Brexit vs. Tesco: Will Britain’s Largest Grocer Stand the Ultimate Test?

Brexit has shaken up the entire UK retail industry – how will incumbent management teams cope with the vastly different competitive dynamics?

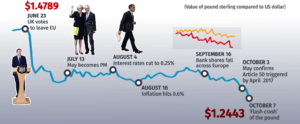

On June 23rd 2016, the United Kingdom (“UK”) voted to leave the European Union (“EU”) and Prime Minister David Cameron subsequently resigned from office, causing the largest ever one-day plummet in value of the Pound Sterling (“GBP”) against the US Dollar (“USD”) and the Euro (“EUR”). [1] Exhibit 1 outlines the GBP / USD exchange rate over time. UK-based retailers were left scrambling to maintain profits as imported goods became exponentially more expensive, leaving countless management teams no choice but to rethink their respective supply chains. Tesco, a leading UK grocery store retailer, has in particular experienced adverse effects arising from the vote. Wholesale suppliers have attempted to pass through blanket price increases onto hundreds of brands, blaming the weak pound for more expensive imports. [2] Until being recently resolved, Tesco had refused to pay the 10% price hike on Unilever brands and consequently, popular products such as Marmite, Ben and Jerry’s Ice Cream, and Hellmann’s Mayonnaise went un-stocked at all Tesco retail locations. [2] Known as “Marmitegate”, Tesco and Unilever recently came to an agreement by which they would revert back to their previous supplier agreement; but issues for Tesco unfortunately do not stop there. [2] They have stopped selling an assortment of beers at the retail level after refusing to accept an additional price increase from Heineken. [3] These wholesaler disputes spell trouble for Tesco with the outlook only looking bleaker for UK retailers expecting higher trade tariffs to even further increase supply chain costs. [4]

Tesco has engaged in a number of near-term initiatives to offset its Brexit induced issues in an effort to retain market share, as the large grocery store chains risk losing out to discount retailers such as Aldi and Lidl. [4] While the concrete exit implications will not be ratified until early 2019, the near-term concerns for Tesco remain the implications of a weak GBP and the corresponding changing consumer shopping habits. CEO Dave Lewis has already flexed his muscles by refusing to accept the price increase from Unilever, claiming that Marmite, among other products, is manufactured in the UK and therefore should be immune to exchange rate fluctuations. [2] Tesco is the largest grocery store chain in the UK and through its sheer scale and presence, has the leverage to push back against unruly wholesaler demands, and will continue to do so as they refuse to be at the behest of their supply chain. In the medium-term, the retailer will be forced to make inevitable changes in its supply chain once the UK officially leaves the EU and international sourcing becomes too costly. 50% of the butter and cheese consumed in the UK comes from milk imported from the EU which will undoubtedly shift Tesco’s sourcing efforts to local producers. [5] Expected increases in inflation will also incentivize UK retailers to source locally and consolidate factories when plausible. [5]

Consumer shopping habits will unavoidably change due to the decreased purchasing power of the GBP; how Tesco reacts to this trend will be a telling indicator of their long-term resiliency and ability to rebound in the midst of the strong headwinds imposed by Brexit. The weakening pound will not only take a toll on the retailers, but also on the consumers, who will alter their consumption habits over concerns related to their finances and current cash balances. [5] UK consumers have been fortunate in the last half decade as prices have remained relatively flat with inflation rates staying well below the forecasted Bank of England levels. [6] It was only a matter of time before the pound weakened and inflation took off, and the Brexit vote will only serve to compound these effects. [6] Tesco would be smart to closely monitor these changing habits and renegotiate with suppliers to tailor procurement to only the most essential products, as it relates to the post-Brexit shopper. They should also explore increasing the amount of in-store promotions to create an allusion of high-value, low-cost bundles, further persuading customers to purchase bucketed products Tesco can realize a healthy margin on. [6]

An uncertainty that will remain top of mind for the entire UK relates to the magnitude of the exit from the EU and the corresponding post EU trading bloc arrangements. How hard or soft the exit will be remains highly speculative. Tesco along with other retailers and UK based entities with supply chains heavily dependent on free trade within the EU, will lobby for a softer exit so as to avoid costlier imports and remain a part of the European single market. Current Prime Minister Theresa May has declared herself a proponent of a hard exit, but Tesco will have to wait and see, unsure of what the future holds, or the radical changes it will have to undergo. [7]

(Word count: 794)

Exhibit 1: GBP / USD exchange rate (06/23/2016 – 10/07/2016) [8]

[1] “Unilever and Tesco Settle Brexit-Inspired Price Dispute.” Fortune, Reuters, 14 Oct. 2016, fortune.com/2016/10/14/unilever-tesco-settle-brexit-price-dispute/.

