On-demand Drone at Farm Friend: Digitalization in Agriculture Takes Off

Uberization is taking place in the agricultural space. A Chinese startup Farm Friend is bringing on the revolution.

Agricultural drones aren’t new technologies by any means. The Association for Unmanned Vehicle Systems International (AUVSI) projects that agriculture will account for 80% share of the commercial drone market globally. [1] “The work of 40 farmers spraying pesticide can be done by one single agricultural drone”, said Yu Yang, founder of Farm Friend. [2]

Industry Pain Point

Despite the fact that agricultural drones increase yield and lower cost, new problems emerged. Professional agricultural drone pilots are needed due to the complex nature of piloting drones. Information asymmetry leaves farmers extremely difficult to find drone pilots. Drone pilots, on the other hand, have long idle time and low labor utilization. [3]

Digitalization of Agricultural Drones

Farm Friend, founded in early 2016 in Beijing, serves as an information-sharing platform that bridges supply and demand. Similar to Uber, Farm Friend doesn’t own agricultural drones, but rather connects agricultural drone pilots (supply) and farmers (demand). At present, Farm Friend deploys more than 5000 drones over 60000 hectares in 10 Chinese provinces. [4]

Digital efforts are ongoing to revolutionize the supply chain:

Short-term Practices

- Digitalize Supply Chain

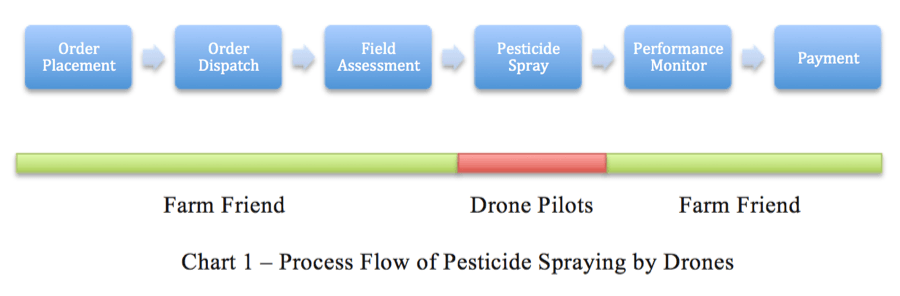

As seen from the process flow diagram in Chart 1, a complete cycle of drones spraying involves six steps. Farm Friend takes care of all the steps except the actual pesticide spraying work. [5]

