Goldman Sachs: Is a dedicated App Store the Future of Retail Banking?

As traditional retail banks catch up to Goldman Sachs’ success with online savings bank Marcus, public open innovation facilitated by a dedicated App Store could build upon Goldman's internal innovation to unlock the next generation of retail banking.

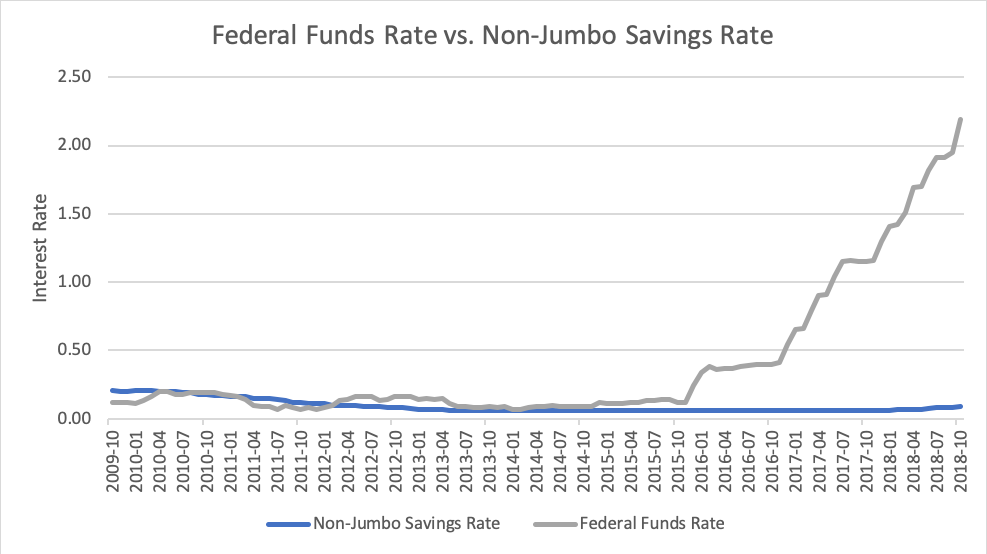

Goldman Sachs’ (GS) entry into retail banking with Marcus in 2016[1] turned heads[2]: why would a premier investment bank with high margins enter the highly competitive consumer banking space? As fixed-income revenue streams decline and corporations reduce their transaction spend, the investment banking industry has grappled with lower revenues, with 2017 at $66 billion industrywide versus $121 billion in 2009[3]. Simultaneously, a 2.1% gap between the federal funds rate and the non-jumbo[4] savings rate has enticed new players to enter digital retail banking (figure 1), including Marcus by GS[5]. Offering savings interest rates at 2.05%−23 times the average rate[6]−Marcus has grown to 1.5 million customers and $23 billion in deposits in two years[7]. However, large commercial banks are taking notice, increasing the average savings rate they offer their customers by 50% in the past year (figure 1) and the number of incentives they provide their commercial bank customers[8]. To continue to innovate and grow market share in the retail banking world, and to protect against advances made by established commercial banks, GS has implemented an internal open innovation crowdsourcing process and invested in multiple FinTechs. Yet, without a large-scale, public open innovation platform, can Marcus reach scale before the traditional retail banks catch up?

Figure 1 – A comparison of the Federal Funds Rate vs. the Non-Jumbo Savings Rate from 2009-2018 [9],[10]