[2] Butler, Sarah, and Julia Kollewe. “Tesco and Unilever Settle Marmite Dispute.” The Guardian, Guardian News and Media, 13 Oct. 2016, www.theguardian.com/business/2016/oct/13/tesco-unilever-resolve-marmite-dispute-price-supermarket.

[3] Rodionova, Zlata. “Tesco Scraps Heineken Beers Including Amstel, Sol, Tiger and Kingfisher from Its Shelves amid Brexit Price Row.” The Independent, Independent Digital News and Media, 22 Mar. 2017, www.independent.co.uk/news/business/news/tesco-heineken-beers-brexit-price-row-amstel-sol-tiger-kingfisher-scrap-supermarket-a7644026.html.

[4] Churchill, Francis. “Localise Supply Chains Post-Brexit, Supermarkets Told.” Supply Management, 27 June 2016, www.cips.org/supply-management/news/2016/june/localise-supply-chains-post-brexit-supermarkets-told/.

[5] “Brexit’s Impact on the British FMCG Retail Landscape.” Kantar Retail, www.kantarretail.com/brexits-impact-on-the-british-fmcg-retail-landscape/.

[6] “Tesco/Unilever Dispute Outlines the Post-Brexit Landscape for Retailers and Consumers.” Global Management Consultancy, 20 Oct. 2016, www.crimsonandco.com/news/2016/10/tescounilever-dispute-outlines-post-brexit-landscape-retailers-consumers/.

[7] Sims, Alexandra. “What Is the Difference between Hard and Soft Brexit? Everything You Need to Know.” The Independent, Independent Digital News and Media, 3 Oct. 2016, www.independent.co.uk/news/uk/politics/brexit-hard-soft-what-is-the-difference-uk-eu-single-market-freedom-movement-theresa-may-a7342591.html.

[8] Linning, Stephanie. “Victory for Britain in Great Marmite War! Tesco Comes out on Top as Unilever Withdraws Blanket Price Rises for 200 Top Brands after Threats of a Boycott by Shoppers.” Daily Mail Online, Associated Newspapers, 13 Oct. 2016, www.dailymail.co.uk/news/article-3835034/Major-brands-axed-Tesco-shelves-row-supplier-Unilever-demanded-10-cent-price-rise-falling-pound.html.

[9] Mcdermott, Victoria. “How Is Brexit Affecting the Retail Supply Chain?” Retail Week, 19 May 2017, www.retail-week.com/topics/supply-chain/how-is-brexit-affecting-the-retail-supply-chain/7020873.article.

I was intrigued by your comments on the impacts to the UK dairy supply chains. I agree with your point that Tesco and others will likely be forced to source more locally, but I think some of the impacts of potential new dairy tariffs (going both directions) might be pretty complex and the local industry might not be quick to scale up. Looking at this report (https://ahdb.org.uk/brexit/documents/Dairy_bitesize.pdf), it seems like some short term options might be turning more to Canada, the US, Australia, or New Zealand for cheese, while New Zealand in particular might try to compete with local butter producers for share of the UK market.

At the same time (and consistent with most of your points), attempts to strengthen local butter and cheese production might take a long time. It seems that the majority of UK milk and cream exports go to Ireland, where it is processed and ultimately imported back into the UK as finished products (e.g. butter and cheese). I’m not sure how quickly the UK dairy industry can scale up its dairy processing capacity, but it seems like they would have to do so quickly to keep up with demand since Ireland has been serving this function for a long time.

While it makes sense that, faced with lower purchasing power, UK consumers would turn to discounters like Aldi and Lidl, my first thought was that these discount retailers would suffer more than regular supermarket chains in the wake of Brexit. My assumption was that as discount retailers, they had tighter margins so less flexibility to absorb increases in supply chain costs, and as German companies, and discount stores to boot, their supply chains were likely more European/international than UK-based stores. I was surprised to read about Lidl’s 100% British meat program (https://www.thesun.co.uk/news/1344085/how-aldi-and-lidl-are-set-to-benefit-most-from-brexit-compared-to-other-major-supermarkets/). I wonder what drove their early decision to focus on local sourcing.