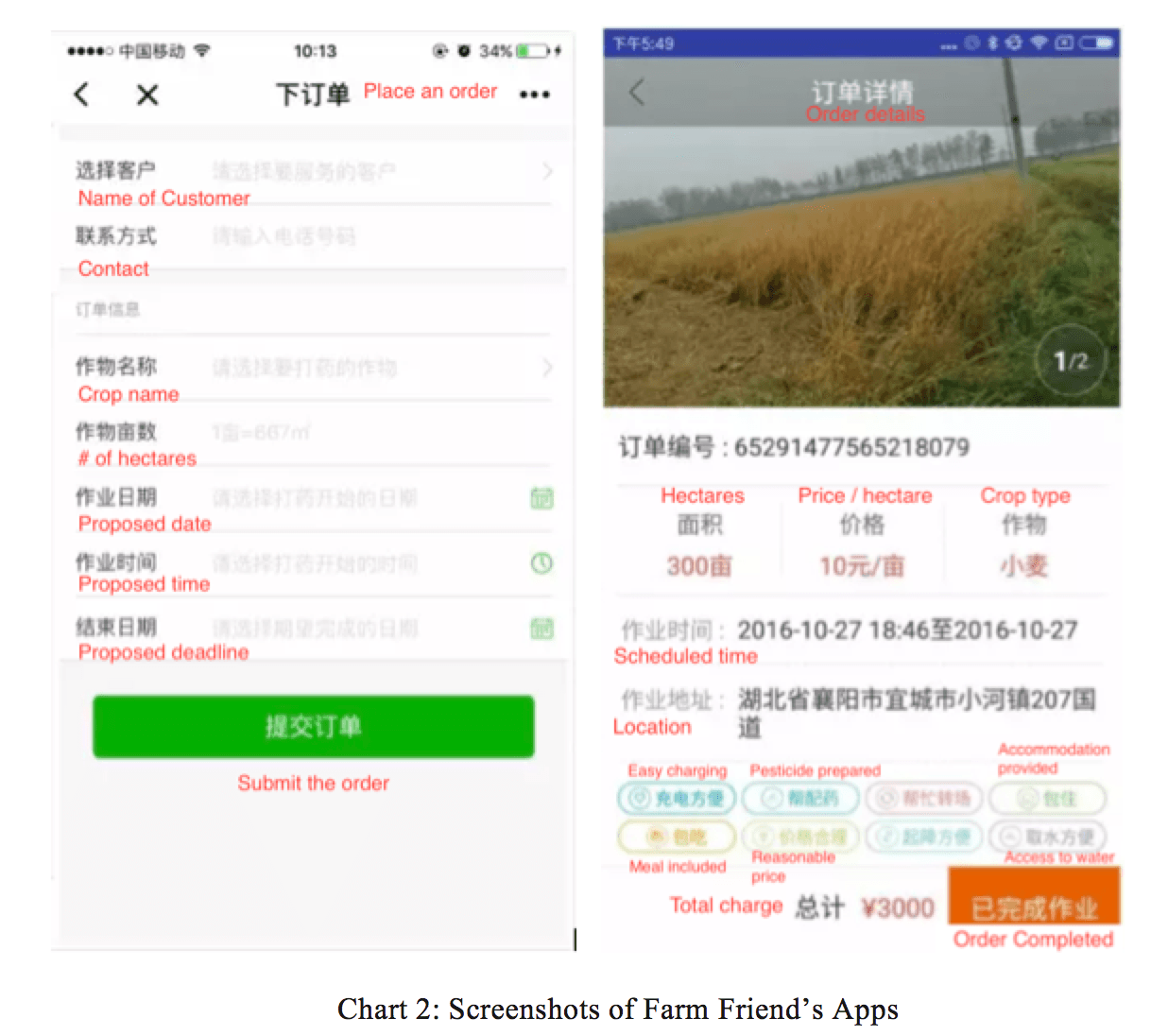

For example, the screenshot in Chart 2 (English translation in red font) demonstrates the user interface of order placement for farmers (left-hand side) and order information for drone pilots (right-hand side). [6] Farmers can easily place an order by inputting their preferred date and time, crop name, hectare of farmland, and contact information. Drone pilots get the information once the order is dispatched. When the work is done, drone pilots click “Order Completed” and can expect bank deposit once performance feedback is received. The dispatch algorithm prioritizes short distance between farmlands and drone pilots, minimizing the travel time and cost for drone pilots. [7]

- Offline Engagement and Digitalization

In many online-to-offline business models, success boils down to the company’s offline capabilities. Farm Friend partners with offline players in the industry to engage users. They empowered local agricultural product retailers with SaaS to digitalize their operating system. [8] At the same time they leveraged retailers’ close relationship with farmers to conduct user acquisitions and engagement. [9] For example, farmers who don’t know how to use Farm Friend’s app would go to the offline spots to get help from local retailers.

