Nike: Will Investing in New Technologies Help Reverse its Recent Poor Performance?

Technology is causing tectonic shifts in the sneaker manufacturing industry. In a period of declining sales and earnings, Nike has to transform its supply chain to stay relevant.

Nike, the world’s leading sports brand has been under-performing as of late. The company is one of the Dow’s worst performers in 2016, plagued by poor earnings and declining domestic sales. In the ultra competitive sneaker industry, how can Nike keep up with the competition, be it from other giants such as Adidas or hot startups such as Allbirds?

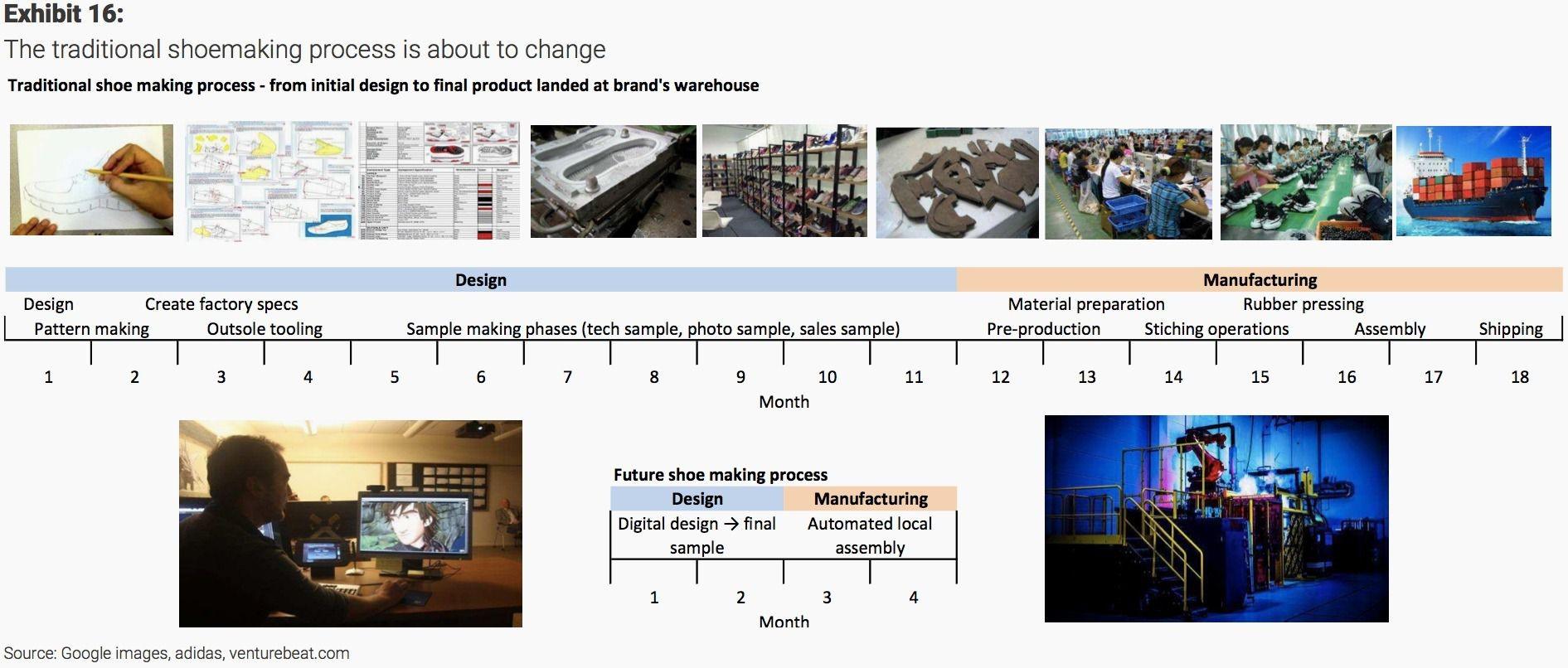

Over the past few years, technological advancements in sneaker manufacturing have led to “tectonic shifts” in the production process. To stem its earnings decline, it is imperative Nike transform its supply chain. To illustrate how significant some of these shifts are, the use of automation and virtual prototyping now has ability to decrease manufacturing lead times from eighteen months to just four, allowing companies to respond to rapidly changing customer preferences [1].