I was really intrigued by Tesco’s decision to not stock imported goods like Marmite and Ben & Jerry’s after wholesalers hiked up prices by 10%. Your points above about the detrimental impact on the consumer seem quite poignant, and I would surmise that, at a certain point, consumer demand for these brands would result in a market entrant (perhaps a foreign company not facing this price increase from the weakened GBP) willing to provide these goods to UK shoppers with strong taste preferences and brand loyalty. While Tesco may argue it has buying power in this supply chain given its size, it seems they are losing this battle today and being pushed to source locally as a result. I wonder whether Tesco could better defend against the threat of new entrants by passing on the price increase to the end consumer, at least in the short term; even if new entrants come in with lower priced items, shoppers going to Tesco for the rest of their groceries are likely to add these products to their basket even with a price increase. This article from the GSB suggests that that may be especially true for bigger basket shoppers: https://www.gsb.stanford.edu/faculty-research/publications/shopping-behavior-consumer-preference-store-price-format.

I was initially surprised that Tesco was attempting to pass on the price increases to their suppliers rather than their customers. After all, the customers are the ones who voted to Brexit. However, the initial results are indicating that this is looking like a smart move. From what I could find, it seems as though Tesco’s competition has tried to pass on more of the increase in cost to customer. Meanwhile, Tesco has kept prices increases very low by using their scale to negotiate with suppliers and by cutting costs in other places. The result: in October, Tesco announced their first dividend in 3 years to go along with profits that exceeded analyst expectations (more here: http://www.livemint.com/Companies/HFJmTLvsYqWpFLXyS4ra4J/Tesco-to-pay-first-dividend-in-3-years-as-profit-beats-estim.html). I certainly don’t think this means that Tesco has weathered the storm. To Sam’s point, building up local dairy supply chains will be a long, challenging task requiring more strategic decisions by Tesco. If their performance thus far is any indicator, I believe Tesco can survive and make the best of this difficult situation.

This is a brilliant article on a crucial and highly relevant topic. I agree fully with the issues laid out and arguments drawn on the impact of foreign exchange shifts on Tesco’s business model. However, it is worth noting that foreign exchange is only one of several supply chain risks relating to Brexit for Tesco. Considered below are two of the other potential Brexit challenges for Tesco worthy of consideration: migration effects and tariffs.

Migration effects

Closely linked to the Brexit vote was the expression of a desire for unchecked EU migration to the UK to be curbed. This could have serious consequences for Tesco’s supply chain. Tesco employs over 300,000 people in the UK (https://www.tescoplc.com/media/392373/68336_tesco_ar_digital_interactive_250417.pdf) across head office, the retail stores and the distribution network. Many of these are working in the UK from the EU, and could have their citizenship status and right to work revoked in the event of a ‘hard’ Brexit. Even if right to work assurances are given for current EU nationals, lack of labor supply in the future could cause raised wages and increased costs. This is a significant issue for Tesco, and in this case they may have no recourse simply to pass the additional costs on to their suppliers.

Tariffs

In the event of a ‘hard’ Brexit, tariffs would likely be placed on imports from the EU. This would have disastrous consequences for UK retailers, including Tesco. In a ‘no deal’ scenario, the UK and EU would resort to WTO trading arrangements, with some estimating food tariffs would reach 22% (https://www.ft.com/content/7f0c732c-93b8-11e6-a80e-bcd69f323a8b). Tesco would be forced either to squeeze their European suppliers, take the profitability hit themselves, pass the costs on to consumers, move supply chains through the UK (which, given the projected migration issues, would be more expensive than ever), or some combination of the above. This is a very real threat to Tesco’s business.

As you note in your essay, solutions will not come easy. Lobbying the British public, and by extension Theresa May, seems the only way out.

I am curious about how Amazon Fresh may try to take advantage of the rising prices for British grocers. While they currently have only about 1% of the market having begun offering their food delivery services in the UK last year, Amazon likely will not face the same challenges with rising costs that British grocers such as Tesco are facing. In addition to likely not having to pass on higher prices to consumers, Amazon offers the additional benefits of convenience and a range of offerings that goes well beyond what most UK grocers have. According to a Financial Times article from January 2017, Amazon offers 130,000 items while one of the UK’s most popular delivery services, Ocado, offers only 40,000 (https://www.ft.com/content/b8f65bf6-dbe9-11e6-86ac-f253db7791c6). I am interested to keep an eye not only on how Tesco navigates the Brexit negotiations, but also how it handles the looming threat from online retail giants such as Amazon.

