be feasible in this industry?

Additionally, do you have a sense of how Eli Lilly is monetizing the OIDD platform? I would imagine this is a key determinant of whether external parties choose to engage with the portal. Finally, do you believe OIDD will be a sustainable competitive advantage for Eli Lilly or will competitors develop similar programs?