Onwards, Upwards: How Delta Air Lines Can Seize Supply Chain Digitalization

The airline industry is notorious for losing money — can supply chain digitalization reverse this phenomenon for the long run?

Delta Air Lines is known for being the network leader in the highly competitive US airline industry. Factors such as fuel prices, the weather, labor and unions, the macroeconomic business cycle, and regulation all affect how airlines choose to operate. The digitalization of supply chains has many implications for Delta and the industry. The nature of the passenger aviation industry has from the very beginning required close tracking of movement of assets, the planes. However, there remains room for substantial improvement in the supply chain of airlines, particularly in the area of demand forecasting.

Exhibit 1: Basic supply chain funnel for seat tickets [1]

Despite technology-enabled progress from a customer-facing standpoint (the delta.com user experience, mobile device applications, check-in kiosks, customer service applications, airport information displays and related initiatives [2]), Delta and the US airline industry as a whole have done little to innovate in the rest of their supply chains. Delta should care about this megatrend for two main reasons: intra-industry competition and inter-industry competition.

Intra-Industry Competition

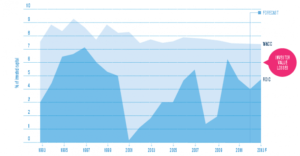

Despite consolidation and increased fare segmentation, the airline industry remains highly competitive as seats are effectively commodities from the average consumer’s point of view. An airline’s schedule must be set a few months in advance by its scheduling team. These forecasts are based on factors such as historical demand, seasonality, and early indications of demand online. These long lead times arise from the need to coordinate with airports, set time schedules for pilots and flight attendants, and ensure matching aircraft availability. Thus, in the scheduling process, Delta can be relatively certain about its costs but relatively uncertain about the revenue it will generate. In addition, empty seats on a plane that takes off equates to revenue that can never be recouped. Better forecasting of demand will enable Delta to avoid the industry’s historical tendency to over supply the market, engage in price wars, and lose money for investors [Exhibit 2].

Exhibit 2: Global airline ROIC has historically been below WACC [3]

Inter-Industry Competition

In recent years, money has been poured into developing alternative modes of transport: autonomous vehicles, Hyperloops [Exhibit 3], subscription-based short haul services such as SurfAir. Elon Musk believes the Hyperloop could shorten the trip from New York to D.C. to 30 minutes [4]. Short haul revenue could be taken away from Delta as these alternative modes of transport advance over time, achieve economic feasibility, and begin directly competing with certain airline routes.

Exhibit 3: Hyperloop One’s XP-1, which has achieved 192 mph during tests [5]

Delta’s management realizes the importance of investing in the digitalization of its supply chain. It was the first major US carrier to introduce RFID tagging on customer baggage, an initiative expected to reduce lost items by 25% [6]. On a forward-looking basis, Delta is pouring “more than $1.5B in technology over next 4 years to improve operational reliability and grow digital footprint” [7]. While the specifics of where that money will be deployed is unknown to the public, one can guess that a sizeable amount will go towards improving its direct digital channels, where an increasing number of tickets have been sold, leading to better customer experiences and reduced distribution costs [2].

We can learn from the rise of web-enabled direct to consumer businesses the immense value of owning the customer relationship. For the business, it could enable a leaner and more flexible asset base, reduced distribution costs, and more control over its brand. For the consumer, it often results in a better and more personalized experience. Under agreements with online travel agencies (OTAs) such as Priceline, Delta gets no visibility into the actions leading up to the purchase of the e-ticket. Rather than forfeit control of distribution and discovery to OTAs and other middlemen, Delta has taken efforts to be the primary distributor of its product. OTAs’ share of e-ticket revenue is down 2 percentage points, to just 25%, during the period from 2013-2015, reflecting this shift [8].

Concurrently, Delta should develop in-house teams solely devoted to demand forecasting and the productive use of this information. Currently, operating teams that deal with information technology are largely treated as discrete entities: revenue management, marketing, and fleet management are separately managed departments within the airline. Delta should integrate these teams so that the work they do is visible across the chain and their collective findings can be translated into more prudent demand forecasting. The true value-add will come from learnings between the layers of knowledge.

It is easy to hype the power of big data. One major constraint to better digital supply chains is talent: Who will execute when skill in this area is desirable across industries? It is up to us to cultivate interest in this area for the current and next generations.

