Getting Smart: How Progressive Is Deploying Data To Win in Auto Insurance

Progressive wants to use digital data to lower your car insurance rates and transform the auto insurance industry.

On October 6 2016, John Sauerland, VP and Chief Financial Officer of The Progressive Corporation, explained how, less than three years ago, his teams were dealing with a “data explosion.” So what did they do? “We literally had analysts trying to create mini server farms in the closets near their workspaces”[1] Since then, he told Wall Street analysts, “we got smart. We brought in the right technology. We’ve developed the talents internally.”[2]

Why did Progressive, one of the nation’s largest car insurers, suddenly have too much data to process?[3] The answer lies in a rapidly evolving technology that is changing the automotive insurance landscape: telematics.

Auto Insurance Business Model

Automotive insurance provides drivers protection against financial liability that may result from property / physical damage. Such protection is purchased for a monthly fee, called “premiums”). Successful models are driven by insurers’ ability to:

- Price risk accurately – Insurance policy premiums are driven by the probability of a claim (an event upon which the insurer needs to refund drivers for damages). Assessing this probability accurately therefore allows insurers to price premiums at the lowest possible cost of coverage (and hence attract more customers through such cost competitiveness). Historically, insurers relied on factors such as demographics, age, past driving record (if any), residence location, and credit history, as proxies for driving prowess.[4]

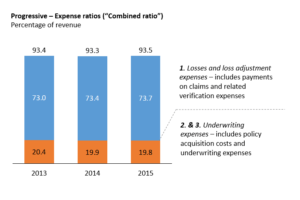

- Minimize policy acquisition expense – After claims, advertising / channel fees (e.g. to agents) add about 20-30% of premiums to insurers’ cost structure. The best insurers can acquire customers for lower costs, as well as reduce churn within their customer base (and hence extend premiums for free or with minor retention discounts. Increasing retention should increase customer lifetime values.

- Minimize overhead per customer – Premiums also cover administrative expenses, including customer support, claims management, and headquarter costs. Such costs typically experience scale economics. Larger insurers, therefore, exhibit lower overhead per customer due to this operating leverage.

- Generate investment income – A time-lag exists between receiving premium cash and dispensing cash for claims. Auto insurers can also generate a small percentage of income by investing this cash during the period.

The Impact of Telematics

Telematics uses digital technologies to analyze individual driving abilities and price risk accordingly. By leveraging driver data, insurers become more competitive by passing the savings to customers. Such technologies include GPS-tracking in mobile phones, as well as on-board device (OBD) dongles that plug into cars.[5] In addition to the data for individual drivers, insurers can add to their overall data set to identify loss trend correlations with other proxy factors. Doing so helps to refine pricing across the entire customer base, rather than just the telematics penetrated base.

Introduction of Snapshot

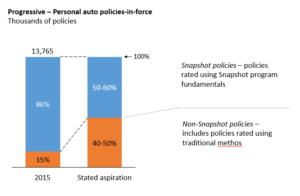

Snapshot is Progressive’s response to telematics. Since first launching the program in 2011, it has – as of October 2016 – reached “2 million policies rated using Snapshot fundamentals.”[6] Customers can achieve up to 30% in discounts.[7] Using an average annual auto insurance premium of $1000 / policy suggests $2 billion of premiums benefit from the program: roughly 15% of Progressive’s roughly $14 billion personal auto policy portfolio.[8] [9]

Looking ahead, Snapshot appears to represent an important component of Progressive’s futurel. In a March 2016 conference call, Chairman Glenn Renwick told analysts “Snapshot…continues to be something very important to us.”[10] Renwick also set a reference for Progressive’s penetration, stating “ultimately, when we start talking about penetration numbers…in the range of that 40%, perhaps even 50%.”[11]

Can Progressive reach its goal?

Despite Progressive’s ambitious targets, challenges to adoption exist. The following additional steps are positive; they will, however, require further evolutions in the future.

