DIGITIZING THE MAKERS OF VIAGRA

It’s hard to tell whether the lack of innovation in the healthcare industry has been driven by heightened regulation or risk-adverse corporations, but one thing is certain: Industry leaders like Pfizer must start to embrace digitalization or risk losing some of their competitive advantages.

Having recently worked in the healthcare industry, I was able to witness how innovation can be slowed due to an unwillingness to embrace the entrance of new technology. Today, global pharmaceutical companies such as Pfizer, which generates $53B in revenues annually and has 63 unique manufacturing sites around the world [1], must decide whether to continue to operate as usual or make the necessary investments needed to digitalize their supply chain.

Pfizer must choose the latter and make the necessary changes needed in order to A) support their expanding supply chain, B) improve connectivity within the organization, C) and meet the needs of key stakeholders, such as distributors, who expect a customized experience.

THE PROBLEMS

Like much of healthcare, the pharmaceutical supply chain is highly complex and tightly regulated. So far, the industry has been slow in implementing changes to the supply chain through the use of digital technology. Part of the reason for that is that “high margins …[lead] to a stronger focus on new product development and sales rather than on optimizing operations.” [2]. However, companies like Pfizer have created an opportunity for other companies to disrupt the industry. For example, IBM Watson has worked to digitize healthcare and the supply chain by recently developing a solution that creates a more transparent supply chain through cognitive learning [3]. While there is no question that Pfizer has a competitive advantage due to their R&D capabilities and their global supply chain, the question going forward is whether they have the capabilities to digitize their supply chain or will have to rely on others like IBM and relinquish control of a critical component of the company.

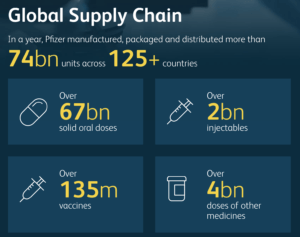

Figure 1: Pfizer’s Global Supply Chain [1]

As the world becomes more global and Pfizer continues to expand their reach into more countries, their supply chain will only become more complex. The only way to address that is through digitizing their supply chain. Currently, Pfizer is faced with a supply chain that is disconnected and includes numerous systems, some of which are locally customized [4]. In order to best serve customers and maintain data integrity, Pfizer must digitize its IT supply system to accurately ensure that their supply matches their demand. They can digitize their supply chain by improving logistics visibility through consolidating both internal and external data, such as transporting data from tracking devices into a single platform [5]. Doing so will not only allow Pfizer executives to better manage a global company, but it will also allow them to better serve key stakeholders, who will have more accurate information on the time frame of orders. They will also be able to pass along demand trends that they see from customers.

THE CHANGES

Pfizer has already started to address some of these concerns. They have begun to harmonize their systems through creating a standard enterprise resource planning system that links the manufacturing, financial, and commercial sides of the business. By improving connectivity not just on the supply chain but in other parts of the company, Pfizer is hoping to drive efficiency and visibility throughout the organization.

In response to new entrants such as IBM Watson, who are attempting to increase the speed and accuracy of supply chains by leveraging data and analytics, Pfizer has developed a Highly Orchestrated Supply Network (HOSuN) approach [1]. This approach has allowed Pfizer to track the movement of products throughout the supply chain. The HOSuN approach is also designed to align inventory, supply chain planning, and global trade compliance to ensure that the supply chain is balanced and that the company is adhering to strict regulations that vary across the globe.

THE FUTURE

For Pfizer to properly position themselves for success, they must continue to invest in developing an end-to-end supply chain integration solution. They have taken the right first step by investing in cloud-based networks and an enterprise reporting system [6]. But they must leverage the data they have collected to create harmony across the supply chain and utilize analytics to improve efficiency and reduce downtime. It is believed that through digitization and analytics, downtime in Pharma plants can be reduced by 30- 40% [2].

Moreover, an opportunity still exists to utilize data to better serve distributors. Although the company has taken steps to integrate various parts of the supply chain that were originally siloed by moving to one cloud platform internally, they can better serve customers by connecting distributors to the platform, so they can have improved visibility into the supply chain and flag any issues they may foresee [7].

Going forward, the question is about whether Pfizer will be able to digitize its supply chain while fending off new entrants. Will they be able to implement some of these changes promptly, or will regulation once again slow down the pace of change in healthcare?

(Word Count: 798 words)

REFERENCES

[1] Pfizer, 2016 Annual Report, https://www.pfizer.com/files/investors/financial_reports/annual_reports/2016/our-business/manufacturing-quality-and-supply-chain/index.html accessed November 2017.

[2] Ehrhardt, Marcus & Behner, Peter. “Digitization in pharma: Gaining an edge in operations,” PWC, October 19, 2016. [https://www.strategyand.pwc.com/reports/digitization-in-pharma], accessed November 2017.

[3] Webber, Lori. “Top Supply Chain Trends for 2017,” IBM, [https://www.strategyand.pwc.com/reports/digitization-in-pharma], accessed November 2017.

[4] “Digitizing the supply chain: Why Pfizer is investing in IoT, drones and personalized medicine

,”Internet of Business, January 31, 2017, [https://internetofbusiness.com/digitizing-supply-chain-pfizer-iot], accessed November 2017.

