Remove the Friction, Prevent the Fire – Disrupting 3M’s Supply Chain

Minnesota-based 3M, best known for its consumer products such as Post-it® notes and Command™ hooks, aims to use digitization to remove friction at all connection points in its supply chain.

Digitization as a Competitive Advantage for Physical Manufacturers

Introducing technology into the supply chain, also known as ‘digitization,’ offers companies the opportunity to pull both the revenue and cost levers to strengthen their profit margins. 3M, with over 55,000 products [1], faces a complex supply chain and logistics environment and is thus poised to either benefit from the implementation of supply chain digitization or suffer from its absence.

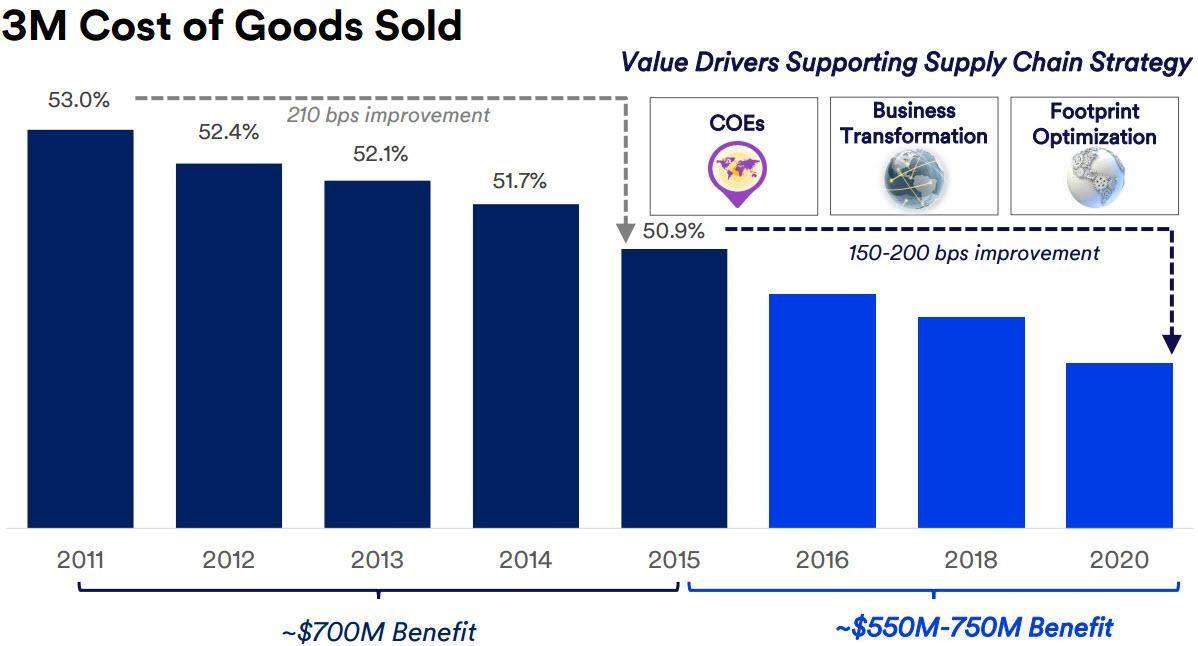

With worldwide topline sales stagnating near $30 billion since 2012, 3M must look to reduce costs if it hopes to grow its bottom line [4]. Fortunately, declining crude oil prices have decreased raw material transportation prices and allowed cost of sales to decrease from 51.7% in 2014 to 49.9% in 2016, but 3M recognizes that it cannot predict future costs. With an eye towards future profit growth, 3M has been investing in process improvements and supply chain technology to minimize its ongoing costs.

3M Uses Digitization to Reduce Costs and Increase Sales

The most immediate concern for 3M is to improve operating margins. The first goals are reducing cycle time throughout 3M’s manufacturing facilities and decreasing its inventory buffers. This war began as early as 2012, when 3M announced its goal to cut cycle times by 25% [5]. Now armed with the tools for digitization, the company is primed to take a more aggressive stance. By connecting itself to suppliers, 3M may be able to reduce the time needed to process orders, and by creating total internal transparency among the many 3M manufacturing plants, the company can also reduce the processing time taken between steps in its supply chain. In addition, with transparency into customer networks, 3M can safely pare down its buffer.

3M is also using digitization to meet its sustainability commitments. For example, the company is partnered with a paper supplier that sources barcoded trees from certain forestry partners. By connecting to the supplier’s system, 3M can trace 85% of its global paper production supply to specific mills, and 40% to the exact forest – allowing it to be certain of the legality of its paper sources [7].

In the long term, 3M’s goal is to use digitization to increase sales by integrating itself into its customers’ supply chains. The ultimate vision of Mr. Keel is to engage in co-innovation and joint R&D with 3M’s largest customers. For example, 3M may engage with large phone manufacturers up to 18 months before launch in order to ensure delivery of the right type and quantity of fiber optic cabling. Whether customers allow this level of transparency depends on the trust that will be built from the shorter-term digitization steps mentioned above [7].

