Robots To The Rescue of Lost Trust In Banks

Banks can regain lost trust through a virtual assistant that will be customers true ally in managing their finances

- 71% of millennials would rather go to the dentist than listen to anything their bank has to say. [1]

- 86% of US adults felt their money was safe at their primary bank, but just 59% felt their bank was a credible place to seek financial advice and only 43% felt their bank knows them. [2]

With these customer statistics, and the rise of competition in FinTechs, traditional banks know they need to step up their game in financial management and advice.

Personal Financial Management (PFM) tools can help banks both understand their customer better and become their trusted financial advisor. These applications allow customers to aggregate their accounts of different banking institutions into one tool, in order to be able to effectively track where they are spending their money, create budgets and plan future spending, and receive recommendations tailored to their needs.

FinTechs (such as Mint and Personal Capital in the US) are dominating the PFM space. Switching barriers are relatively high, as customers have already logged their data in these applications and are familiarized with them. Customers usually rely on only one PFM, so being their go-to PFM is essential for banks. So, how can banks effectively get in the game and be the PFM used by consumers?

Traditional PFMs show static snapshots of the financial situation of clients. Getting the customer to use the bank’s PFM requires stepping up the service and offering next-generation, engaging PFMs. [3]

Personetics, an Israeli FinTech, utilizes machine learning to provide personalized and proactive guidance on financial management. Personetics co-founder and CEO David Sosna says: “While digital banking assistants are gaining popularity, the ones that will stand out will be those that deliver smart interactions based on true understanding of each customer’s financial behavior and needs”. [4] Personetics has created virtual assistants (DiDi in Israel Discount Bank, NOMI in Royal Bank of Canada) that deliver personalized guidance, conversational self-service, and automated self-running programs that help customers reach their financial goals. [5]

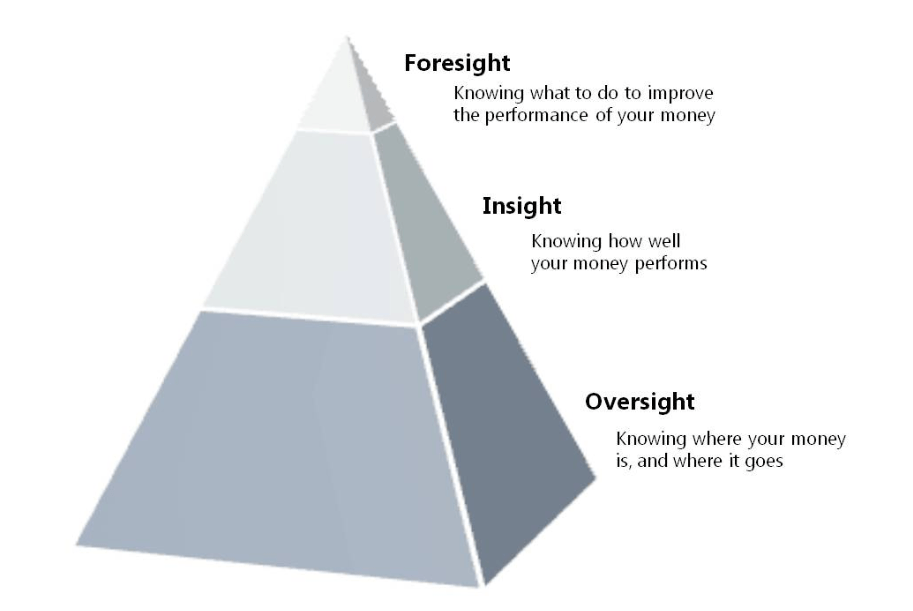

Next-generation PFMs step away from traditional PFMs, with proactive engagement, goals and challenges, personalized advice, forward-looking data, and self-learning analytics that continuously improve based on customer behavior. [6] PFMs can offer innovative solutions to the clients’ needs, such as being linked to roboadvisors for customers that want low-cost, easy and fast solutions to invest when they have liquidity. They capture the full potential of the analysis, including a personalized call to action.

Exhibit 1: 3 levels of benefits from PFM tool for consumers [7]

For banks, getting the customer to aggregate the accounts they have in other banks gives them holistic data on their customer, including their products and overall behavior. The possibilities for cross-selling and up-selling are exponential using machine learning and adapting the recommendations to the specific customer.

Beyond sales, there is the broader target of regaining customers’ trust and the perception that the bank is “on their side”. Banks have a huge opportunity to regain customer trust through their AI-driven virtual assistants. This interaction with customers is a chance to help them become the trusted source for all aspects of the customers’ personal financial management. For example: recommending consumers a product more suited to their needs, even if this product is less financially profitable for the bank; or notifying about insufficient funds before charging the overdraft fee, even if this means losing the fee. These cases are pivotal for a customer perception about their bank: showing they care for their customers and are willing to look out for their best financial interests. [8]

Personetics has an opportunity to partner with banks to help them with the challenges that the industry faces in the personal financial management space, in particular:

- Opportunity to regain customer trust by not only providing analysis of their finances but going the extra mile and delivering recommendations that truly add value to the customer. Extra personalized recommendations and putting customers’ interests first are differential in customer satisfaction. Having a virtual assistant that helps you in your finances like a partner/ally can create a loyal lifetime relationship.