These changes are even more drastic in the long run as automation will likely upend the entire manufacturing industry. The numbers are staggering; According to experts, 1.3 million new robots will be installed in factories over the next three years and about 56% of Southeast Asian salaried employment is at risk of displacement by technology over the next 20 years [2]. As one of the world’s largest manufacturers, Nike has to act, fast.

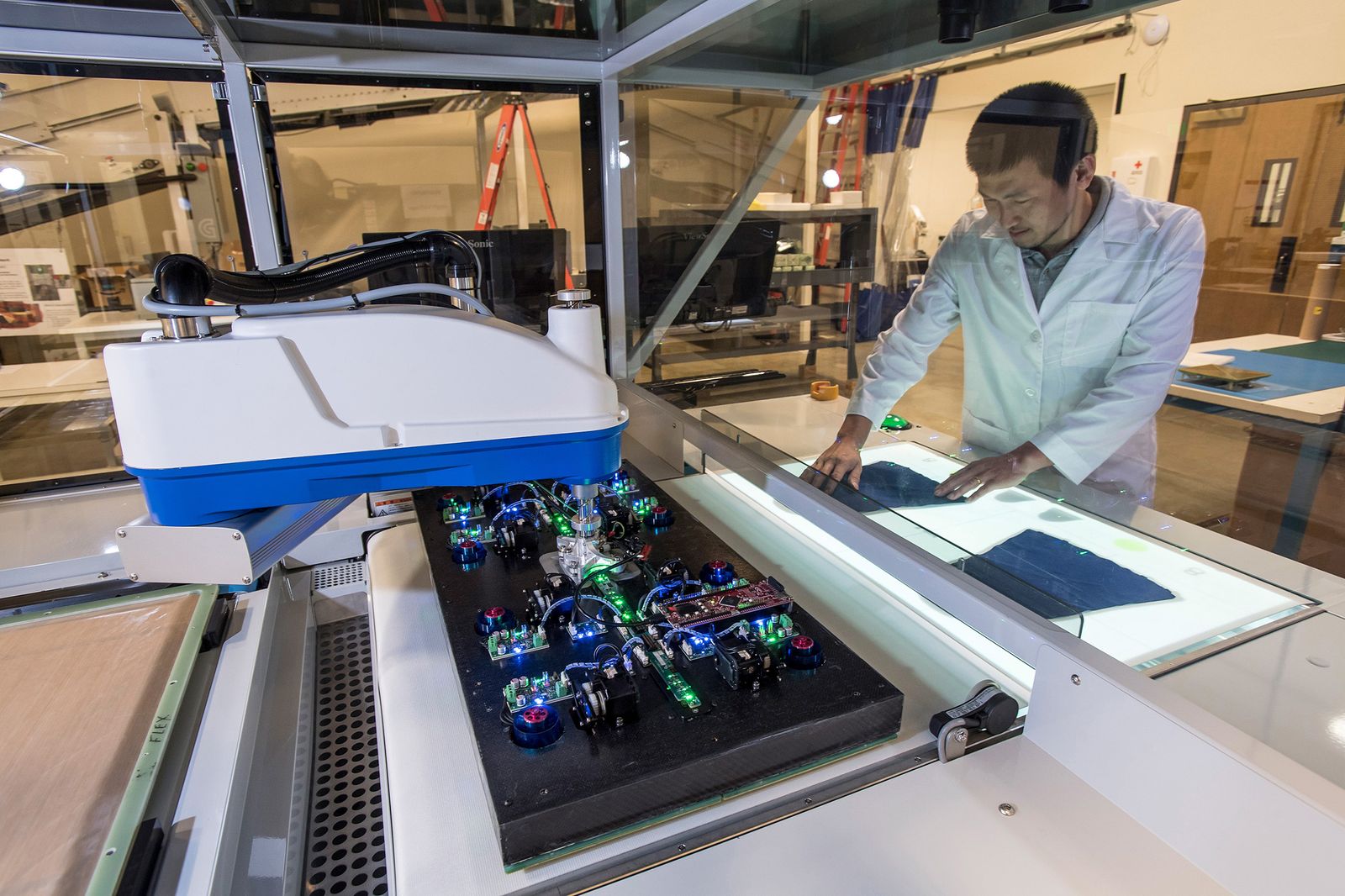

To maintain its competitive edge, Nike has formed partnerships in attempt to reinvigorate its sales and cut costs. In 2015, it partnered with Flex to introduce greater automation into its labor-intensive shoe-making process [3]. Flex’s facility in Mexico has worked on innovations that allow for laser-cutting and automated gluing, ultimately accelerating the production process. So why is this groundbreaking for Nike and how do these changes translate into healthier financial returns?