This article and subsequent responses highlight fascinating predictions on how Brexit might impact Tesco’s supply chain. Wholesalers are attempting to pass through significant price increases to Tesco. As this article discusses, in the near-term, Tesco is leveraging its scale and buying power to push back against “unruly wholesaler demands”. But in the long-term, would Tesco have enough leverage to mitigate rising food costs by bypassing wholesalers entirely? By decreasing the “length” of the supply chain, Tesco could realize cost benefits that enable them to minimize price increases to end consumers, while still maintaining quality products. This action could put them at a significant competitive advantage to other grocers who may be more reliant on wholesalers and therefore forced to raise their prices. Would such a drastic change to the supply chain be possible?

This article also brings to mind a separate but related question: how will Brexit’s threat to the food supply chain impact restaurants? According to an article in The Independent, “thousands of UK restaurants could be at risk of going out of business as…the Bexit vote raises costs for imported food and threatens to squeeze consumer spending”. [1] Not only would restaurants be hit with the rising costs of food, but demand is also likely to fall as consumers are forced to spend more on their own groceries and are therefore less likely to eat out.

Sources:

Zlata Rodionova, “Brexit: Over 5,500 restaurants at risk of closing down”, The Independent, December 5, 2016, http://www.independent.co.uk/news/business/news/brexit-latest-food-prices-restaurants-risk-closing-down-going-bust-a7456311.html, accessed November 2017.

Thanks for the great read. While I agree with some of the earlier comments that Tesco’s recent performance has been good in light of Brexit-imposed challenges (and that the establishment of a dividend is a strong confidence-boosting signal), the composition of the results does show softness in its local market operations (specifically on the top line), and operating margins are being held up by international operations that have not seen the same difficulties. The fact that Tesco was able to perform on the margin front is impressive (and is likely a result of much of what was discussed in the article and Tesco being a dominant player in the British supermarket space), but the relatively low margin nature of the grocery store industry means that swings in sales can have a significant impact on company cash generation. In light of macroeconomic uncertainty that the company cannot control, the company needs to maintain a laser-sharp focus on both the supply and demand sides of the equation, focusing both on keeping COGS low and driving incremental organic revenue by applying the demand-generating tactics that Student suggested above. Bloomberg’s take on Tesco’s results can be found here: https://www.bloomberg.com/news/articles/2017-10-04/tesco-to-pay-first-dividend-in-3-years-as-profit-beats-estimates.

Thanks for a great reading! I believe Tesco could take additional actions in its supply chain strategy to minimize the impact of Brexit in its production costs:

1-Now that the trading negotiations results are still unclear, Tesco could leverage its scale to lock into long term contracts with EU suppliers and minimize or mitigate part of the increased tariffs. By committing to buy large quantities in the future, suppliers could be interested in giving additional discounts to Tesco. Suppliers would be interested since shifting very large quantities of their products to other sources might also be very difficult.

2- As you mention, Tesco will definitely have to consider sourcing from domestic suppliers even at a higher cost. In order to minimize potential inefficiencies from domestic supply, Tesco could elaborate training programs for new suppliers. Additionally, committing to large quantities could be again an important lever since this commitment can help suppliers to undertake additional capital investments to make their sourcing more efficient which again in overall would benefit Tesco.

3-To mitigate that all the increased cost goes to the consumers, Tesco can also benefit from UK products that used to be exported to the EU. If these products have lower demand their price will decrease and Tesco could benefit from its scale to offer high discounts to the end consumer.

Very interesting topic Charlie, I appreciate hearing the diverse solutions proposed in the comments because I had the same reaction as you that Tesco has a very difficult road ahead, likely requiring radical changes. Similar to PC above, I was surprised at just how successful the discount stores have been in the post Brexit era. The New York Times had an article that showed both Aldi and Lidl experienced double-digit growth for over 12 weeks this summer. They highlighted the previous stigma of shopping at discount grocers and how that started changing with the financial crisis and now even more post Brexit. Customers, especially younger shoppers, are increasingly willing to purchase generic items to avoid the premium on brand names. [1] This trend toward generic friendly shopping is likely one of the main reasons discount stores have been able to grow post Brexit when costs of imports are increasing.

Although historically Tesco has competed in the upmarket space, I wonder if their new focus on keeping prices low is the start of a new era. They will inevitably need to implement many of the suggestions discussed in previous comments as well (increasing domestic production, long term contracts, supply chain efficiencies) but a shift towards discount may also help them compete in the changing grocery market.