- Device usage – Historically, Progressive has asked customers to plug-in a dongle into their car for 90 days to evaluate their driving. Once the time expires, customers send the device back, so Progressive can re-use with other customers. This cumbersome processes has lowered adoption.[12] Looking ahead, however, Progressive has announced two measures. First, it will launch a mobile version of the system, titled “Snapshot 3.0” later in 2016. Second, it has partnered with General Motors, whose new vehicles have built-in devices, reducing the hassle of an additional dongle.[13]

- Privacy concerns – Customers have traditionally been reluctant to share their driving and location information. At an industry level, customer awareness is growing.[14] As Progressive launches its mobile version of Snapshot, which will leverage location just as a range of apps do (e.g. Uber, Google Maps), the insurer expects this concern to wane.[15]

- Competition – While Progressive is regarded as an industry pioneer, most other major insurers have launched their own telematics platforms. Examples include Allstate’s Drivewise, State Farm’s Drive Safe and Save, and Nationwide’s SmartRide.[16] Progressive’s customer acquisition efforts, such as new product roll-outs and partnership with auto OEMs, should influence its ability to remain a leader.

Do you think Progressive can reach its goal…?

Word count: 798

[1] The Progressive Corporation Investor Day Materials, October 06, 2016.

[2] The Progressive Corporation Investor Day Materials, October 06, 2016.

[3] The Progressive Corporation, 2015 Annual Report.

[4] Dwight Hakim, “Insurance telematics? What is it? Why we should care.,” Verisk Analytics, http://www.verisk.com/visualize/insurance-telematics-what-is-it-and-why-we-should-care.html, accessed November 2016.

[5] The Progressive Corporation Investor Day Materials, October 06, 2016.

[6] The Progressive Corporation, FY2016Q1 Results Conference Call, May 06, 2016.

[7] Barbara Marquand, “Comparing Drivewise, Snapshot and Other Usage-Based Insurance Plans,” Nerdwallet, February 8, 2016, https://www.nerdwallet.com/blog/insurance/comparing-drivewise-snapshot-usage-based-insurance/, accessed November 2016.

[8] Value Penguin, “Average Cost of Insurance: Car, Home, Renters, Health, and Pet (2016),” https://www.valuepenguin.com/average-cost-of-insurance, accessed November 2016.

[9] The Progressive Corporation, 2015 Annual Report.

[10] The Progressive Corporation, FY2015Q4 Results Conference Call, March 02, 2016.

[11] The Progressive Corporation, FY2015Q4 Results Conference Call, March 02, 2016.

[12] Nathan Golia, “Usage-Based Insurance: 5 Reasons This Is the Year,” Drive Factor, http://www.drivefactor.com/usage-based-insurance-5-reasons-this-is-the-year/, accessed November 2016.

[13] The Progressive Corporation Investor Day Materials, October 06, 2016.

[14] “2016 Usage-based insurance (UBI) research results for the U.S. consumer market,” LexisNexis, August 2016, http://www.lexisnexis.com/risk/insights/insurance-telematics.aspx, accessed November 2016.

[15] The Progressive Corporation Investor Day Materials, October 06, 2016.

[16] Barbara Marquand, “Comparing Drivewise, Snapshot and Other Usage-Based Insurance Plans,” Nerdwallet, February 8, 2016, https://www.nerdwallet.com/blog/insurance/comparing-drivewise-snapshot-usage-based-insurance/, accessed November 2016.

Thanks for the informative article on Progressive! It is interesting to think about a future auto insurance industry where customers are evaluated based on actual driving data rather than simple demographic metrics. I wonder though if customers can game the system by learning to be a better driver within the 90 days that the dongle is installed in their car. If they then send back the device, do their driving habits revert back to lower safety levels? It seems as those an app version would solve a significant amount of this testing issue.

Similarly, do the premiums ever reflect up-to-date monitoring data? It seems as though the most proactive way to institute premiums based on performance is to change pricing in the next month based on driving records. For instance, if I drove really poorly in April, my insurance premium could go up in May. This would be a major change for the industry.