Ollie’s Bargain Outlet: Good Stuff Cheap!

Company Overview:

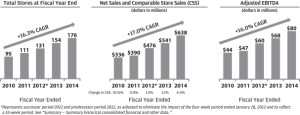

Ollie’s Bargain Outlet (“Ollie’s”) is a discount retailer offering brand name closeout merchandise through 202 stores across 17 states. The compelling value proposition Ollie’s offers consumers of “Good Stuff Cheap®” is directly a function of their ability to capitalize on an operating model that is aligned with and supports their business model. Specifically, Ollie’s has a number of operational levers that they can pull to drive sales and profitability, including their ability to effectively source, distribute and optimize merchandise across categories, as well as their loyalty program, Ollie’s Army. At the core of their business model is a differentiated retail concept offering consumers a fun shopping experience and compelling value proposition as products are sold at up to 70% off department and 20-25% off mass market prices because of their sourcing strategy and operational strengths. In their most recent earnings call, Ollie’s estimates FY15 total net sales of $745 million (17% increase), driven by comparable store sales growth of 4%, and Adjusted EBITDA of $95 million (19% increase), representing a 13% margin.

Business Model:

Treasure Hunting: The Ollie’s motto of “Good Stuff Cheap” draws an attractive customer base of “treasure hunters” to the store to make repeat purchases. Ollie’s offers a unique shopping experience distinct from those of traditional department stores (a.k.a. “fancy stores”) and mass market (e.g. Walmart) with significant cost savings to the consumer. The fun and distinctive signage throughout the store and “treasure hunting” atmosphere lends itself to a customer experience that drives customers to buy now (“when it’s gone, it’s gone”) and more frequently visit the store.

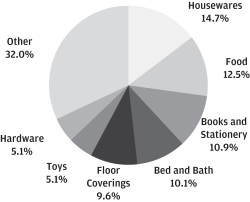

Merchandise Optimization and Private Label: Ollie’s offers products across a variety of categories, including housewares, food, books & stationary, bed & bath, floor coverings, toys, and hardware. In addition to brand name and closeout merchandise, which comprise the majority of purchases (70% in FY14), Ollie’s also offers private label goods in categories where the consumer is not as conscious of brand, e.g. furniture.

Operating Model:

Procurement: The Ollie’s motto of “Good Stuff Cheap” also applies to their procurement strategy as a key success factor for their operating model is the ability to cheaply source recognized, name-brand merchandise to provide value for the consumer. Namely, their ability to continuously attract customers is largely contingent upon their ability to continuously source closeouts, overstocked and salvaged merchandise through a variety of channels, including rather creative ones, e.g. bankruptcy sales.

Distribution and Footprint: A real estate feasibility consultant estimated that there is an opportunity for more than 950 Ollie’s locations in the U.S. and Ollie’s has planned for the long run accordingly. Ollie’s has two distribution centers in PA and GA that can support between 375 and 400 stores and has invested in their infrastructure, allowing them to continuously grow their store footprint.

Ollie’s Army: Over 55% of sales in FY14 were from members of the Ollie’s loyalty program, Ollie’s Army, which is 5.2 million users strong and a key component of their operating model. Generating recurring revenue at existing stores by drawing in these customers more frequently benefits the company from a comparable store sales perspective, which is critical for retail businesses of this nature.

Summary:

Overall, the key elements of the Ollie’s operating model are aligned with the key elements of their business model, from their procurement to their sale of “Good Stuff Cheap.” Their merchant team has successfully leveraged their increased scale and entrenched supplier relationships with manufacturers, distributors and retailers to select the best opportunities in order to offer a compelling value proposition to their customers. In fact, the business has been able to be more selective recently as their IPO this summer drove additional sourcing opportunities from the increased visibility. By consistently appealing to their attractive customer base, Ollie’s has been able to profitably grow; all their stores have been profitable in each year since they opened their first store in 1982.

Merchandise Categories:

Growth:

What an interesting company! Your post clearly lays out Ollie’s customer value proposition and points to the most relevant elements of the operating model that exist to support its business strategies.

I was curious about a few aspects of Ollie’s business and operating models after I read your summary:

1) Distinctiveness in a Competitive Space: As you pointed out, Ollie’s business model relies on consumers consistently shopping at its stores for deals on a range of products (high-end and low-end), but how does differentiate itself in a crowded clearance/wholesaler industry? I imagine Ollie’s faces competition from similar retailers such as National Liquidators, Big Lots etc- is Ollie’s able to win because of the diversity of its range of products? Superior locations? Compelling loyalty program?

2) Response to Dot Coms- you mentioned Ollie’s attracts a customer base of “treasure hunters”, a consumer base accustomed to browsing before purchasing. Given the overwhelming presence of online retailers with a similar business model (e.g. overstock.com, H&J closeouts), is much of Ollie’s business moving online? I imagine the Ollie’s consumer would similarly appreciate the ability to virtually browse its aisles. Would this force the company to expand its distribution centers (and incur those costs)?

Enjoyed reading about this company which has clearly carved out a niche within the discount channel. You mention sourcing as a key value driver in the operating model, so I’m wondering how they are able to source products at 20-25% discounts to Wal-Mart? Presumably it is similar to a dollar store model (i.e. sourcing a lot of close-out merchandise from other retailers), in which case, do you think the ability to do so is sustainable were the company to grow store count by 4x to the 950 opportunities you mention above?

It looks like growth has been driven almost entirely by new store openings, do you get a sense of who Ollie’s is taking share from when they enter a new market? It appears the mix of consumables is far below Wal-Mart or dollar stores so may be some of the players that “Baker’s Dozen” mentions above. Given the product mix, don’t think this business translates to e-comm so will be important to understand who the loyal customer is (age, location, demographics, income, etc.) to frame the Amazon threat.

The most compelling case as to the alignment of the business model and the operating model here to me is alignment between the “bargain hunting” experience with the procurement strategy – both share this concept of “Good Stuff Cheap” that you lay out quite clearly. To me this seems to be one of the key drivers of the impressive top-line and bottom-line growth that you referenced for FY15.

I am curious to learn more about how the Company continues to have strength in procurement in different economic cycles. One example that comes to mind that arguably faltered due to a collapsing procurement strategy is Gilt Group. Gilt benefited from high-end retailers’ struggle to clear shelves following the financial crisis, and had a great deal of high quality inventory. However, as the economy improved and the amount of overstock good declined, Gilt’s value proposition also deteriorated and growth slowed. I realize Ollie’s is targeting a different part of the value chain, but I imagine they might face similar procurement issues when the economy takes off.