Digitization in Oil & Gas – is Shell a Leader or a Laggard?

Recently Royal Dutch Shell announced their ambition is to be “the most innovative energy company in the field of digital”. How far away are they from achieving that goal?

Digitization trends within the Oil & Gas industry

In the past 24 months, oil and gas companies have gone from soaring profits to crippling losses. Facing intense pressure to increase operational efficiency and drive margins, they are increasingly turning to digital technology. As noted in a recent Strategy& study, “the term Digital addresses the confluence of data, machines and people that form the basis of Internet of Things (IoT) which can ultimately create several opportunities: improve asset reliability, boost throughput and optimize field recovery.”[i]

One oil and gas major fully embracing this change is Royal Dutch Shell, which announced in 2013 its ambitious plan to become “the most innovative energy company in the field of digital”.[ii]

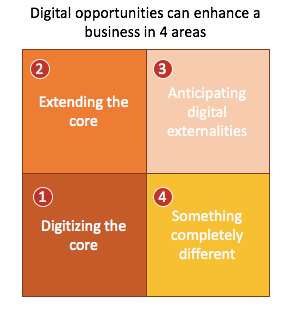

When thinking about digitisation, four types of opportunities can enhance Shell’s business:

- Digitizing the core – incremental improvements to Shell’s core business

- Extending the core – enhancing Shell’s B2B and B2C offerings through digital technologies

- Anticipating digital externalities affecting the core – adapting to competitive threats to Shell’s core business

- Developing something completely different – developing a completely different business through digital

Digitizing Shell’s core business

This is where Shell has made the most progress, embracing digital across the company’s value chain:

- Strategic applications – Utilising data to optimise value levers and enhance management decisions. For example, Shell recently developed a partnership with a laser company called WellDog. The innovative project uses lasers to find oil and gas in shale formations: looking at the photons that bounce back from these rock formations helps drillers decide where to put wells.[iii]

Examples of Shell Motorist mobile app (Source: Shell website) - Processes, governance and integration – Enabling data sharing and increasing efficiency of internal processes. In the last few years, Shell has increasingly automated cash flows with the company, building large technical centres of expertise in Kuala Lumpur and Krakow.

- Improving customer offers – Using mobile technology to improve retail offers. The Shell Motorist app gives drivers access to Shell offers, their loyalty card balances, and helps them find the nearest Shell filling station.[iv]

- Data capture – Collecting Big Data, particularly in ‘digital oil fields’. In 2015 Shell realized a $1 million return on an $87,000 investment in digital technology (sensors and analytics) to monitor oilfields in some of Nigeria’s toughest terrain[v]. Shell has also used Big Data for preventative maintenance, to reduce breakdowns and downtime.[vi]

- Supply chain optimization – Big Data is also being used to streamline the transport, production, and retail distribution of Shell’s products. Shell is vertically integrated; it is therefore involved in every aspect of the process from drilling oil through to selling fuel to customers or heating for their home. The company uses complex algorithms, taking in to account production costs, weather patterns and economic indicators, to allocate resources and set retail prices. Shell is also using remote sensors and mobile technology to optimise inventories and information across the supply chain. [vii]

Extending Shell’s core business

Although less advanced than their core activities, Shell is looking at opportunities to extend their B2B and B2C offers. Their venture capital arm, Shell Technology Ventures, has recently invested in Sense Labs, which developed a home energy efficiency device for consumers. The unit connects to the home power supply and measures energy consumption of all appliances and devices, sending real-time updates to apps, allowing consumers to reduce energy usage and costs.

Where Shell is lagging behind: adapting to external threats and developing different businesses

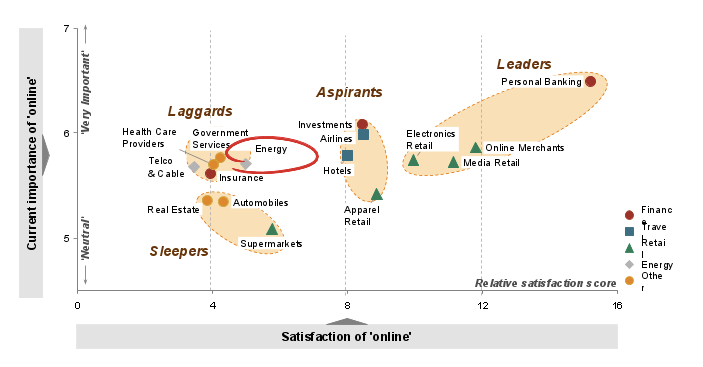

Despite the moves made in their core business, there is still a huge gap between what Shell could be doing and what they are doing. A recent survey completed by the Boston Consulting Group showed Energy companies to be ‘laggards’ when it came to adoption and accessibility to digital technology[viii].