Looking forward, 3M will need a measured approach. Digitization works best when companies employ a holistic approach that considers the entire organization under a new design. Due to the massive scale of 3M’s supply chain and its breadth of products, and the high upfront cost, 3M risks beginning an immense corporate evolution that ends up half-baked – and that could be devastating.

If 3M is able to achieve its long-term vision of integrating itself into the R&D chains of its customers, one longer-term question remains. This would represent a radical shift for the company and arguably place it in an entirely new market. What new business risks, both financial and operational, does 3M expose itself to by entwining its business practices with those of its customers for close to two years before the product goes to market?

(796 words)

[1] Gunther, M, “3M’s innovation revival.” Fortune 500, September 24, 2010, [http://archive.fortune.com/2010/09/23/news/companies/3m_innovation_revival.fortune/index.htm], accessed November 14, 2017.

[2] Silver Star Electronics, [http://ssedubai.com/3m/], accessed November 15, 2017.

[3] Shrauf, S, and Berttram, P, “Industry 4.0: How digitization makes the supply chain more efficient, agile, and customer-focused.” Strategy&, September 7, 2016, [https://www.strategyand.pwc.com/reports/industry4.0], accessed November 13, 2017.

[4] 3M Annual Report 2016, January 2017, [http://investors.3m.com/financials/annual-reports-and-proxy-statements/default.aspx], accessed November 13, 2017.

[5] Hagerty, J, “3M Begins Untangling its ‘Hairballs.’” Wall Street Journal, May 16, 2012, [https://www.wsj.com/articles/SB10001424052702303877604577382260173554658], accessed November 13, 2017.

[6] Utesch, M, “3M: Increasingly Efficient, But is it the Right Time to Buy?” Seeking Alpha, June 7, 2017, [https://seekingalpha.com/article/4079204-3m-increasingly-efficient-right-time-buy], accessed November 15, 2017.

[7] Banker, S, “Digitization and the 3M Supply Chain.” Forbes, May 3, 2017, [https://www.forbes.com/sites/stevebanker/2017/05/03/digitization-and-the-3m-supply-chain/#5258a141c12c], accessed November 13, 2017.

I applaud 3M for its effort to get out in front of its competition in the digital era with this technology, differentiating itself to customers while also savings costs (a double whammy!). To your question – I don’t see significant risk to getting to close to your customers in this capacity. In fact, I think ingratiating yourself with your customers is a good way to not only increase stickiness, but also provide them with a better product, at a lower price. Hats off to this chemicals business that is changing with the times!

I agree with Shooter that there is a lot of upside to 3M further integrating with its customers’ R&D processes as a way to add more predictability into its own supply chain. Especially as a company with a large B2B segment, they have the opportunity to develop meaningful partnerships with a more consolidated set of large customers. Co-creation should result in supply chain partners that are more aligned to preserving the best interests of both parties rather than only optimizing for themselves.

One of the main risks I see is that partnering with customers could potentially limit 3M’s own innovation as they would need to shift resources away from its R&D initiatives and towards its customers’ projects. 3M has historically been a driver of innovation in the market, but without the focus and resources dedicated to their own projects, will they lose that competitive advantage?

Besides the aspects pointed out by EK, I am concerned with increasing governance complexity and reduced agility when integrating R&D with customers. Defining a balanced partnership format, including conditions of exit and autonomy levels, is core to the success of the plan.

3M has recently been through a restructuring process, rearranging its former “Six Sectors” to “Five Business Groups” and combining 40 businesses down to 26 to increase overall customer relevance and drive scale. The company claims that the new structure has benefits such as increased agility and accelerated priority R&D investments.

Although integrating into the R&D of customers may bring significant value in terms of securing long-term partners and reduced cost to serve with targeted innovation, such arrangement may impair 3M’s independency in terms of choosing which problems to focus on. As a company grounded in innovation, having R&D departments sharing its time with an additional layer of approval and bureaucracy is inefficient and may hamper the development of brand new technologies in general.

(Source for restructuring process – 3M’s Investor Relations, 2016 Investor Day – http://s2.q4cdn.com/974527301/files/doc_events/2016/Inge-G-Thulin_CEO.pdf)

If I understand correctly, 3M is looking to use a digitized supply chain to tackle costs in the short term and gain new R&D related revenue from customers in the long term. The cost strategy – reducing cycle time, inventory holding costs, expedited deliveries, and such – will occur incrementally as data gets cleaner and managers figure out how to use the data. Integrating with suppliers on the supply chain front is a great way to achieve a lot of this. But BASF is a well established company, and I wonder about the 1000s of suppliers on the tail end, whose supply chain information technology calibers and capabilities vary greatly. It would be more difficult to get those suppliers to invest in the same platform and protocols. We also saw with the Barilla case that business entities need compelling evidence of the upside to hand over their data, so 3M will need to devote more human capital to managing that. Lastly, a company with the size and age of 3M will encounter internal resistance from people who are content with the status quo.