[1] Tsang, Amie. “As Brexit Nears, ‘Discounters’ Gain Ground in U.K. Supermarket Wars.” The New York Times, The New York Times, 3 Aug. 2017, http://www.nytimes.com/2017/08/03/business/britain-brexit-supermarket-inflation.html.

I find it very interesting that Tesco pushed back against suppliers to the point of stock-outs. In the retail business, stock-outs are often considered the absolute last option and great pains are taken to prevent them. However, I agree with Tesco’s approach to leverage its negotiating power to ensure its supply chain remains relatively stable. I wonder if other grocery chains will start to have the same issues and that rising prices in general will have to ultimately be passed onto the consumer. Although this could cause some short-term pains, it may be inevitable as Brexit takes its course and this phenomenon will ultimately be less painful if Tesco’s competition suffers the same fate.

While I am excited about the prospect of increased local sourcing, I worry that the infrastructure just isn’t there yet and won’t be for quite some time. I found an interesting article that says grocers are trying to secure alternative sourcing means for goods that could face the biggest tariffs, but suggests the rush to secure supplies could push up costs [1]. Grocers will need to invest in their sourcing teams and perhaps even invest directly in local farmers (much like Chipotle has done) to ensure their supplies can meet demand.

[1] https://www.bloomberg.com/news/articles/2017-10-30/brexit-s-retail-mess-you-can-t-move-a-supermarket-to-frankfurt

This is a very interesting and challenging topic. You addressed really well the challenges for the UK, which are undeniable. It is very hard to predict or forecast how the UK will adapt to post-Brexit in the coming years if they go for a hard one. In fact, Tesco cannot predict the future reaction of its consumers: should they negotiate a mid-point price with their suppliers or invest in more products of their own, which might also represent a great opportunity. But there is another part of the problem rarely debated: what is the impact for the EU of having the UK leaving the single market? I agree with you that the outcome (soft vs hard) of the Brexit is still unpredictable, but we can expect reactions from the EU side given the significance of trades with the UK.

Another thing I would consider for Tesco is the expansion in discount stores under a Tesco sub-brand. Studies forecast that the biggest increase (12%) in discount stores over the 2013-2018 period will occur in the UK [1]. Brexit or not, it is certainly an opportunity to catch for Tesco.

[1] https://www.planetretail.net/presentations/ApexBrasilPresentation.pdf

Thanks for analyzing this interesting topic. I resonate a lot with what I experienced previously in auto industry. The similar part is that a global supply chain and market presence can make company very vulnerable to exchange rate fluctuations. On the one hand, short-term political incidents can drive fluctuations that are challenging for companies to react quickly with its pricing strategy. On the other hand, difficulty of predicting long-term exchange rate makes it really tough to make such desicions such as where to invest for the next plant. In my previous job, we have monthly exchange rate projection for the next 5-10 years flowing through to the porgram financials, which often significantly impacts the profitability and some times might change the direction of decision completely. Such challenge further amplifies with several stakeholders across the value chain. I agree with your proposal to lobby with government, although it will be a very challenging task to do.

Super interesting read! I was reading into other instances where there have been large currency fluctuations, and came across an article in the Guardian that says Unilever raising prices by 15.5% in Latin America after currency devaluation only led to at 5% drop in sales [1]. It’s interesting to them consider how much of the feud with Unilever was justified and how much may have been Unilever taking advantage of a bad situation.

The questions you raised around dairy, etc. are going to be hard for the UK to deal with moving forward. Will there be a movement in the UK to source more dairy from local farms? If so, Tesco may want to play a role in setting up the capabilities to do so in exchange for having priority over production on specific farms. This could potentially help mitigate the impact of a price increase on dairy products in the store. As you mentioned, with UK citizens increasingly nervous and price sensitive, huge price hikes may not be feasible for consumers and therefore Tesco could gain a significant competitive advantage by finding ways to source products so that things like dairy remain affordable at Tesco, and consumers are likely to shop there vs. at competitors.

[1]. https://www.theguardian.com/business/2016/oct/13/unilever-finance-director-graeme-pitkethly-defends-company-tesco-price-row-marmite

Very interesting read — I’ll be curious to see whether and how Tesco adapts to these challenges, given the threat you described from discount retailers such as Aldi and Lidl. It makes sense that you would see customers shift toward retailers that are perceived to be more “value-oriented.” To mitigate the impact of price increases on customer value perception, it looks like some stores are reducing product sizes while keeping prices constant, hoping customers won’t notice (https://www.bloomberg.com/news/articles/2017-04-11/eat-more-marmite-and-skip-flossing-to-beat-brexit-inflation). It’s unclear whether this idea originated with the retailers, wholesalers or manufacturers, but I wonder if the potential upside in the near term is worth the reputational risk if customers wise up to this strategy given the heightened sensitivity around Brexit’s effects.