For example, what is stopping Shell from developing a ‘fuel on demand’ platform, which refuels cars wherever they are parked? It is possible that Shell is reluctant to make this move, as it will cannibalize their existing retail business…but that doesn’t mean no one else will.

Shell could also look to expand in a completely different way, using learnings from other industries. Qantas for example leveraged data analysis and mobile apps to set up an insurance program called Qantas Assure, which using frequent flier miles and points from fitness trackers. Qantas benefits because they are able to monetize unused air miles’ inventory, and their customers become even more loyal.[ix] Perhaps Shell could do something similar with Shell rewards?

Going forward

Shell is taking large leaps towards digitization, but there is still a long way to go. As a recent article for Forbes stated: “Getting by with dated and fragmented technology will no longer work for an industry that is experiencing massive shifts due to heightened market pressures, efficiency demands, and the ever-increasing need for new technology.”[x]

Words: 792

[i] Nathaniel Clark, Abhish Abraham, Sanchit Goyal, “Improving oil and gas efficiency through digital”, Strategy&, http://www.strategyand.pwc.com/reports/improving-oil-gas-efficiency-digital, accessed November 2016

[ii] Richard Coope, “Partnering to deliver innovation at scale for Shell”, LinkedIn, https://www.linkedin.com/pulse/partnering-deliver-innovation-scale-shell-richard-coope, accessed November 2016

[iii] Ken Evans, “Digital tech drives innovation for oil & gas companies” D!gitalist Magazine, June 10th 2016, http://www.digitalistmag.com/digital-economy/2016/06/10/digital-tech-drives-innovation-for-oil-gas-companies-04258338, accessed November 2016

[iv] Royal Dutch Shell, “New Technologies – Mobile”, http://www.shell.com/energy-and-innovation/overcoming-technology-challenges/digital-innovation.html, accessed November 2016

[v] Martha DeGrasse, “Pumping profits: Shell saves $1M with IoT”, http://industrialiot5g.com/20160415/channels/news/pumping-profits-shell-saves-1m-iot, accessed November 2016

[vi] Bernard Marr, “Big data in big oil: how shell uses analytics to drive business success” Forbes, http://www.forbes.com/sites/bernardmarr/2015/05/26/big-data-in-big-oil-how-shell-uses-analytics-to-drive-business-success/2/#4860206f5639, accessed November 2016

[vii] ibid.

[viii] Expert interview – BCG Energy Practice partner

[ix] Glenda Korporaal, “Qantas Loyalty digital initiatives” The Australian Business Review, http://www.theaustralian.com.au/business/aviation/qantas-loyalty-digital-initiatives/news-story/c332f258cbd0b794d41b705bb2226cf4, accessed November 2016

[x] Martha Aviles, “Technology Innovation and Adoption in Oil & Gas Industry – Why did it slow?”, Forbes, http://www.forbes.com/sites/drillinginfo/2015/07/14/technology-innovation-and-adoption-in-oil-gas-industry-why-did-it-slow/#42194a3a506a, accessed November 2016

Great information! I wonder how the shift to digitization differs for the smaller and larger oil and gas companies. If the industry is lagging as a whole, who is farther ahead and who is behind relative to competitors? The large oil and gas companies have more capital to invest in new technologies. On the other hand, they are usually weighed down by procedural requirements that slow change within the organization. Smaller, private companies have the ability to adapt to changes quickly, since they aren’t as concerned with perception of shareholders and a media spot light.

Deviyani – Thanks for bringing to light what large oil companies are doing and can do to improve using technology. I was particularly fascinated by how they are using sensors to find oil and shale and how they are using big data. I never knew they were employing such methods and I thought the former was particularly good because then oil companies do not have to spend extra capital drilling before knowing for sure that they’ll find oil. Look forward to hearing about what oil companies do going forward as they look to move from laggards to leaders!