How to Rent Your Neighbor’s Tesla with Getaround

Getaround is the self-proclaimed “Airbnb of cars”. Development of smartphones and location-based technology has driven development of the sharing economy. New peer-to-peer car rental services threaten a market dominated by the big three (Avis, Enterprise, and Hertz) and threaten car manufacturers in the longer term[1].

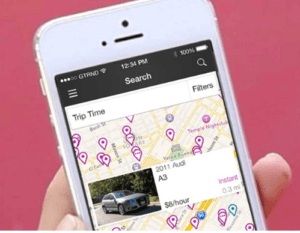

Founded in 2009, Getaround is the self-proclaimed “Airbnb of cars”. Car owners can list their underutilized car for on-demand rentals and active owners can earn $10,000 per year per car[2]. Customers can browse cars listed in their neighborhood on their smartphones and rent by the hour. Their most novel feature is the ability to physically access the cars through your smartphone: Getaround’s proprietary Connect hardware in every vehicle allows renters to locate and unlock the car via its mobile application (keyless), eliminating the need to ever meet the car owner. Getaround started in San Francisco and has expanded to other US cities such as Austin, Chicago, San Diego. As of November 2014, Getaround had 600 cars available and 1,300 active users in San Francisco but those numbers are likely higher today[3].

Source: Getaround.

Source: Getaround.

Why do we need this?

Today, the process of renting a car is inconvenient and inflexible. Pricing and selection are unclear. Consumers have to visit the car rental counter (if nearby). And there’s no easy way to simply rent for an afternoon hike outside the city. Getaround removes the friction from the car rental model and offers an easy, instantaneous way to book impromptu trips. The average renter also saves $1,800 per year by using a car sharing service instead of owning a car[4].

There are 250mm personal vehicles in the US yet average utilization is only 4-5% (car sits idle for 22 hours/day)[5]. Getaround allows underutilized assets to generate revenue for the owner. Car value depreciates the moment you drive it off the lot: Getaround allows owners to offset this.

Compared to the car rental market (expected to be $100bn by 2022), the current global car sharing market is small at $1.2bn but is expected to reach $5bn by 2020[6]. Getaround thinks the face of mobility will change 10-15 years from now, where people will be selling the service of transportation more than the underlying vehicle. According to the CEO, this market is a $2tr domestic ecosystem up for grabs[7]. Getaround has raised over $53mm of venture funding at a $200mm estimated valuation from investors including Triangle Peak Partners, Menlo Ventures, Cox Enterprises, and SOS Ventures[8].

How does it work?

When a car owner decides to join the network, Getaround employees will inspect the car and install their hardware which tracks the car’s location and speed and allows the doors to be unlocked via a smartphone. Their IP is in their keyless technology which retrofits any car.

Source: Getaround.

Owners pay $99 to install the device into their cars, and $20 per month for the service. Getaround takes a 40% commission on rentals and guarantees the car owner they will earn $1,000 in three months[9]. Availability and pricing is completely up the owner. The costs of running this platform are insurance and 24/7 roadside assistance.

A massive amount of trust in the platform is needed for this system to work where transactions average $50 on a $30,000 car[7]. Its algorithms will screen a person’s profile within a minute to see if the platform trusts them to rent a vehicle out to. They also partnered with Berkshire Hathaway to provide insurance up to $1,000,000 for every trip, so the owner’s insurance is never hit[5].

Looking ahead

Getaround faces competition from the OEMs who are offering their own ride sharing models and direct competitors like Turo. GM is launching its own ride sharing model and has partnered with Lyft and acquired Cruise. Tesla envisions a future network where owners can rent their vehicles on-demand when not in use. To combat this competition, Getaround has partnered with Ford and Toyota which allow people to help finance new cars by renting it out on Getaround[7]. Toyota will also offer vehicles, beginning with premium Lexus cars, for rental on Getaround.

Near term, Getaround biggest challenges will be user adoption and network scale, which go hand-in-hand. They should continue to partner with OEMs to increase network availability to drive user adoption. As users become more comfortable with the model and switch from traditional rental, car owners will feel more comfortable with the idea of renting, similar to the traction Airbnb experienced. Getaround could also look into partnering with governments for public infrastructure: utilization of existing assets is low-hanging fruit for increasing capacity when public funds are constrained.

Longer term, the biggest barriers are trust and safety. Getaround has addressed some of this through its technology, insurance, and monitoring, but the sharing economy will need a thoughtful, systematic crisis management strategy in order to grow.

Source: TechCrunch.

(Word count: 786)

[1]First Research, “Automobile Rental & Leasing – Quarterly Update”, September 26, 2016.

[2]Getaround, “How it Works”, https://www.getaround.com/tour, accessed November 2016.

[3]Megan Rose Dickey, “Getaround’s Revenue Has Doubled To “Tens Of Millions” In The Last Six Months”, TechCrunch, September 28, 2015, [https://techcrunch.com/2015/09/28/getaround-revenue-2015/], access November 2016.

[4]David Zhao, “Carsharing: A Sustainable and Innovative Personal Transport Solution with Great Potential and Huge Opportunities”, Frost & Sullivan Market Insight, January 28, 2010.

