Cinemark: On the Way Up…and Down

Cinemark hasn’t been caught flat-footed in the advent of digital technology, but a more comprehensive commitment to technology will be necessary to drive stable, sustainable results

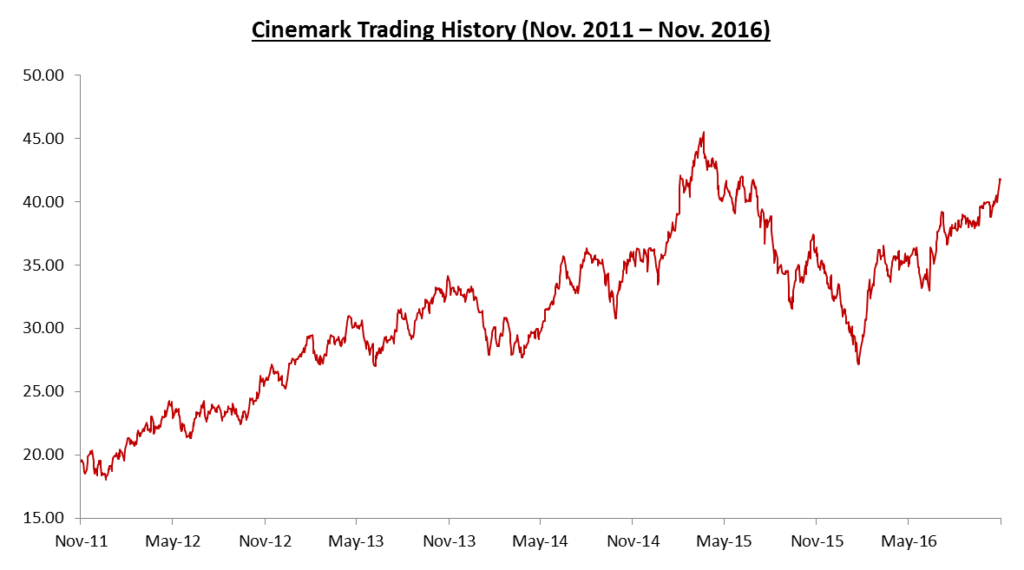

Investing in Cinemark requires a strong stomach. In each of the past five years, the company’s stock has swung 25–55%[1] as investors have traded feverishly around industry attendance figures and the company’s quarterly results.

While several factors have played into the whipsaw action in investor sentiment, underpinning everything is the disruptive uncertainty brought on by the proliferation of digital media. In the United States, there’s no denying that attendance, the lifeblood of the industry, is in steady decline. Over the past decade, per capita movie attendance has dropped at a compound rate of 2% per year[2] as the number and quality of media options available at the push of a button has exploded. More and more, Hollywood studios and cinema operators alike are relying on a small number of blockbusters to attract massive audiences and drive the lion’s share of a year’s profits.[3] When a slate of blockbusters hits, the lions feast; when it misses, they starve. Hence, the roller coaster ride for Cinemark’s investors.

Despite its intra-year volatility, Cinemark’s stock has performed remarkably well over the past five years. Indeed, its share price today is more than double what it was at the end of 2011. It’s no secret that digital media has disrupted the cinema industry, and Cinemark’s ability to adapt to changing conditions has helped the company consistently outperform expectations.

Thus far, Cinemark has done an exemplary job of sustaining growth and profitability by tweaking its core strategy and adjusting its operating model. Going forward, however, I believe the company will need to do a more comprehensive job of harnessing technology to buck the trend of shrinking audiences.

—

Cinemark’s business model has traditionally rested on providing consumers with three things: (i) exclusive access to new content from Hollywood studios; (ii) a larger-than-life entertainment experience; and (iii) delicious, albeit dramatically overpriced, concessions. In the past, the company’s operating model has been very much in sync with this value proposition. Today, however, Cinemark and other cinema operators face strong technological pressure on two of these key fronts.

With regards to the first, the window of exclusivity has shrunk as Hollywood has dramatically reduced the time between a movie’s release in theaters and for in-home viewing.[4] Also, the emergence of on-demand content providers like HBO and Netflix has created serious competition for consumer mindshare. With regards to the second, the increasing affordability of home theater systems has eroded demand for the traditional movie theater experience.

The first and clearest way in which Cinemark has adjusted its strategy is by expanding into Latin America, where the penetration of digital media is considerably lower and audiences are still growing at a rapid pace. Since the mid-1990s, Cinemark has built a noteworthy platform as the number-one cinema operator in Brazil and Argentina and a leading player in Chile and Colombia.[5] This expansion has accelerated in recent years, as investment in digital projectors has allowed Cinemark to distribute films via satellite to remote cities that would have been impractical for expansion even five years ago.

The second way in which Cinemark has reacted is by investing in digital technology like 3-D theaters and IMAX-style screens to create an experience consumers simply cannot recreate at home. By charging a premium for these tickets, Cinemark has been able to maintain strong revenue growth in the US despite overall audience declines.[6]

Leveraging the flexibility afforded by digital projectors versus analog components, Cinemark has also started screening alternative content like classic films and live events. Based on a 2015 survey, over 60% of consumers expressed interest in seeing classic movies in a theater, while nearly 40% expressed interest in seeing live sporting events at the cinema.[7] By diversifying out of new releases, Cinemark believes it can meaningfully boost attendance in times of low demand.

