Equity Bank: Banking on Mobile

How Kenya’s Equity Bank is leveraging digital footprints to grow its double-bottom line.

When was the last time you walked into a bank? For me, it was when I first opened my account at Bank of America over ten years ago.

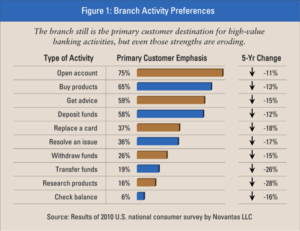

The rise of consumers’ digital footprints is pushing banks to redefine their value proposition and operating model. Banks traditionally offered a value proposition of high levels of customer service delivered via a brick and mortar, relationship-banking operating model. Banks able to form the best relationship with their customers were the ones offering the most value to their customers. However, with consumption shifting towards digital channels, we are seeing a major transition in banking value proposition and operating model: Banking is “no longer somewhere you go, but something you do”.[1]

In emerging markets large banks have typically focused on corporate finance rather than small and rural business lending. This has been driven by high operating expenses associated with underwriting and servicing these loans and a lack of traditional credit-risk information in providing in these segment.[2] However, the growing penetration of digital technologies such as mobile and smart phones banks is lowering banks’ cost of accessing these consumers.

Equity Bank in Kenya

Equity Bank has “more than 9 million customers, making it the largest bank in terms of customer base in Africa and having nearly half of bank accounts in Kenya.”[3] Their strategy is to become an “all-inclusive financial services provider with a growing pan-African footprint” through delivering high volume and low margin growth[4]. Equity Bank’s annual reports from the early 2000s (see for example, Equity Bank Annual Report from 2005) consistently emphasize growth in staff, branches, and ATMs with growth in customers and assets as the model through which they would achieve this[5]; however, the bank in 2015 shows a 4% growth in its customer base alongside a 7.4% decrease in its staff[6], indicating a shift towards more efficient growth.

To catalyze this leaner growth, the bank will leverage Kenya’s impressive 90% mobile phone penetration and 44% smart phone penetration.[7]. They are shifting away from the traditional relationship banking value proposition of service in order to instead focus on delivering value through convenience and accessibility.

A key manifestation of this was Equity Bank’s July 2015 launch of Equitel, a mobile virtual network operator operating on Airtel’s network enabling banking transactions for customers. Chief executive James Mwangi underlined the value of Equitel, “The biggest problem with accessing a bank is not bank charges, it is the cost of access. I will have to go 70km to where the bank is; I will have to pay public transport; I will have to spend the whole day to get to the bank….If we really want the masses and low-income people to join banking, then we should make financial products very affordable, and that is the value proposition that we are making to the market.”[8] Equitel offers the lowest mobile banking charges out of all players in the market[9] and now the majority of the Equity’s loans are disbursed via mobile phones via their short-term, low interest Eazzyloan scheme[10].

While the growth of Equitel will help Equity serve a greater number of underbanked customers at a lower cost, there are two additional steps it should take to ensure that they are able to deliver on their promise of affordability and convenience.

First, high smart phone penetration enables Equity to access a treasure trove of mobile behavioral data and to therefore better segment customer risk, price in the risk of default, and shift their customer base to a less risky clientele. This data and risk-based pricing would bolster Equity’s long-term ability to offer lower price products in the future.

Second, Equity should leverage mobile phone data to more effectively market their products to customers. Partnering with mobile data analytics such as Cignifi might help them segment their customers and push appropriate products to them. Whereas in the past a customer may have needed to commute many miles to get to the nearest bank, Equity now has the data and ability to predict and deliver what customers want directly to their fingertips.

Lastly, in its transition to providing increased affordability and convenience through mobile schemes, it is important to note that Equity is making a bet against its existing brick and mortar operations. As shown earlier, branch staff are being let go in tandem with the growth of mobile banking. This has the potential to be a tumultuous transition with lots of PR risk if Equity pushes forward too quickly, and they must therefore be sure to manage internal expectations and find alternative employment opportunities for their staff.

Word Count: [769]

[1] Wings, Heinz, and Heinz Benölken. Banking 3.0 Trends, Brüche, Geschäftsmodelle, Spielregeln. Herzogenrath: Shaker Media, 2013. Print.

[2] In spite of these challenges, many large banks do have large portfolios of small business and rural loans; however, these portfolios are often purchased from smaller niche financial institutions that perform the loan underwriting and servicing, and they are usually purchased as a result of regulatory requirements for serving BOP customers.

[3] Equity Bank Limited. http://ke.equitybankgroup.com/about-us/our-history/our-history. 2016. Accessed November 17, 2016.

[4] Equity Bank Limited. http://ke.equitybankgroup.com/about-us/our-history/our-history. 2016. Accessed November 17, 2016.

[5] Equity Bank Limited. “Equity Bank Annual Report 2005”. www.equitybankgroup.com/index.php/files/download/451. March 1, 2006. Accessed November 17, 2016.

[6] Equity Bank Limited. “Equity Bank Annual Report 2015”. www.equitybankgroup.com/index.php/files/download/917. March 1, 2016. Accessed November 17, 2016.

[7] Moses Kemibaro. “Kenya’s Latest 2016 Mobile & Internet Statistics”. http://www.moseskemibaro.com/2016/10/01/kenyas-latest-2016-mobile-internet-statistics/. October 1, 2016. Accessed November 17, 2016.

[8] Zoe Flood. “Kenya’s mobile innovation brings digital money closer”.://www.bbc.com/news/business-28142515. July 4, 2014. Accessed November 18, 2016.

[9] Mpesa Charges. “Equity Bank’s Equitel Kenya, Thin SIM and Mobile Banking in Kenya.” Copyright 2015-2016. http://www.mpesacharges.com/equitel-kenya-finserve-and-equity-mobile-banking-in-kenya/. Accessed November 18, 2016.

[10] ANJUM H. ASODIA. “Mobile phones take over Commercial banks’ loans sector in Kenya”. http://www.coastweek.com/3945-Mobile-phones-take-over-Commercial-banks-loans-sector-in-Kenya.htm. Accessed November 18, 2016.

Very interesting read. I think a big reason why Equity has been able to transition towards mobile banking, is because of the high penetration and the comfort of using of mobile money in Kenya. More than 75% of Kenya’s adult population is banked via traditional bank or mobile money accounts such as M-PESA. This is significantly above the global average of 62%.The World Bank credits this high financial inclusion to the success of mobile money [1]. I wonder whether Equity bank would have been successful if there wasn’t already so much comfort with using mobile money in Kenya. It makes me wonder, whether the launch of Equitel was to ensure their relevance and not lose all their grass route transactions to the likes of M-PESA which could potentially leverage is reach to expand into microlending and small scale loans.

[1] http://www.theeastafrican.co.ke/business/Kenya-tops-list-of-banked-population/2560-2697138-jh9o4iz/index.html

[2] http://qz.com/445114/dominating-mobile-money-could-lead-to-the-break-up-of-kenyas-biggest-mobile-network/

Hi Cookie Monster, great post and nice to see someone posting about a retail banking success in Kenya outside of M-Pesa. Do you think the Central Bank of Kenya should be doing more to drive volumes through products put out by actual banks, such as Equity, rather than a teleco such as Safaricom (given that Safaricom is not regulated be the Central Bank)?