I also wonder what will happen to the smaller grocery stores and chains that have substantially less purchasing power with their wholesale suppliers. Perhaps there will be consolidation among them, or they could get picked up by some of the larger chains.

The CEO of Tesco said: “I don’t believe it will lead to less choice and poorer quality — we won’t let it do that. At the moment, as a UK retailer, we have a much deeper and richer supply chain than all our competitive set. We don’t see any reason why currency changes should change that.” We now know that the CEO was terribly wrong on the availability of choices and I wouldn’t be surprised if the quality of items deteriorates over time as the UK is forced to in-source more products that are better suited to be produced elsewhere. There are only but so many products that can be produced in the UK so the price will continue to be impacted by currency fluctuations, which adds several other challenges to the country, including inflation.

Source: http://www.businessinsider.com/tesco-ceo-dave-lewis-brexit-supermarkets-food-prices-2017-10

Great topic Charlie. From my perspective, Tesco’s current predicament is representative of the broader food supply challenges in the UK that are created as a result of Brexit.

It appears that ~1/3rd of Britain’s food currently comes from EU sources and as established above, the weakening pound will have implications across the value chain in the form of higher prices for consumers, lower margins for suppliers, lower margins for Tesco, and/or meaningful supply chain enhancements/improvements to combat the challenges. However, what I’m most concerned by is the impact that Brexit may have on the cost/prices of goods produced within the UK (and the implications go well beyond dairy).

According to Business Insider, ~30% of the UK food and drink manufacturing workforce are European migrants, and the Brexit vote already appears to be deterring EU workers from moving to Britain. This is a MAJOR issue in the short to medium term – barring immediate manufacturing automation, UK F&B manufacturers would need to hire UK citizens and in an environment with extremely low unemployment rates (~4.3%), UK citizens are likely a more expensive labor resource. These increased labor costs will likely also lead to increased prices for consumers.

Another concerning factor is that in a period with increasing food costs/prices (and decreasing strength of the pound), the poorer UK citizens will likely be the hardest hit – less able to purchase healthy fruits and vegetables as prices rise (and so, more susceptible to poorer food choices – e.g., fast food/soda/etc.). I mention this only because it is just another implication/derivative of the Brexit decision that may not get much attention.

Sources:

[1] http://www.businessinsider.com/tesco-ceo-dave-lewis-brexit-supermarkets-food-prices-2017-10

[2] http://www.businessinsider.com/brexit-uk-food-supply-eu-report-sleepwalking-crisis-2017-7?r=UK&IR=T

[3] http://www.businessinsider.com/uk-food-industry-warns-brexit-could-leave-a-third-of-firms-unviable-2017-8?r=UK&IR=T

[4] http://www.bbc.com/news/business-41252976

Charlie, I think that this is a great essay deep diving on effects of Brexit on retail industry through an example. I agree that Brexit will result changes in prices, profit margins and customer behavior. Regarding the value loss of Pound Sterling against US Dollar, customers’ willingness to pay will decrease and it eventually will lead to significant change in product range and quality offered not only in Tesco but also in other retailers. In such situation one might argue that companies with more local sourcing will gain a competitive advantage and have more room to sustain promotional activities. On the other hand increasing demand to local manufacturers might also cause prices to rise and margins to diminish. At this point best thing to do would be wait and see the effects of Brexit.

The negative potential impacts of Brexit have been well exposed both in the media and in your incredibly well written article. However, there is a very simple benefit that will be crucial to the success of the UK moving forward. By leaving the European Union, the United Kingdom will also be free from the strong and destructive nature of the rest of the continent’s regulations. As a matter of fact, food importing is one of the areas that are most affected by these rules. So why is this relevant to Tesco? Because it can use this opportunity to improve and internationalize its supply chain! I would like to use a personal example that happened with the business where I worked. As one of the largest Brazil nuts exporters in the world, we had the United Kingdom as a top 3 market. However, after the creation of European Union regulations, it became very hard to continue trading with the UK. The result? Supply of Brazil nuts to London decreased, and prices skyrocket. I wonder how many other barriers aren’t in place and how many other supply chain opportunities won’t come after Brexit.

