Could Insurance Companies be the Solution for Climate Change?

Allstate and other insurance companies should take on a proactive approach towards reducing the rate of global warming that can ultimately result in a win-win situation.

Property and Casualty (P&C) Insurance companies have historically taken a reactionary approach towards responding to severe natural disasters, relying on past data to predict future catastrophe events. However, global warming has amplified the frequency of these catastrophic disasters, creating record-breaking extreme weather events that makes it increasingly difficult for insurance companies to assess the underwriting risks due to natural disasters. In United States, weather-related events caused by floods, hurricanes, severe thunderstorms and prolonged droughts have increased nearly fourfold since 1980, resulting in $560 billion in insured losses between 1980 and 2015.

Insurance companies have two major revenue sources: premiums charged from their customers and earnings from investing these premiums. Both of these revenue streams have been impacted by global warming. Allstate Insurance, the largest public insurance company in US and the foremost bearer of these magnified expenses, is taking immediate actions to account for climate change risks in its catastrophe models and investment portfolio.

Adjusting underwriting risks: With protection premiums of over $30.87 billion in 2015, Allstate utilizes a combination of 3rd party vendor models, scientific climate change forecasts, and historical data to assess property exposure to catastrophic events. Weather and natural catastrophe loss volatility and other climate impacts are factored into the Company’s Enterprise Risk and Return Management (ERRC)-approved risk limits and are reviewed on a regular basis. The Company has also taken steps to reduce risk exposure by purchasing reinsurance and cutting homeowners’ insurance in disaster-prone areas – such as those in the Gulf Coast states – where recent hurricanes have wiped out the 75 years of revenue that the Company has cumulated.

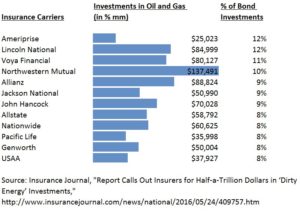

Adjusting portfolio investment risk: Regulatory changes related to climate change and growth in the alternative energy sector have placed downward pressure on the oil and gas industries, which unfortunately still comprises a sizable portion in Allstate’s investment portfolio. Allstate began to take small measures to diversify its portfolio by investing over $900 million in low-income-housing tax credits (LIHTC), renewable energy, and other socially responsible investments, which equates to only 1.25% of overall portfolio size. Within the Company’s bond portfolio, 8.2% of its investments are still in Oil and Gas companies.

PROACTIVE APPROACH TO CUBRING GLOBAL WARMING:

The internal measures that Allstate has implemented alone is not enough to reduce global warming on a larger scale. Increasing insurance premiums or reducing coverage to certain geographic areas will only transfer the cost to the individuals. Instead, the Company should also take on a proactive approach towards reducing the rate of global warming that can ultimately benefit everyone in the long-run.

Incentivizing its customers – Allstate has introduced Homeowners Policy Green Improvement Reimbursement Endorsement, which encourages customers to replace damaged and energy-intensive equipment with energy-efficient appliances by reimbursing them the additional replacement cost. The Company can further innovate on new insurance products that incentivize costumers to adopt environmentally friendly practices with discounts to their monthly insurance premiums based on established standards or by penalizing customers who fail to meet those standards.

Incentivizing businesses through investment decisions – With over $72 billion of assets under management, Allstate and insurance companies are among the biggest players in the financial markets. Yet, according to a Reuters report, insurance companies have in general been slower to reduce climate change risk in their investment portfolios, and only 12% of insurers are taking “tangible” actions compared to 23% of pension funds.

Allstate should look to its European counterpart, Axa Groupe Insurance, who has pledged to sell $560 million of coal assets and triple “green investments” to 3 billion euros by 2020. Shifting Allstate’s current portfolio allocation into climate change solutions could help significantly accelerate the growth of socially responsible, green companies. Allstate could also set aside a small percentage of its assets in a fund that invests only in renewable energy or green-tech focused startups. These solutions would not only help the Company diversify its portfolio but also allow it to participate in the upward growth of these new green companies.

Incentivizing local governments and increasing involvement in regulatory policy – Because economic losses from large catastrophic events are mostly incurred by insurance companies or federal agencies like FEMA, state governments have fewer incentives to prepare for extreme weather events. In 2014, Farmers Insurance threatened to sue Chicago cities for neglecting to secure enough sewers and storm drains in preparation for the heavy rainfall. The threat itself has opened conversations between the state and insurance companies to help build safer cities. Allstate could partner with other insurance companies to influence state policies and hold governments responsible for implementing stricter building standards and putting the right infrastructure in place to better prepare for severe weather conditions. Finally, insurance companies can work with the government on sharing research resources and insights so that all parties can be better prepared in case of a natural disaster.

(796 Words)

Bibliography:

Petru, Alexis, “Farmers Insurance Drops Climate Change Lawsuits Against Chicago-Area Cities.” Triple Pundit, June 10, 2014, [http://www.triplepundit.com/2014/06/farmers-insurance-drops-climate-change-lawsuits-chicago-area-cities/], accessed November 3, 2016.

Atkin, Emily, “Big Insurance Companies Are Warning The U.S. To Prepare For Climate Change.” Think Progress, April 21, 2015, [https://thinkprogress.org/big-insurance-companies-are-warning-the-u-s-to-prepare-for-climate-change-eb3fdf22d674#.esz0wv329], accessed November 3, 2016.

NAIC (National Associations of Insurance Commissions). Climate Change and Risk Disclosure Report – updated on June 13, 2016. [http://www.naic.org/cipr_topics/topic_climate_risk_disclosure.htm], accessed November 3, 2016.

Allstate. Climate Change 2015 Information Request. [http://corporateresponsibility.allstate.com/wp-content/uploads/2016/06/ALL_CR14_CDP_2015_Climate_Change_Disclosure.pdf], accessed November 3, 2016.

Allstate Investments. [https://www.allstateinvestments.com/who-we-are.html], accessed November 3, 2016.

Allstate. 2014 Corporate Responsibility Report. [http://corporateresponsibility.allstate.com/wp-content/uploads/sites/4/2015/09/Allstate_CR_Report_2014.pdf], accessed November 3, 2016.

AON. 2015 Annual Global Climate and Catastrophe Report, [http://thoughtleadership.aonbenfield.com/Documents/20160113-ab-if-annual-climate-catastrophe-report.pdf], accessed November 3, 2016.

Cohn, Carolyn, “Insurers ignoring risks of oil, gas investments: study.” Reuters News, July 20, 2016, [http://www.reuters.com/article/us-insurance-investment-climatechange-idUSKCN100318], accessed November 3, 2016.

Patel, Tara, “Fossil-Fuel Divestment Gains Momentum With Axa Selling Coal.” Bloomberg, May 22, 2015, [http://www.bloomberg.com/news/articles/2015-05-22/fossil-fuel-divestment-picks-up-momentum-with-axa-selling-coal], accessed November 3, 2016.

This blog post does a great job of outlining the threat that global warming poses for insurers as well as the steps that insurers are taking to react to and preempt that threat. Unfortunately, though, it seems to me that any insurance actions taken to prevent global warming will fall prey to the tragedy of the commons. Reducing greenhouse gas emissions in the U.S. is not enough; even if every insurance company in the US banded together to incentivize sustainable practices among the people that they insure, pollution from emerging economies like China and India could be enough to offset any gains made in the U.S.