While each of these adjustments has bolstered Cinemark’s performance in recent years, none of them has made a convincing dent in the long-term trend of audience decline in the digitally-saturated US market. The key to doing so, I believe, is in increasing engagement with existing customers to drive return trips to the theater.

Cinemark Connections, the company’s mobile app, is in its very early stages, but could be a powerful tool to offer targeted promotions and increase customer loyalty. 84% of US moviegoers already use mobile and internet-enabled devices to plan their trips to the theater[8] and by funneling customers through its own app, Cinemark could utilize purchasing history to structure personalized discounts for upcoming releases. In doing so, Cinemark could stimulate demand and drive revenues from both tickets and high-margin concessions, which customers could also order through the app. With strong data, Cinemark could partner with studios to develop its promotions and, by introducing flexibility into a traditionally rigid pricing scheme, dampen volatility in attendance and results.

(Word Count: 797)

[1] Capital IQ. CNK International Co., Ltd. 5Y Share Price. https://www.capitaliq.com/CIQDotNet/Charting3/Builder.aspx?CompanyId=9975350, accessed November 16, 2016.

[2] Motion Pictures Association. Theatrical Market Statistics, 2015. http://www.mpaa.org/wp-content/uploads/2016/04/MPAA-Theatrical-Market-Statistics-2015_Final.pdf, accessed November 14, 2016.

[3] Turan, Kenneth. Los Angeles Times. Hollywood’s Hedgehog Mentality Threatens Its Survival. http://www.latimes.com/entertainment/movies/la-et-mn-ca-onfilm-turan-20140921-column.html, accessed November 16, 2016.

[4] Granados, Nelson. Forbes. Changes To Hollywood Release Windows Are Coming Fast And Furious. http://www.forbes.com/sites/nelsongranados/2015/04/08/changes-to-hollywood-release-windows-are-coming-fast-and-furious/#6d79b90d5e5f, accessed November 15, 2016.

[5] Eaton, Collin. Dallas News. Cinemark Uses Technology, Latin America to Stay in Picture. http://www.dallasnews.com/business/business/2011/06/29/cinemark-uses-technology-latin-america-to-stay-in-picture, accessed November 15, 2016.

[6] Cinemark. Q3 2016 Earnings Call Transcript. http://investors.cinemark.com/phoenix.zhtml?c=192773&p=irol-audioarchives, accessed November 16, 2016.

[7] Kulp, Leo. April 16, 2016. Cinemark Holdings, Inc. Toronto: RBC Capital Markets Equity Research, p. 12-13.

[8] National Cinemedia. Investor Presentation, November 2016. http://files.shareholder.com/downloads/NCMI/3245288710x0x844463/D576B451-77F7-4257-9DA7-CBBE9397974B/National_CineMedia__Inc._Investor_Presentation.pdf, accessed November 15, 2016.

Zach, thanks for sharing your insights on Cinemark. I found it interesting that their app is in its infancy. Like you mentioned, an application will be key in increasing customer loyalty. Piriya just wrote an interesting piece on the hospitality industry and how they have broken down the “customer journey” to find additional ways to create value. In addition to greater investments in applications, I think this approach would also be equally as valuable to the movie industry. Whenever I go to the movies, I generally go out to dinner as well. I wonder if there is value in Cinemark or other movie companies integrating with local restaurants. Instead of adding to a customer’s entertainment experience, integrate with other companies to recreate the experience in entirety.

Reminds me of our IDEO case. It will be a challenge for Cinemark to retain their customer base unless they find new ways to add value. They don’t want to find themselves in the same position as Blockbuster. I agree with John that the key could be in finding new ways to add value to customers along the way. Since movies are such a social experience, how can they use their mobile app to create a social experience online for movie-goers? Can they develop a social rating system like rotten tomatoes in their app so movie goers can discuss the film afterwards and (hopefully) generate buzz for other movie goers? Could they allow customers to choose their seat & order their concessions in advance so everything is waiting for them at the theater and they no longer have to wait in line? The key will be in finding ways to make the movie-going experience easier, more social and more enjoyable to convince customers to get off their couch.

Zach, thanks for sharing. Super interesting post. To what extent do you think Cinemark’s return profile is a function of the company’s strong performance in the face of secular headwinds? As a highly cash generative, mature business that pays a relatively large dividend do you think the company is valued on yield? I wonder to what extent the impressive return profile is a related to rates staying lower for longer over the ’11-’15 period and the company’s dividend yield looking more and more appealing on a relative basis? With this in mind, would be curious how you think about the company’s valuation today given the secular headwinds to its business.

Zach, thank you so much for the read. I remember when Regal came out with their first digital rewards program, and I have friends and family that still cherish their points and frequent popcorn vouchers! Perhaps, theatres could implement innovations similar to airline miles programs. Under this initiative, consumers can gain progressive membership status upgrades from increased consumption (movie watching!) that can result in premium seating purchases, discounts at nearby retail and food outlets (think airport lounge benefits), IMAX movie upgrades (like getting bumped to first class), or where designated companions can join the elite movie fan for free.