This essay and the many thoughtful comments were fascinating The implications of Brexit on Tesco and the broader UK food business are very complex and interesting to learn about.

Like ES, I was surprised that Tesco responded to the effective price hike of imported goods with stock-outs, given how undesired stock-outs are for retails and for the customer experience. That made me curious about the impact on Brexit on CPG companies across the globe, who were at the receiving end of that decision and are exposed to significant losses through Brexit. Euromonitor did an interesting analysis of which CPG companies will be most affected by Brexit, based on the premise that exposure to Brexit losses is driven not only by amount of UK sales the company has, but also by the elasticity of the category the CPG plays in. One finding was that Nestle is most exposed to Brexit financially, even though Unilever has the most UK sales, because Nestle’s core products (pet care, bottled water) are generally more elastic. [1] In addition to UK-based companies like Tesco, it will be interesting to monitor the impact of Brexit on the global CPG industry as the timeline and actual mechanics of Brexit play out.

[1] http://blog.euromonitor.com/2017/03/brexit-impact-largest-fmcg-companies.html

Charlie, thanks for covering Brexit, and in particular the effects it will have on one of Britain’s most revered brands. Having grown up in the UK, your essay piqued my interest in uncovering what the potential impacts Brexit may have on smaller retailers versus a behemoth such as Tesco. Initial sentiment seems largely positive. In fact, it appears as if many small businesses are investing in growth in a dynamic and uncertain environment. As of October 2016, applications for small business loans had increased 132 percent YoY (http://www.telegraph.co.uk/connect/small-business/how-have-small-businesses-fared-since-brexit/). This suggests that while smaller businesses may be feeling the pressure of currency devaluation, they do believe that in order to survive they need to invest in growth.

The other side of the same coin suggests that perhaps SME owners do not fully understand the implications of Brexit. 55% of SME participants in a recent BCG report stated that they had so far made no plans with regards to Brexit, and that their banks will still continue to lend to them in a post-Brexit world (http://www.telegraph.co.uk/business/2017/07/04/small-businesses-likely-hit-hardest-brexit-disruption/).

So while there may be continued optimism, there still exists a high level of opacity particular for smaller market participants. It may be that the larger corporations, who are in constant dialog with policy makers and legislators, may be best prepared for the hard Brexit that Theresa May is leading Britain towards.

Brexit certainly presents challenges to Tesco and to the UK’s grocery industry. With these challenges, however, there will be opportunities for other business models to succeed if Tesco cannot adapt. A New York Times article published over the summer [1], specifically outlines these opportunities for the discount British grocers Aldi and Lidl. They may be able to capture a significant market share. These discount stores offer far less variety and amenities compared to their upscale competitors, and previously would not have even been considered as an option for higher income consumers. Their ability to maintain low cost originates from a bare bones business model. For example, the stores offer fewer items, these items are put on shelves for consumers in the boxes in which they arrived, and the items are from the stores own discount brand.

Their sales have been increasing faster than their competitors, and it will be interesting to see how long this trend continues. Both companies are contemplating expansion outside of the British market.

Source:

[1] https://www.nytimes.com/2017/08/03/business/britain-brexit-supermarket-inflation.html

Thanks Charlie for your post. I agree that Tesco and many other UK companies will need to manage increased costs of goods sold related to Brexit. It makes sense that the UK can shift to local producers for dairy items, but I imagine some produce currently sold, such as tropical fruits, would be nearly impossible to grow within the U.K. Tesco will need to balance paying higher tariffs on these goods with cost savings initiatives related to other goods that can be produced locally.

Another adaptation I would recommend to Tesco is to further reduce SKUs by reducing assortment within key categories. By buying less variety but in larger quantities, Tesco will have greater buying power in their relationship with fewer suppliers and be able to negotiate lower prices. These cost savings can be passed onto consumers whose wallets are also being squeezed, via promotions that Charlie mentioned or by everyday low prices.

Finally, I’m surprised that Tesco was able to use it’s sheer size to pressure Unilever to lower supply costs – the UK itself represents only 5% of Unilever’s sales (Source: https://www.theguardian.com/business/2016/oct/13/unilever-finance-director-graeme-pitkethly-defends-company-tesco-price-row-marmite). It appears that Unilever was faring more poorly from a public relations perspective and consumer pressure and a decrease in share price may have also been convincing factors in encouraging Unilever to answer Tesco’s demands (Source: https://www.theguardian.com/business/live/2016/oct/13/pound-sterling-brexit-price-row-tesco-unilever-live).