We can look at the benefits from both a revenue and cost perspective. From a revenue standpoint, Nike is now not only able to offer greater customization for its sneakers, but it is also able to meet consumer demand more quickly. After all, who wouldn’t want perfectly fitting monogrammed sneakers delivered quickly to their doorstep? As for cost, Nike will enjoy substantial labor cost savings. This is particularly evident in Vietnam, where Nike sources 40% of its shoes [4] and where labor costs have been climbing steadily. In fact, analysts estimate that Nike could save $400m in labor and material costs, representing a 5 per cent benefit to its EPS [5]. Though not explicitly mentioned, it likely that automation could also lead to lower defect rates which translate into further cost savings.

Nike has also adopted technology to speed up its design process. It has been able to cut its multiple week prototyping process down significantly through the use of virtual prototypes. Through its partnership with NOVA, the powerful technology platform from DreamWorks, Nike produces photorealistic 3D images that eliminate the need for numerous physical prototypes [7] which translate into more designs in less time.

Nike also understands that adopting new technology is insufficient. To ensure sustained long-term growth, Nike needs to invest heavily into internal R&D and fund promising projects that could potentially revolutionize its production lines. It has done some of this through its investment in Grabit, a startup that uses electroadhesion to help machines manipulate objects in novel ways. Grabit has reportedly provided Nike with upper-assembling machines that can work at 20 times the pace of human workers [6].

Though I find the progress Nike is making reforming parts of its supply chain encouraging, it needs to do more to combat the decline in brick and mortar retail.

Though Nike has tried to buck the trend by launching concept stores to create a premium in-store experience [8], this is not sufficient. Nike might want to consider downsizing its store footprint (reduce rent and inventory costs) and follow in the steps of Bonobos and Grana where inventory is offsite, customers try in store but order online. Nike’s June 2017 partnership Amazon is a big step [9], but the company could also as a result, cannibalize its own retail stores (this also deals a further blow to its distributors such as Foot Locker whose shares have plummeted) [10]. Ultimately, Nike needs to continuously innovate at the downstream end of its supply chain to make sure its physicals don’t become extinct.

What are some the technologies retail stores have been implementing to counter the decline in brick and mortar retail? Will these strategies be applicable to Nike?

It seems distributors (Dick’s, Foot Locker etc.) are being increasingly irrelevant in Nike’s supply chain, can these companies be turned around?

(743 words)

Sources

[1] Bain, M. (2017). A revolution is coming in the way your sneakers are designed and manufactured. [online] Quartz. Available at: https://qz.com/1000737/a-revolution-is-coming-in-the-way-your-sneakers-are-designed-and-manufactured/ [Accessed 13 Nov. 2017].

[2] Garcia, T. (2017). Nike, Adidas adding robots to supply chain to deliver shoes customers want faster. [online] MarketWatch. Available at: https://www.marketwatch.com/story/nike-adidas-adding-robots-to-supply-chain-to-deliver-shoes-customers-want-faster-2017-06-07 [Accessed 13 Nov. 2017].

[3] TODAYonline. (2017). Robotics in the running for Nike’s factories of the future. [online] Available at: http://www.todayonline.com/world/robotics-running-nikes-factories-future [Accessed 13 Nov. 2017].

[4] Clough, M., Black, M. and Welch, M. (2017). Nike and Ford Caught in Crossfire of Trump’s Trade Overhaul. [online] Bloomberg.com. Available at: https://www.bloomberg.com/news/articles/2017-01-23/nike-and-ford-caught-in-crossfire-of-trump-s-free-trade-overhaul [Accessed 13 Nov. 2017].

[5] TODAYonline. (2017). Robotics in the running for Nike’s factories of the future. [online] Available at: http://www.todayonline.com/world/robotics-running-nikes-factories-future [Accessed 13 Nov. 2017].