(Word Count: 787)

References

[1] ”Importance of digital supply chain in airline industry” by Abishek Singh, Infosys. https://www.tnooz.com/article/airline-industry-digital-supply (accessed November 2017)

[2] 2016 Annual 10-K Report, Delta Air Lines. http://s1.q4cdn.com/231238688/files/Annual%20Meeting/2017/2016-Annual-10-K-Report.pdf (accessed November 2017)

[3] “Airline profitability: airlines can no longer afford to be the poor relations of aviation,” Center for Aviation. https://centreforaviation.com/insights/analysis/airline-profitability-airlines-can-no-longer-afford-to-be-the-poor-relations-of-aviation-117521 (accessed November 2017)

[4] ”Elon Musk says he has ‘verbal govt approval’ for D.C.-to-New York Hyperloop“ by Michael Laris and Brian Fung, Washington Post. https://www.washingtonpost.com/local/trafficandcommuting/musk-says-he-has-verbal-approval-for-dc-to-new-york-hyperloop/2017/07/20/0754628e-6d62-11e7-b9e2-2056e768a7e5_story.html?utm_term=.41584ed8c1af

(accessed November 2017)

[5] “Hyperloop One Unveils XP-1,” Hyperloop One Media Gallery. https://hyperloop-one.com/media-gallery (accessed November 2017)

[6] “Group highlights Delta, makes case for industry-wide RFID bag tracking” by Ashton Morrow, Delta. http://news.delta.com/group-highlights-delta-makes-case-industry-wide-rfid-bag-tracking (accessed November 2017)

[7] Deutsche Bank Global Industrials and Materials Summit Presentation, Delta. http://s1.q4cdn.com/231238688/files/Conferences/2017/Delta-Air-Lines-8th-Annual-Deutsche-Bank-Global-Industrials-Materials-Summit.pdf (accessed November 2017)

[8] “Report: Airlines’ limits on OTA fare listings add costs: by Danny King and Kate Rice, Travel Weekly. http://www.travelweekly.com/Travel-News/Airline-News/Report-Airlines-limits-on-OTA-fare-listings-add-costs (accessed November 2017)

The gravest threat to U.S. airline carriers over time has been the macro-economic cycle, specifically when unpredictable downturns result in a decline in travel. Airline margins are incredibly tight. According to The Economist, the airline industry generates a 1% profit margin and averages profit of $4 per passenger (1). Large fixed operating costs (airplanes) are expensive and stubbornly fixed in nature. Customers also tend to show zero loyalty. Further, despite a recent onslaught of combinations in the U.S. airline industry (American – U.S. Airways; United – Continental; Delta – Northwest), average ticket prices have continued to decline (2).

I agree that the cost side of the equation has historically been the only lever that airline management teams can pull. Predictive analytics might help with forecasting demand, scheduling plane operations, communicating flight schedules with air traffic control; however, such measures seem like band-aids on the larger problem.

It is interesting that more bookings are going through the airlines websites as opposed to OTAs. I wonder though how many of those buyers first comparison shopped on Kayak or Expedia, a behavior that would question the notion that customer loyalty is increasing in any meaningful way. I believe the best hope for airlines is to try to generate some degree of brand loyalty or monopolistic pricing power by focusing on certain regional routes. Investments in digital have a lot of potential to cushion profits during good times. It is the bad times that I am still worried about.

(1) https://www.economist.com/blogs/economist-explains/2014/02/economist-explains-5

(2) https://viewfinder.expedia.com/news/2017-global-air-travel-outlook-expedia-airlines-reporting-corporation-release-report-worldwide-air-travel-trends-pricing/

Interesting article! Great recommendation regarding integration of functions across the company.

I wonder what type of “edge” Delta would have over competitors given that any major airline could employ this same predictive analytic approach. As early as 2014, United had a “collect, detect, act” system that analyzed 150 variables in a customer’s profile to customize offerings (1). Big data insights definitely seem to have a marginal impact (by securing more ancillary revenue by understanding what services consumers care about), but does big data have the power to shift the industry from a negative/low margin industry to an attractive one?

Securing talent as you mention is one hurdle, but I believe the fact that “big data skills” are transferable across industries, more and more people will be willing to invest in developing these skills. So while people with IoT / big data skills will be in more demand, I believe the talent pool of qualified people will grow over time as well.

I also wonder if there are other analytic approaches to refining airline offerings. As we saw in the United case, sometimes aggregating data to find trends is less telling than diving into the data and picking out a few sample routes to focus on to draw insights regarding optimal routing. Less data, not more, can sometimes be more effective for root-cause analysis.