Medium-term Solutions

- Data Informed Crop Health Plan

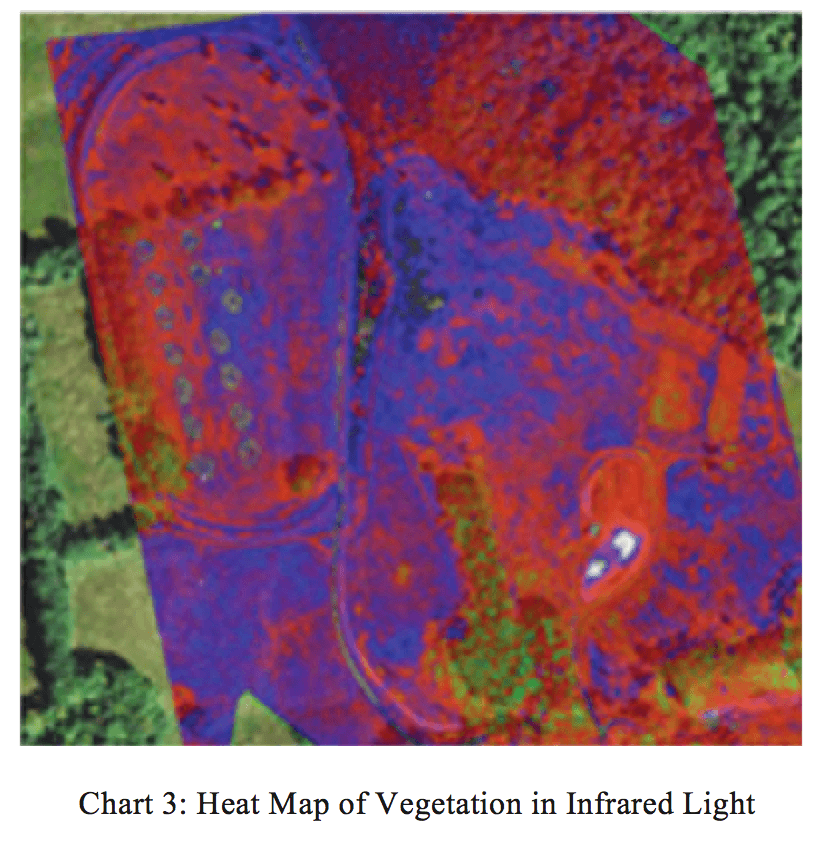

Agricultural drones currently collect data to monitor spraying performance. Drones equipped with specialized cameras, GPS and mapping tools can survey fields from above to track flying trajectory, spraying efficiency, pesticide coverage, etc. [10] Moving forward, Farm Friend would offer integrated solutions of crop health. By utilizing big data and more advanced sensors, Farm Friend could collect multispectral data that identifies crop’s disease and weeds, measure irrigation, analyze soil health, and detect biotic stress early on. [11] Chart 3 produced by a drone from PrecisionHawk, depicts vegetation in near infrared light to show chlorophyll levels. [12]

- Standardization of Pesticide Usage

Currently there’s no industry standard of pesticide usage in China. Improper use of pesticide not only decreases yield, but also posts significant challenges to environment and food safety. To address the long-standing environmental issues and food safety concern, Farm Friend is cooperating with governmental agencies and research institutes to formulate industry standards on how to properly apply pesticide by drones. [13]

Other Recommendations

Besides doubling down the investment in big data, Farm Friend could also consider the following areas.

Short term

- Improve market liquidity – aggressively acquire users on both supply side and demand side, to further improve dispatch efficiency through network effect.

- Build brand loyalty – establish farmer community and provide farmers with information such as irrigation know-hows, industry news, and technology tutorials.

Medium term

- Enhance offline presence – strengthen relationships with local players in the upstream and downstream of the industry. This helps build competitive advantage to defend themselves from new industry joiners.

- Maintain good relationship with government agencies.

Looking outside the window of Farm Friend’s office in Wangjing, China’s new “Silicon Valley”, Yang was proud of what his team has accomplished in less than two years. He was also excited about the ~$1 trillion agricultural market that’s not yet penetrated by Internet. [14] However there are still lots of uncertainties. Though the first mover, how could they maintain competitive advantage against industry leaders like DJI who might forward integrate to enter this market? How will they achieve profitability? What’s the pricing strategy towards their price sensitive users? How to balance the complicated stakeholders’ interest in a traditional industry of thousand years of history? No one knows the answers. Perhaps only the vast farmland can tell.

(Word Count: 786)

Bibliography

[1] Darryl Jenkins and Dr. Bijan Vasigh. “The Economic Impact of Unmanned Aircraft Systems Integration in the United States”, Association for Unmanned Vehicle Systems International, http://www.auvsi.org/our-impact/economic-report, accessed November 2017.

[2] [3] Yu Yang. Interviewed by Li Chen, July 28, 2017.

[4] Farm Friend. “About Us.” http://www.farmfriend.cn/aboutus, accessed November 2017.

[5] Wang, Xianwei. “Business Model of Sharing Economy in Agriculture.” AgriGoods Herald, Sep 14, 2017. [http://paper.nzdb.com.cn], accessed November 2017.

[6] Farm Friend. “Software Download.” http://www.farmfriend.cn/new_file.html, accessed November 2017.

[7] [8] [9] Hao, Jie and Xue, Jingdong. “Farm Friend: Redefining Agriculture.” China Economic Information Journal, Oct 31, 2017. http://www.zgjjxx.net.cn/2017_21/a29.html, accessed November 2017.