[6] Fortune. (2017). These Robots Are Using Static Electricity to Make Nike Sneakers. [online] Available at: http://fortune.com/2017/08/30/robots-static-electricity-nike-sneakers/ [Accessed 13 Nov. 2017].

[7] Bain, M. (2017). A revolution is coming in the way your sneakers are designed and manufactured. [online] Quartz. Available at: https://qz.com/1000737/a-revolution-is-coming-in-the-way-your-sneakers-are-designed-and-manufactured/ [Accessed 13 Nov. 2017].

[8] Bowman, J. (2017). Nike Inc’s New Soho Store Shows Why the Future of Retail Is Experience-Based. [online] The Motley Fool. Available at: https://www.fool.com/investing/2017/04/10/nike-incs-new-soho-store-shows-why-the-future-of-r.aspx [Accessed 13 Nov. 2017].

[9] Wattles, J. (2017). Nike confirms Amazon partnership. [online] CNNMoney. Available at: http://money.cnn.com/2017/06/29/technology/business/nike-amazon-shoes/index.html [Accessed 14 Nov. 2017].

[10] Townsend, M. and Freund, M. (2017). Foot Locker Dives as Investors Brace for ‘Several Years of Pain’. [online] Bloomberg.com. Available at: https://www.bloomberg.com/news/articles/2017-08-18/foot-locker-plunges-as-athletic-goods-sales-contraction-deepens [Accessed 14 Nov. 2017].

Great article, Kai! This really hits home for me because I am a huge NIKE apparel fan, especially when it comes to shoes. A couple of things that came across my mind when reading your article:

First, I am a bit conflicted about NIKE cutting its manufacturing down considerably. I know that might sound crazy, but let me explain. While it is great that there will be more varieties of shoes available, when it comes to athletic shoes, I personally am looking for performance/fit/durability over rotating style. For my last pair of NIKE sneakers, the FS Lite II, I had to buy 4 pairs at once because I was afraid that when I went to repurchase the shoe 6 months later, I wouldn’t be able to find it online, let alone the actual brick and mortar store. Constantly rotating and changing shoes means less quantity of each shoe type. I think this works for fashion and style, but not when it comes to athletics (or not to the same degree…)

Second, to address your comments about brick and mortar stores and their role in the supply chain. I think these stores need to leverage Web 2.0 and other social/internet mediums to better educate their employees on the shoe benefits. I think back to my best shoe buying experience at a little place called West Seattle Runner in Seattle, Washington. The store employee made me try on shoes, run across the store, try different exercises, try different socks, etc. Afterwards he gave me an assessment of which shoe fit my running style and what would be most comfortable for the long term. Store employees at Foot Locker, Dick’s, etc. need to get online, learn about the product, and deliver what online retailers like Amazon can’t….first-class customer service and showcasing the trialability of a product. This isn’t just for running, but for basketball, soccer, football…you name it! Retailers could bring in small turf pitches or track surfaces and allow their customers to try their cleats, shoes, or sneakers in a real setting, all while getting advice from a knowledgeable store employee.

Thanks for the fun article! Great job!

Kai, to your question of what are some of the things to do to counter the decline in brick and mortar retail… I think cause is not entirely lost. I see a lot of new brands doing quite well in retail (say Warby Parker… Everlane is opening their first store, etc.). What feels different though is that these new age brands are focused on things like transparency, connection to the actual makers, competitive prices. I think massive companies like Nike can learn from these brands and figure out how to better connect to customers even as a ubiquitous brand.

Thanks, Kai for the thoughtful post. In your article, you touched upon Nike’s recent decision to sell through Amazon, which represents a strong channel conflict for its traditional retail partners. Nike’s decision implicitly demonstrates the degree to which traditional brick and mortal retail is being disrupted, and the growing clout of Amazon. Personally, I believe that the future of traditional brick and mortar retail remains bleak. As customers are increasingly comfortable with shopping online, more and more of the traditional mall foot-traffic (where most Foot Lockers are) will be diverted online. I can imagine one day (not that far off) when a customer sitting at home can click on a button on Amazon, scan his feet through his iPhone, and get a customized pair of shoes delivered to his doors less than a week via an Amazon drone. To be clear though, I think selling through Amazon will ultimately be a boon for Nike – but be a clear existential threat to its traditional retail partners.