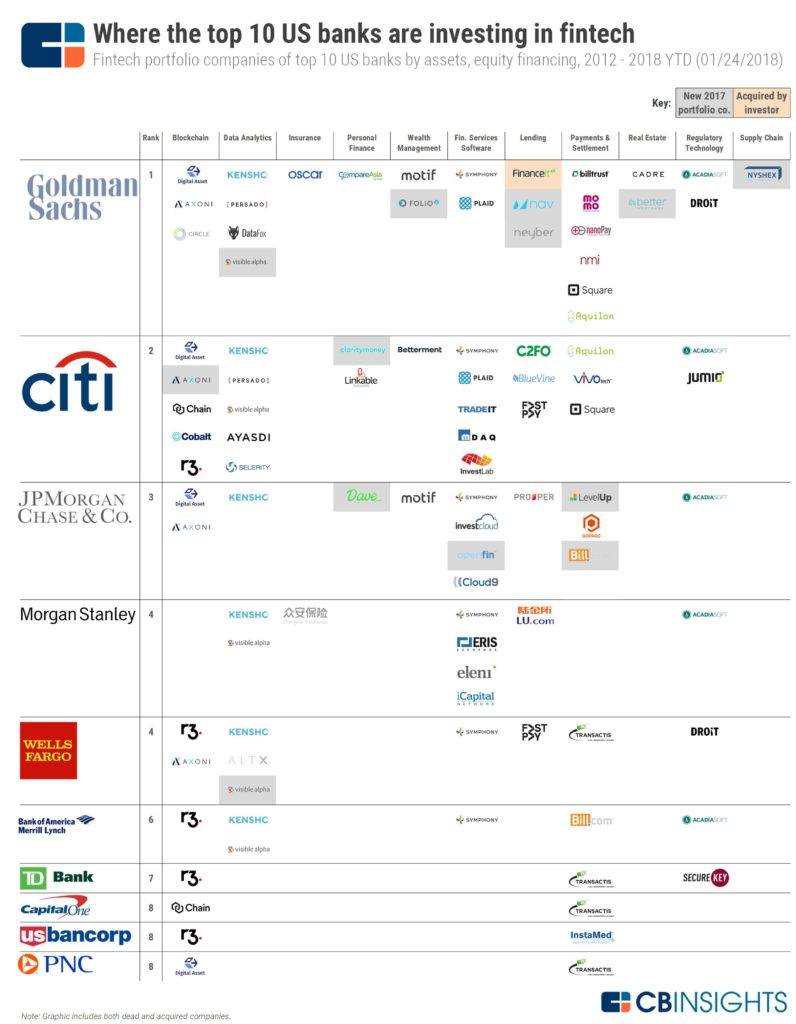

Currently, GS innovation strategy can be divided into FinTech investments and an internal open innovation crowdsourcing, named GS Accelerate[11]. In the short term, GS has made 27 FinTech investments (figure 2), which capture a range of opportunities, from blockchain and analytics to insurance and lending. Over the medium term, GS Accelerate was launched earlier this year to leverage in-house talent to innovate new products and services, particularly as GS expands into retail banking. GS Accelerate launches incubators with 2-6 people assigned to tackle new business opportunities, risk management solutions and ways to improve the company’s efficiency.

GS innovation strategy places the bank at the forefront of innovation. Nonetheless, Marcus’ $23 billion in deposits is small compared to over $9 trillion in US savings[12]. If GS seeks to increase retail revenue to $5 billion[13], GS will need to rely on more than its internal innovation, and leverage a larger scale community to quickly and effectively scale.

Figure 2 – Where the top 10 US banks are investing in FinTech[14]