[10] Shunwei Capital. “Farm Friend Announced the Completion of RMB50 Million Series-A Financing with Gobi Ventures as the Leading Investor.” Medium, Jun 7, 2017. [https://medium.com/@ShunweiCapital/farm-friend-announced-the-completion-of-rmb50-million-series-a-financing-with-gobi-ventures-as-the-e4cef423e271], accessed November 2017.

[11] Fintan Corrigan. “Multispectral Imaging Camera Drones In Farming Yield Big Benefits.” DroneZon, October 10, 2017. [https://www.dronezon.com/learn-about-drones-quadcopters/multispectral-sensor-drones-in-farming-yield-big-benefits], accessed November 2017.

[12] Anderson, Chris. “Agricultural Drones – Relatively cheap drones with advanced sensors and imaging capabilities are giving farmers new ways to increase yields and reduce crop damage.” MIT Technology Review. [https://www.technologyreview.com/s/526491/agricultural-drones], accessed November 2017.

[13] Wang, Xianwei. “Business Model of Sharing Economy in Agriculture.” AgriGoods Herald, Sep 14, 2017. [http://paper.nzdb.com.cn], accessed November 2017.

[14] National Bureau of Statistics of People’s Republic of China. “Agriculture Product.” Statistical Yearbook 2016. [http://www.stats.gov.cn/tjsj/ndsj/2016/indexch.htm], accessed November 2017.

This is a great topic! In thinking about how Farm Friend can retain its position when companies like DJI have the ability to forward integrate, I believe that DJI has little interest in playing the middle man and will be better suited to stick to its expertise within making the drones themselves. However, what Farm Friend is doing is easily replicable, so it will come down to relationships with farmers and drone pilots. Farm Friend’s best play would be to create loyalty and continue expanding to other marketplaces–admittedly, easier said than done.

Thanks for the comment! It’s true that DJI is now scrambling to sort out their own supply chain challenge of fulfilling the massive customer orders. They have limited capacity or interest at this stage to forward integrate into this platform business.

And I completely agree with you that Farm Friend now doesn’t have high enough technological barrier to defend itself. However as a tech player, besides building technological barriers, they might achieve competitive advantage via network effect and economies of scale. Therefore your point of deepening the relationship with farmers and drone pilots and scaling up the business to achieve higher efficiency makes tons of sense to me.

I really like the comparison made to Uber, because I think a similar playbook can be followed here in order to mitigate the threat of DJI. Similarly to how the actual auto manufacturers are only now scrambling to increase utilization of their fleet of vehicles by partnering with on-demand apps or autonomous driving ventures, I don’t believe that DJI will try to move into this area in a timely fashion since it is so far outside of their core competency.

The two suggestions in the article I like the most are to 1) increase market liquidity, and 2) partner with government agencies. For the former, aggressively doing so is the only way to ensure the long-term survival of this company, and the latter may help build a sustainable competitive advantage for the company.

Given the nature of drones and the increasing commoditization of them, I believe it would make sense for them to eventually partner directly with a drone manufacturer, customize those drones specifically for this application, and then rent/sell these drones to pilots. This is analogous to how Uber is increasing supply of drivers by partnering with car rental companies to use their extra cars in the fleet.

Thanks for the comment! Your suggestion of establishing direct partnership with drone manufacturer is very interesting. Uber is also doing something similar to partner with auto manufacturers and car rental companies to provide vehicles in undersupplied markets. Borrowing from Uber’s example, it made me realize several ways of achieving that. One is via drone financing/leasing – by leasing drones (usually too expensive for farmers to own) to farmers or drone pilots, it can quickly improve market supply and further improve market liquidity. But someone has to provide collateral, be it farmer’s credit history, or other types of assets. Another way is revenue sharing – by charging commissions, both Farm Friend, drone manufacturers can achieve higher revenues. The question is how much farmers are willing to pay for the commissions.

That’s a really good point about the revenue sharing – reminds me of the Indigo Agriculture case as well. I can imagine a situation in which, as a drone pilot, I may only own one drone but have the ability to fly multiple over the course of a given day in a few different locations. In that case, it would make sense for me to use my own drone in one farm, but lease a bunch of other drones from Farm Friend (which shares revenue associated with those leases with the drone manufacturer). Farm Friend would then get revenue from the drone lease on top of the revenue already being generated via the other services they provide.