[5]Getaround, “Getaround Unveils First All-In-One Car Sharing Solution at TechCrunch Disrupt; Announces Insurance Agreement with Berkshire Hathaway”, May 24, 2011, [https://www.getaround.com/press/library/2011/05/24-Getaround-at_TechCrunch_Disrupt], accessed November 2016.

[6]Technavio, “Global car rental market to surpass growth rate of 16% during 2016-2020”, Business Wire, August 22,2016.

[7]Sam Zaid, “Goldman Sachs Innovation Symposium”, conference presentation, March 16, 2016, New York, NY.

[8]Crunchbase, “Getaround”, [https://www.crunchbase.com/organization/getaround#/entity], accessed November 2016.

[9]Lizette Chapman, “Car Sharing Company Getaround Fuels Up at $200 Million Valuation”, Wall Street Journal, November 20, 2014, [http://blogs.wsj.com/venturecapital/2014/11/20/car-sharing-company-getaround-fuels-up-at-200-million-valuation/], accessed November 2016.

MayC, your post raises a number of questions for me on the benefits of a sharing economy-based business. While a two-way sharing platform provides for a highly scale-able business model (i.e., the ability for Getaround to use existing cars on the road which requires no capital investment by the company to scale, unlike traditional companies such as ZipCar or Car2Go), the business model also has very little barriers to entry when it comes to building brand and scaling. This, coupled with the fact that switching costs for car-owners and consumers is virtually zero, makes it a tough business to maintain sustainable margins (as car owners will gain bargaining power as more entrants enter the space and Getaround can no longer command 40% commissions). Ultimately, because these car-sharing platforms do not have a product but are simply intermediaries or connectors, they will have to find some way to differentiate itself on brand and user experience, like Uber has been able to in the ride sharing marketplace. While digitization created a strong initial opportunity for Getaround, I see it as a large challenge in the coming years for the company to maintain and grow its position.

Great post MayC. I think we are on the same page. Sharing model is the future for many industries, including car industry. This is an application completely different than the zipcar and the uber model. The real question is: is this model in competition with ZipCar or they complete each other? How can the consumer decide which of the two models is better for him/her.

I believe in general many changes will happen soon in the automotive industry. No matter what happens, I will still try to rent a Ferrari from a person who underutilizes it.

Interesting post MayC. I wonder how this industry would be affected by cab aggregators such as Uber entering into the driverless cars space. Would it still be incentive enough for both parties if instead they could simply use the Uber service. I believe that the size of the pie will not increase, and instead this service will be cannibalised by driverless cars.

Thanks MayC. I remember people postulating about this idea when Airbnb first became mainstream as cars felt like the next logical target for the gig economy. I completely agree that the process of hiring a car is unnecessarily burdensome and innovation in this area is needed. However, my primary concern stems from the fundamentally different competitive landscape. Unlike accommodation, where hotels never owned the assets to compete in home-sharing, car OEMs already own the underlying assets. OEMs have invested heavily in tech disruptors, including driverless car technology, and have greater access to capital, making them formidable competitors to technology pure-plays.

Thanks for the post, MayC. I’m really intrigued by this concept, but I still have a few questions. Maybe I’m alone in this opinion, but I actually think it is pretty easy to simply rent a car for the afternoon in the current market (including from the big 3 car rental companies). Zipcar and other similar car-sharing options like Car2Go seem to present easy options available now. How will something like Getaround complete with these options? Do you think of them as direct competitors?

Your post also made the point about Getaround helping off-set depreciation of new vehicles. However, wouldn’t increasing utilization and exposing the car to drivers that might not be as inclined to take care of the vehicle (i.e., more damage) likely increase/accelerate the depreciation? Wouldn’t those factors potentially counteract the additional revenue being generated by participating in Getaround?

I share JJCW’s concern and I’m thinking about the impact of self-driving cars on Getaround’s business model. If or when self-driving cars become mainstream, I don’t see a real future for individually owned cars. These could be replace by companies or local governments that would own a large number of vehicles that would be made available to the public. In such a scenario I no longer see a market for Getaround unless it will also own assets and concequently not be a technology pure-play anymore.

Great post, MayC! This “Airbnb of cars model” is very interesting, particularly since Getaround has managed to make it easier to actually borrow the car with its proprietary keyless entry system. While it sounds like there is tremendous potential upside with increased utilization and decreased need for vehicle ownership, I would be interested in learning more about how close Getaround is to viable scale. Clearly you need a lot of adopters for this model to work well, and if you have to walk 30 minutes to reach the car you want to borrow, maybe you would just use an Uber or Lyft to reach your intended destination.

I am also curious about potential negative effects of this system. For example, what if you borrow a manual transmission car but aren’t very good at driving a stick? Or could frequent switching of vehicles lead to more road accidents due to drivers who aren’t as familiar with their borrowed cars? If you think your brakes will be more responsive than they are or assume your headlights will switch on automatically because that’s what you are used to, that could lead to problems.

Very interesting post! Given that the trust between the car owner and the car renter is the most important factor here, I wonder what additional steps Getaround can do to strengthen the bond between customers and owners. I also wonder what sort of marketing the company has done to get its name out there. Everyone is comfortable with using AirBnB because we’ve all heard of it but not that many people have heard of Getaround. I bet that more advertising can help build more trust.