[5] Schrauf, Stefan & Berttram, Philipp. “Industry 4.0: How digitization makes the supply chain more efficient, agile, and customer-focused,” PWC, September 7, 2016. [https://www.strategyand.pwc.com/reports/industry4.0], accessed November 2017.

[6] Paul Taylor, “Pfizer moves supply chain to cloud,” Financial Times, September 11, 2012, [https://www.ft.com/content/1608e5d6-fc59-11e1-ac0f-00144feabdc0], accessed November 2017.

[7] HBR, “Digitizing the supply chain,” October 10, 2017, video, https://hbr.org/webinar/2017/10/digitizing-the-supply-chain, accessed November 2017.

Solomon,

Thanks for writing an interesting article about another type of business that is struggling to keep up with our rapid conversion to digitization. I agree with the points you made about Pfizer needing to embrace digitization in order to keep up with a changing supply chain, improve internal processes, and meet distributors’ needs. I can see how companies like Pfizer struggle to simultaneously prioritize operations optimization while maintaining their competitive advantage as manufacturers of cutting-edge pharmaceuticals. Will efficiency improvements come from hiring consultants? Building internal teams? Restructuring their organization? I think creation of a standard enterprise resource planning system is a good first step, but they will have to do much more in the coming decade to stay ahead of the curve.

I think there’s yet another big reason large pharmaceuticals will need to embrace digitization. The widespread move to digital information sharing has incited a revolution where consumers and patients are now much more aware of the types of treatments and therapies available to improve their health.[1] As people begin to want to take control of their own treatments, Pharma companies like Pfizer will be faced with the challenge of maintaining their competitive edge in a world where their consumer has access to better information on their products, prices, and competitors.

[1] David Champagne, Amy Hung, Olivier Leclerc, “How Pharma Can Win in a Digital World,” McKinsey & Company, November 29, 2017.

Thank you for writing this interesting piece, Solomon. It had not previously occurred to me that large Pharma is one of the slower movers to hop on the “digitization train” in regards to improving operations. I agree with your and Sarah’s assessment, however, that new digital technologies could help pharmaceutical companies such as Pfizer address some of the difficulties that have arisen in the sector – including: global expansion, competitive pressure on pricing from generics and increasingly complex supply chains (due to expanding portfolios of drugs through R&D and acquisitions) [1].

However, there are a few key issues that Pfizer must consider as it continues to pursue this digitization strategy. One key issue I foresee could be changing regulations. As technology becomes more integral in the production / development of drugs, the FDA or other regulatory bodies could create and enforce a new set of criteria / standardization on Company’s processes to ensure safety and quality drug production. If the systems Pfizer has developed are not in compliance, it would result in a huge time and financial burden on the Company to alter its operations.

Another key risk is that of cybersecurity. As Pfizer begins to collect and analyze more data and store it on a central cloud, there is a risk that hackers could access incredibly sensitive company data, such as pricing data or details of contracts.

[1] https://www.pharmamanufacturing.com/articles/2017/pharmas-digital-supply-chain-transformation/

Thanks much Solomon. I agree with the concept of digitization of the supply chain. I wonder whether Pfizer can successfully leverage the data accumulated to improve its supply chain efficiency. As you mentioned, the margin profile was so lucrative that the company historically did not bother to work on the supply chain. Nowadays, I still suspect whether the management has the bandwidth or can find the right specialized talents to tackle the problem. Maybe the talents are more willing to join IBM Watson given its reputation in technology, instead of Pfizer which is viewed as a pharmaceutical player. In addition, historically, companies like Owens & Minor have developed expertise in healthcare supply chain. They may be in better positions to optimize the supply chain.

Great piece Solomon!

What I found most striking is why Pfizer and other pharmaceutical companies have been slow to digitize given that they have the resources to do so. I agree that competitive pressures will play a role and there is evidence that pharmaceutical companies that utilize digital technology in their supply chains have higher growth. However, one of the conditions needed to implement this change is a digital culture mindset and organizational appetite for change. Interestingly, given the regulatory environment in which pharmaceutical companies operate, their culture of risk aversion reflect that environment. I think the biggest obstacle for achieving such improvements in digitizing their supply chain will depend on their leaders’ ability to change the culture of such a large company that has been comfortably earning high margins for decades.

https://www.accenture.com/us-en/insight-highlights-life-sciences-pharmaceutical-grow

https://www.edelman.com/post/agency-role-digitizing-pharma/

Thank you, Solomon!

You outlined a great set of benefits that Prizer might get by digitizing their supply chain. I would also add, that by doing so it would be able to solve, at least partially, another important problem – drug counterfeit that is $75bn–$200bn [1] in lost revenue and leads to hundreds of thousands of deaths [2]. By having more transparency on how the product moves along the supply chain it’s possible to detect and mitigate swindlers, drive revenue up and greatly increase safety. I believe that this should be the primary target for pharma’s digitalization and is totally possible with the current tech solutions such as a combination of blockchain and IoT, e.g. startup Mediledger [3].

[1] https://www.worldfinance.com/special-reports/trade-in-illegal-medicine-hits-pharmaceutical-sector

[2] http://www.bbc.com/news/business-37470667

[3] http://blocktribune.com/blockchain-joint-venture-aims-stop-counterfeit-drugs/