Interesting topic! I have a background in drone operations, and I think there are a variety of initiatives Farm Friend could pursue to maintain a competitive advantage. In the States, the FAA has released very little guidance on drone piloting. Many regulations exist all the way down at the municipal level, but frequently it is unclear where drones are permitted. Farm Friend should continue to partner with government agencies from a safety/legal perspective to highlight geographic areas that may not be permitted for drone usage. In addition, drones are highly susceptible to wind and precipitation. The app could include weather data so that pilots and farmers can plan orders accordingly. Lastly, I agree that the app should expand to include aerial imagery. Many drone pilots are hobbyists who own multiple platforms. Farm Friend could be limiting its growth opportunities if it fails to invest in the full suite of agricultural services.

In TOM, we’ve been spending the past few days talking about network effects and 2-sided platforms, like Uber and Farm Friend. When we discussed Uber, Fasten and Lyft, we asked the question if this is a ‘winner takes all’ market. I ask myself this here – is this a winner takes all, or most, market? My sense is that although Uber and Farm Friend are both 2-sided platforms, the similarities primarily stop there. With transporting a person from point A to point B, it’s difficult to differentiate service and ride-sharing has become a commodity good. However, with Farm Friend, there are many ways to differentiate service and the product across competitors. Thus, I think there’s plenty of room within the market for multiple competitors to succeed and add value to customers.

That’s a great question. My understanding of what constitutes a “winner takes all” markets include the following conditions (not necessary though): first mover advantage, network effect, technological barrier of entry, and economies of scale. The important question is how to quickly scale up to achieve and maintain those advantages. I agree that due to the variable nature of services and products from Farm Friend or Airbnb, it’s much harder to speed up as Uber/Lyft does. But once those advantages are achieved, the moat might be difficult to destroy.

I’d be curious to see if some sort of profit sharing or cost saving agreement could be reached with the farmers in a manner similar to the other agriculture entrepreneurs who were hacking the microbiome of crops. It seems like similar factors may be in place in terms of trying relatively untested methods that could have substantial upside but may first incur some losses. On a somewhat separate note, another concern that I would have as a farmer is that the increase of data, especially of data in someone else’s hand may further commoditize my business. The products that I’m selling are already commodotized, and if the methods (or at least the day-day results of the methods) become well known it seems as if the process may commoditize further.

I’m not sure the fact that DJI is an industry leader and manufacturer doesn’t mean that it poses quite as large a threat as you’ve laid out here as a possibility. With drone technology emerging across all sectors, it’s clear that the applications for new drones are very broad. I’m not sure agriculture would be the most obvious of those applications (photography, weather, and traffic updates all strike me as potentially easier markets to enter from the manufacturing end). To think otherwise is similar to wondering if Volvo would enter the ride-sharing business since they make the cars they can drive in. For now, Farm Friend needs to focus on building relationships and reputation. If they provide their core promise and have broad reach, they can protect their first mover advantage.

My two concerns with this otherwise promising business are as follows:

Will China seek to regulate this disruptive technology by introducing more stringent controls on drone usage (as has occurred in the US?).

–This does not seem to be a company concern at the moment, but I could foresee a series of mishaps motivating changes to current rules (or the lack thereof). For example, if a drone crash resulted in, say, a fire or significant property/ecological damage, this might prompt regulators to intervene. That said I see no reason to believe Farm Friend poses such dangers and would encourage them to track metrics to this effect in order to be able to prove their relative safety should this ever come under question by the public or government agencies.

How defensible is this technology against competitive entrants?

–While I don’t think other startups could catch up with Farm Friend in China at this point (given its well-established partnerships with local retailers and ability to recruit offline customers, i.e. its relative defensibility against smaller entrants) I am concerned that agricultural powerhouses like Monsanto (which maintains significant operations in China) could have the resources necessary to drive Farm Friend out of the market through a price war (especially given such companies lower costs of supplying pesticides in this market).

The opportunities in the drone farmland space is tremendous. As you mentioned at the end of your article, this space has the opportunity to become crowded quickly, and I think it is upon Farm Friend to scale up in order to benefit from the potential network effects. I just see the barrier to entry for competitors being low in this arena, especially with major players such as DJI at the table. The company either must find its segment in the market or build drone and labor efficiencies/technology that suggests its innovation and relationships with suppliers are strong and competitive.