Everlane: Minimalist wholesale strategy and minimalist design

How the powerful combination of e-commerce and digital advertising let direct-to-consumer brands thrive.

No wholesale, no problem.

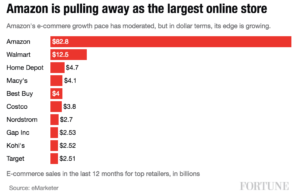

It’s not new at this point: e-commerce has changed the way the world shops. Alibaba sold $18 billion of gross merchandise in one day [1]. Amazon is predicted to surpass Macy’s as the largest seller of clothes next year [2]. Macy’s announced this summer that they will close 15% of their stores by the end of the year [3].

But e-commerce has not just benefited digital distributors like Amazon. The willingness of customers to buy online coupled with the ease of efficiently reaching customers at scale through digital advertising has also led to the rise of direct-to-consumer (DTC) brands. The killer combination has allowed brands to completely circumvent the traditional wholesale and brick-and-mortar distribution strategies. Social media and cheap digital marketing allows brands to connect one-to-one with customers, who are driven to and buy directly from branded websites. Because the DTC brands do not lose any margin to wholesalers, the customers win with cheaper prices.

A Stylish Combo: E-Commerce and Digital Advertising

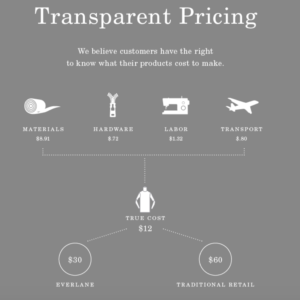

One such DTC that is helping define the future of retail is Everlane. The brand sells high-quality minimalist clothing and accessories at a lower cost than traditional retailers. As the company explains through their “Transparent Pricing” effort, no wholesaler means no extra cost to the consumer.

The higher margin also allows Everlane to invest in sourcing from factories with ethical and sustainable business practices. Everlane details each factory from which their materials are sourced, and explains why the materials are top of the line. For example, Everlane’s cashmere sweaters are produced in a factory in Dongguan, China, which has 800 employees and has been in operation since 2000. The factory sources “directly from Mongolia and spun the yarn on Italian machines in Ningbo,” then builds the sweater in Dongguan [4].

But it’s not just the ability to sell without a wholesaler that allows Everlane to thrive as a DTC brand. The company spends ~$10M on advertising (most digital) and has ~300K followers on Instagram [5]. And like an Everlane crisp white button up with loafers, it’s this stylish combination that really allows Everlane, and other direct to consumer brands to thrive.

Wholesalers, whether online or brick and mortar, don’t just provide distribution for new brands, they also serve as a marketing channel. Because digital advertising and social media allow brands to have one-to-one connections with consumers, there’s no need for Everlane to invest in such an expensive marketing channel. Instead, the extra margin allows Everlane to use high quality materials from ethical factories all while giving us a sweet discount.

The death of brick-and-mortar?

Well, not really. Physical presence will always be important for retailers since customers will always want to touch, feel and try on the newest “Cashmere Crew.” Everlane has recently opened three experiential retail locations in San Francisco and New York [6]. And there is enormous opportunity to bring the lessons from the digital world into the physical store experience.

Personalized digital touchpoints are essential to creating brand awareness and loyalty online. In physical stores, Everlane could leverage technology like beacons and mobile phones to know who is entering their store when. By identifying the customer and matching their identity to their behavior with Everlane online, the brand could personalize the brick and mortar experience and continue to change the retail game [7]. For example, I was recently shopping on Everlane.com and added a few items to my cart. While I liked the items, I did not end up purchasing them. If I then visit an Everlane store, leveraging the power of beacon technology, the salesperson could show me the exact items I was interested in and give me an incredible customer experience. I would probably be more likely to buy the items after this personalized online and offline interaction with Everlane.

Digitization does not have to stop with the online experience. If Everlane could succeed in building the offline store of the future, they’ll set the example for all innovative DTC brands.

[662 words]

Sources:

[2] http://fortune.com/2016/05/11/retailers-stocks/

[3] http://money.cnn.com/2016/08/11/investing/macys-closes-100-stores/

[4] https://www.everlane.com/factories/cashmere

[5] https://jobs.lever.co/everlane/15ad2b32-63be-4345-8619-9c6c5358223a

[6] https://www.everlane.com/visit-us

[7] http://www.businessinsider.com/beacons-and-ibeacons-create-a-new-market-2013-12

Interesting insights! I respect the marketing and branding strategy that Everlane employed, as their focus on minimalism and transparency likely resonate well with Millennials. Many companies (e.g., Birchbox, Casper) have started out in the digital world and then expanded into brick-and-mortar stores. I’m curious whether these physical Everlane stores are profitable themselves, or if they serve as a marketing agent that pre-empts consumers to purchase from Everlane.com.

Great post! I think another thing worth mentioning is by circumventing a wholesaler a DTC brand has more see through into consumer tastes and fashion preferences. PoS control is critical for fashion brands to stay on top of the latest trends. Everlane has the advantage vs. zara’s and H&Ms in that they dont need to invest in owning a store base. But like you mentioned, they are opening some experiential store concepts so maybe the sales split will start to lean a little more offline.

Great post on such an interesting company! I know someone who works at Everlane in SF, and I’ve always found their model fascinating. As a consumer, knowing the transparency that they provide around pricing, material sourcing, and labor that goes into the clothing is so refreshing. Even when I notice that they take a substantial margin for different items, I feel better knowing what I am paying for vs. having no visibility to that in any other clothing shopping experience. I agree that the brick and motor locations are important for online products that consumers typical interact with before making a purchase. Casper and Glossier – two other online only retailers – have made similar strides with pop-ups and true brick and mortar locations. I am interested to see how much these “online only” brands can grow in the future.