Lastly, I would argue that airlines cannot even predict the cost side of the profit equation because fuel costs represent such a large percentage of operating expenses. According to an IATA report published in June 2017, fuel represented roughly 20% of operating expenses for airlines in 2016 (2). In that report there is a clear inverse correlation between fuel prices and airline profits, so I wonder whether the big data hype is going to be impactful enough to insulate the industry and offset swings in commodity prices – I doubt it.

(1) http://fortune.com/2014/06/19/big-data-airline-industry/

(2) https://www.iata.org/pressroom/facts_figures/fact_sheets/Documents/fact-sheet-fuel.pdf

Interesting article and great perspectives above!

I have just bought a return ticket for my trip after the finals. After checking prices for over 2 weeks, I settled for Emirates Airlines. Though a longer flight with two layovers, it was the cheapest and I bet, they offer the same if not better flying experience than Delta. Some of the factors below might have accounted for my choice.

The world is more connected than ever with more open sky agreements allowing many airlines to travel same routes, which means more carriers than necessary per route. No airline has a monopoly over any route, so demand and operations planning is extremely difficult. Furthermore, some airlines are being subsidized by some government (see article below on US airlines accusing Middle East airlines of receiving government subsidies) giving them unfair advantage and allowing to lowball on price. Finally, as alluded to above, beyond a minimum level of safety or quality, air travel is a commodity to the customer.

These are fundamental industry issues that I’m not sure big data can solve (for big data to be effective, you would not only need to forecast demand, you also need to be able to forecast price of your competitors which is impossible), but surely an integrated demand and operations planning system as you have suggested is a step in the right direction. Unfortunately however, all airlines have access to the same tools, so none can lay claim to any competitive edge. The major solution is that we need less airlines not more, at least on a route basis. And maybe Delta should focus on further differentiation in its service offerings

http://www.latimes.com/business/la-fi-travel-briefcase-middle-east-20170610-story.html

You raise a very interesting and important point for the airline industry. I think big data is the way forward for achieving transparency in demand forecasting, however there are a few things that the airlines must keep in mind in order to succeed. First, finding and hiring big data analytics talent will become key and should be on the priority list of any airline CEO. Second, not all flight / tourism / business travel data is relevant and the crux is in filtering out the relevant data for the demand forecasting. Third, gaining access to the relevant data is not always straight forward and the airline companies might face privacy issues here. Finally, drawing the right conclusion from the sea of data will determine whether the airlines will be successful or not in predicting the future demand.

Great article. Rightly so, the author calls out the challenge of innovating against the backdrop of razor thin margins. However, I wonder if it is a safer bet to focus on the application of big data for cost reduction. A recent Forbes article describes the potential for smart sensors, big data, and predictive analytics to help with flight maintenance. (1) Given the aging US airline fleet, perhaps it makes more sense to focus more on cost savings, as opposed to revenue optimization. I wonder if the expected upside of cost reduction outweighs the expected upside of revenue optimization. Moreover, I wonder which of these two strategies would have the higher probability of success, and the lowest cost of deployment.

(1) https://www.forbes.com/sites/oliverwyman/2017/06/16/the-data-science-revolution-transforming-aviation/#381809667f6c

This raises an interesting point in reference to intra-industry competition and the potential view of consumers of airplane seats as commodities items, with little brand loyalty. With multiple airlines, like Delta as you describe, beginning to leverage digitization in their supply chains, I wonder if this represents a future area for brand differentiation between airlines. Or on the contrary, will airlines that fail to make the necessary investments in digitizing supply chain infrastructure throughout all functional areas simply be left behind as obsolete in a future environment in which all surviving airlines are digitized? Recognizing the thin margins available to industry participants to expend capital and remain profitable, I think that Delta’s investments in this area will provide a short-term competitive edge in providing service to customers, such as the RFID tagging initiative you referenced, potentially de-commoditizing its seat offerings and strengthening its brand in comparison to other airlines unable or unwilling to make such investments at this time.

Thanks for exploring this topic. I am curious why you opened with the statement that airlines are notorious for losing money when Delta has had positive and increasing net income from 2010 to 2016 (1). While I agree that the industry should embrace digital innovation in its supply chain, I do not think inter-industry competition is a significant factor as there is no substitute for the vast majority of air travel in the foreseeable future. Also, because of the oligopoly of the airline industry and high barriers to entry, there are less potential disruptors, especially to Delta who has one of the most profitable operating models.

[1] http://s1.q4cdn.com/231238688/files/earnings/2016/4Q/Form%C2%A010-K-Q4-2016.pdf pg. 25 http://s1.q4cdn.com/231238688/files/earnings/2013/Q4/Form-10-K-Q4-2013.pdf pg. 25