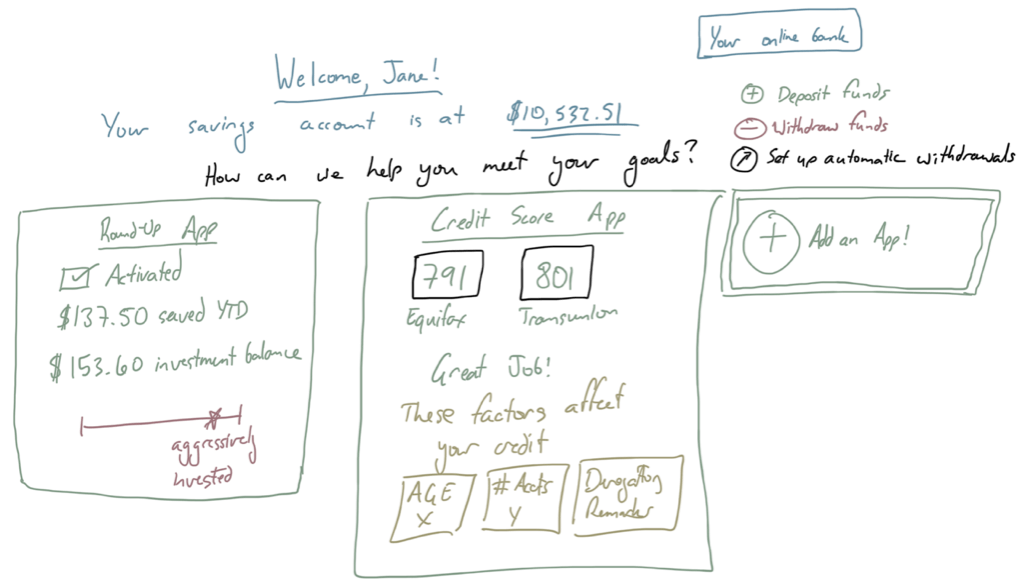

GS commitment to innovation is formidable, but “Joy’s Law” stipulates that no matter who you are, the smartest people work for someone else. Although an individual company can make significant headway in innovation and FinTech investments increase the intellectual diversity of GS workforce, public open innovation captures the intelligence of a wider, global, distributed network of individuals[15]. For example, the success of the iPhone, a product that entered a crowded mobile phone market, is often attributed to its novel App Store that enabled developers from all over the world to create quality applications for its product[16]. GS has a unique opportunity to explore a similar open innovation app marketplace to address the ever-evolving needs of the average consumer in the short term. Let us refer to this opportunity as “GS Open”. With over 250 FinTechs clamoring for customers in an increasingly crowded space (figure 3), GS Open could offer its digital first platform, Marcus, as a base for FinTechs to provide a broad suite of services. Many FinTechs automate tasks that could be more easily accomplished within Marcus’ existing platform and user database, such as rounding transactions to the nearest dollar, investing the rounded amounts in an exchange-traded fund and sharing access to your weekly credit scores (figure 4).

A limitation to GS Open is that in the medium term GS may wish to develop these capabilities in-house, rather than depend on outside developers. In order to maintain the opportunity to develop capabilities in-house over time, GS could follow in the footsteps of Apple, positioning itself as a competitor to the app creators within a common framework that they provide to developers for a nominal service fee. GS Open is a natural progression in GS’ strategy to crowdsource innovation and it could transform Marcus into the iPhone of the banking world.

Figure 3 – The FinTech 250: The Top FinTech Startups of 2018[17]

Figure 4 – Concept design of GS Open, enabling modular app support within Marcus

As investment banking revenues tighten, GS has a unique opportunity to break into retail banking with a fresh approach. The success of Marcus to-date has relied on the delta between the federal funds rate and the average non-jumbo savings rate, made affordable due to the absence of physical bank branches. As traditional banks catch up with Marcus’ savings rates, however, GS will need to build upon its in-house innovation and FinTech acquisition strategy with a public, open innovation platform that enables developers to leverage Marcus’ platform and user database to offer products to an increasingly tech-savvy consumer. Could this open innovation be the key that unlocks $5 billion in retail banking revenues for GS or would developers shy away from the opportunity, dooming it from the start?

[800 words]

[1]Goldman Sachs, 2016. GOLDMAN SACHS LAUNCHES NEW ONLINE PERSONAL LOAN PLATFORM; MARCUS BY GOLDMAN SACHS FOCUSES ON HELPING PEOPLE MANAGE CREDIT CARD DEBT. [Online]

Available at: https://www.goldmansachs.com/media-relations/press-releases/current/announcement-marcus-by-goldman-sachs.html

[Accessed 11 November 2018].

[2]Popper, N., 2016. Goldman’s Online Lender, Marcus, Opens (to Those With the Code). [Online]

Available at: https://www.nytimes.com/2016/10/14/business/dealbook/goldmans-online-lender-marcus-opens-to-those-with-the-code.html

[Accessed 11 November 2018].

[3]The Economist, 2017. Goldman Sachs announces a change in strategy. [Online]

Available at: https://www.economist.com/finance-and-economics/2017/09/16/goldman-sachs-announces-a-change-in-strategy

[Accessed 11 November 2018].