- Increased competition through the sharing of information that will happen in certain ecosystems. Open Banking and PSD2 in Europe allows for data-sharing protocols through APIs. The US does not have a centralized approach to data sharing yet. Under Open Banking, PFMs that aggregate different bank accounts will give access to information regarding external customers’ accounts. This will spark competition as banks may aggressively try to cross-sell to clients through their PFM, based on this information, pushing them to have all their products within their own bank. [9]

(1) Will virtual assistants powered by banks be able to gain consumers’ trust through these personalized and customer-centric recommendations? (2) In an Open Banking data-sharing environment (such as the UK) will the smaller, less price-competitive banks survive the cross-selling strategies derived from having information on external customers’ accounts?

(797 words)

[1]. Conway, Zach. 2018. “Why More Millennials Would Rather Visit The Dentist Than Listen To Banks”. Forbes. Available at: https://www.forbes.com/sites/zachconway/2017/04/19/why-more-millennials-would-rather-visit-the-dentist-than-listen-to-banks/1.

[2] Press, Gil. 2018. “These Banks Are Using AI To Help Their Customers Manage Their Finances”. Forbes. https://www.forbes.com/sites/gilpress/2018/09/12/these-banks-are-using-ai-to-help-their-customers-manage-their-finances/#bbb04f4349ca.

[3] Staff, VB. 2018. “AI And The Next Step In Financial Management Tools (VB Live)”. Venturebeat. https://venturebeat.com/2018/04/10/ai-and-the-next-step-in-financial-management-tools-vb-live/.

[4]”Israel Discount Bank Customers Get Personal Financial Guidance From Didi™ – An AI-Driven Digital Assistant Powered By Personetics’ Cognitive Banking Brain – Personetics”. 2018. Personetics. https://personetics.com/israel-discount-bank-customers-get-personal-financial-guidance-didi-ai-driven-digital-assistant-powered-personetics-cognitive-banking-brain/.

[5] “New AI-Powered Solution From Personetics Simplifies Banking With Automated Personalized Savings And Debt Payoff Programs – Personetics”. 2018. Personetics. https://personetics.com/new-ai-powered-solution-personetics-simplifies-banking-automated-personalized-savings-debt-payoff-programs/.

[6] “Next Generation PFM Powered By AI – Personetics”. 2018. Personetics. https://personetics.com/next-generation-pfm/.

[7] Shevlin, Ron. “PFM Is Dead, Long Live FPM”. 2018. The Financial Brand. https://thefinancialbrand.com/47128/pfm-is-dead-long-live-fpm/.

[8] “3 Ways Digital Assistants Can Turn ‘Selling’ Into ‘Advising'”. 2018. The Financial Brand. https://thefinancialbrand.com/75083/digital-banking-mobile-ai-data-analytics-cx-ux/.

[9] “Data Sharing And Open Banking”. 2018. Mckinsey & Company. https://www.mckinsey.com/industries/financial-services/our-insights/data-sharing-and-open-banking.

There are few financing app solutions like Mint or others, that provide some analysis of your spending across the variety of bank accounts, to-be-paid bills, etc. Do you think that these apps can be competitors to PFM tools? On the other hand, it could work vice versa and put an end to such apps.

Another concern is that such business, as you pointed out, are very dependent on two points: customer trust and data security. In some markets it would be particularly difficult to ensure even one, not to say a word about mastering both. Is there a way how you can approach this trade off without ruining the benefits the technology can bring to the customer?

This article presents a bit of a paradox – if I as a customer is not happy with my bank because I don’t feel like they know me well or connect with me, how can I trust a FIN tech company which is mainly driven by data and no human connection? Call me old, but I strongly believe there is value in the old school banking of personal connection and interaction.

I believe the banks have to really worry about this when augmented reality has developed to a point where it looks so real and is incorporated with machine learning that quickly analyzes my entire behavior. This way, customers can enjoy both worlds – a machine who understands them but does not feel like a machine. The big question here is, are customers willing to let go or privacy laws for machines to understand them? Are they willing to let go of their fears of being monitored?

I’m curious whether this is truly an issue of mistrust, so much as it is an issue of irrelevance. I have only my own experience to draw on here, but I’ve always considered my bank perfectly trustworthy but just not well-equipped to offer any sort of financial advice. I think the survey results cited at the beginning support this.

While making investments in great AI is one way to build a great product, I also think it is a bit beyond the scope of understanding for the average consumer; I can’t be told exactly what it is you are doing with AI, so I just need to be shown that you are doing something that seems to fit my expectations. Banks need to think about what the real KPC’s are – if not trust or incredible AI, then what? User interface? Customer service? – and design around that, creating a product that is truly great to use. I suspect it doesn’t matter if you have the best AI in the world, if the UX is crap.