[4]Non-jumbo savings are defined as all savings deposits under $100k in value

[5]The Economist, 2017. Goldman Sachs announces a change in strategy. [Online]

Available at: https://www.economist.com/finance-and-economics/2017/09/16/goldman-sachs-announces-a-change-in-strategy

[Accessed 11 November 2018].

[6]Marcus by Goldman Sachs, 2018. Homepage. [Online]

Available at: https://www.marcus.com/

[Accessed 11 November 2018].

[7]PYMNTS, 2018. Goldman Says It Has 1.5M Marcus Customers. [Online]

Available at: https://www.pymnts.com/earnings/2018/goldman-sachs-digital-expansion-earnings/

[Accessed 11 November 2018].

[8]Back, A., 2018. Banks Finally Start to Pay Their Depositors. [Online]

Available at: https://www.wsj.com/articles/banks-finally-start-to-pay-their-depositors-1534152600

[Accessed 11 November 2018].

[9]Board of Governors of the Federal Reserve System (US), 2018. Effective Federal Funds Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis. [Online]

Available at: https://fred.stlouisfed.org/series/FEDFUNDS

[Accessed 11 November 2018].

[10]Federal Deposit Insurance Corporation, 2018. National Rate on Non-Jumbo Deposits (less than $100,000): Savings [SAVNRNJ], retrieved from FRED, Federal Reserve Bank of St. Louis. [Online]

Available at: https://fred.stlouisfed.org/series/SAVNRNJ

[Accessed 11 November 2018].

[11]Nonninger, L., 2018. Goldman Sachs promotes in-house innovation. [Online]

Available at: https://www.businessinsider.com/goldman-sachs-promotes-in-house-innovation-2018-3

[Accessed 11 November 2018].

[12]Board of Governors of the Federal Reserve System (US), 2018. Total Savings Deposits at all Depository Institutions [SAVINGS], retrieved from FRED, Federal Reserve Bank of St. Louis. [Online]

Available at: https://fred.stlouisfed.org/series/SAVINGS

[Accessed 2018 11 November].

[13]The Economist, 2017. Goldman Sachs announces a change in strategy. [Online]

Available at: https://www.economist.com/finance-and-economics/2017/09/16/goldman-sachs-announces-a-change-in-strategy

[Accessed 11 November 2018].

[14]CB Insights, 2018. Where Top US Banks Are Betting On Fintech. [Online]

Available at: https://www.cbinsights.com/research/fintech-investments-top-us-banks/

[Accessed 11 November 2018].

[15]K. Lakhani and J. Panetta. The principles of distributed innovation. Innovations: Technology, Governance, Globalization 2, no. 3 (Summer 2007): 97–112.

[16]K. Boudreau and K. Lakhani. How to manage outside innovation. MIT Sloan Management Review 50, no. 4 (Summer 2009): 68–76.

[17]CB Insights, 2018. The Fintech 250: The Top Fintech Startups Of 2018. [Online]

Available at: https://www.cbinsights.com/research/fintech-250-startups-most-promising/

[Accessed 11 November 2018].

I really enjoyed reading your post. The comparison to Apple and the effect that the App Store had on the iPhone’s success is particularly interesting and original. You mentioned that consumers are increasingly tech-savvy, I definitely agree. Particularly as millennials are beginning to save money and learn to invest, it is important for financial firms to innovate to meet their needs. As millennials become more educated on personal finance, do you think there will be any type of course-correction or fear that technology is playing too prominent a role? For example, would consumers initially embrace an open-source platform, but then worry that their data was being distributed too freely? Privacy and safety seem paramount when it comes to personal finance so I wonder how the increasing integration of technology and finance will play out over our lifetimes.

Very interesting article. The need to innovate and move into fintech is a huge focus for bulge bracket investment banks. However, I am a bit weary of using open source innovation in a bank, especially with regards to personal deposits. Open source innovation works best with the sharing of information, which is inherently personal and very private in a banking sense. I would be nervous that any security breach from one of the apps (like we see often on iphones) would cause extreme media backlash as we saw with Wells Fargo.