Easily one of the most unique and intriguing articles of the challenge on the economic reality of protectionism–especially in light of the growing populist sentiments here in the US. I find myself wondering how much of the ultimate risk and exchange rate issue can be eased by the potential for a “soft Brexit.” The obvious secondary question to that is whether Tesco and other retailers with global supply chains will pressure Theresa May’s government to minimize the effect of the forthcoming legislative move to formally depart from the EU. At the same time, the rise of Scottish nationalism and the threat of a second referendum[1] to leave the UK imposes even more risk on Tesco and its competitors, as they could suddenly find their stores subject to yet another set of new laws. Charlie has opened a true Pandora’s Box here when we consider the fact that Tesco’s operating strategy is essentially held hostage by political machinations, which may ultimately force them to become political players themselves.

[1] https://www.theguardian.com/politics/2017/mar/28/scottish-parliament-votes-for-second-independence-referendum-nicola-sturgeon

Charlie – I really enjoyed learning more about how Brexit is impacting Tesco, and future implications for grocery and retail in general. I agree with Grant’s comment above that it is initially shocking that they don’t pass on costs to consumers; however, given the shifting landscape towards discount stores such as Aldi and Lidl, it becomes apparent that the broader pressures in the grocery market leave Tesco with no option but to commit to low costs. Further, as some comments touched on above, I was surprised to learn about the magnitude in which Brexit might exacerbate the growth gap between traditional grocers and discounters. [1] This is due to two factors in my opinion:

1) Discounters have taken proactive steps that might allow them to benefit off of Brexit. For instance, Aldi’s proactive push for local sourcing, and both Aldi and Lidl’s positioning of their headquarters in Germany.

2) Discounters have established customer promises that inherently align to pressures of Brexit: focus on local sourcing and relationship-building with British farmers, de-emphasis on brands, and lean operating models that value simplicity in offerings.

I am curious to see if, and how, Tesco might fight to maintain market share by altering not just its operating model, but its customer promise, in the face of a widening growth gap between discounters and traditional grocers.

[1] http://www.nacsonline.com/magazine/PastIssues/2016/September2016/Pages/Feature12.aspx

Very informative read — thank you Charlie. The fact that even the largest businesses like Tesco are suffering under Brexit makes the plight of small- and medium-sized enterprises (SMEs) especially concerning. As you pointed out, large corporations like Tesco have the scale and bargaining power to somewhat shield themselves from the impact of isolationism, namely decreasing purchasing power of its currency and increasing import/export tariffs. However, SMEs do not have the same privileges and as a result will be the group hit hardest by these policies. To make matters worse, SMEs will likely face higher cost of capital and reduced access to banking services. With SMEs accounting for 67% of employment and 58% of gross value [1], the issue is incredibly pervasive to the population as a whole.

[1] http://www.telegraph.co.uk/business/2017/07/04/small-businesses-likely-hit-hardest-brexit-disruption/

A big tactical problem facing Tesco with the depreciation of the pound and higher import prices is how much of the price increase to pass on to customers. Economists will tell us Tesco should pass on more of the price increase for goods with price-inelastic demand than goods with price-elastic demand. Demand for Unilever products such as Ben and Jerry’s and Marmite may be rather price elastic due to the large number of substitutes, particularly local brands that are not affected by the FX rate. This price-elasticity of demand is evidenced by the fact that discounters are growing at their fastest rate in recent years, in the light of higher food prices, as shoppers are buying more lower-priced food items. [1] Given this reality, Tesco’s profits may be adversely affected due to margin compression with higher cost of goods sold but the inability to pass the entire price increase on to customers. With this landscape, I would recommend Tesco to produce and expand its own private label offerings that are produced in the UK, which will be resistant against changes in FX rates, and will help offset the margin compression of other products.

[1] Wood, Zoe. “Tesco says price rises are last resort as UK growth hits seven-year high”. The Guardian. https://www.theguardian.com/business/2017/jun/16/tesco-price-rises-uk-growth-inflation-pound-brexit

Great read. I agree with you on the impacts of shifting FX on British retailers but worth noting that there are other issues to consider too: tariffs for example (if the UK moves toward a harder Brexit, I expect to see high tariffs being placed on imports). This will hit all retailers, including Tesco hard – whether this will lead them to increase prices to customers or squeeze suppliers is yet to be seen.

Recent events across the globe show us it’s almost impossible to predict how hard or soft the Brexit agreement will end up; the best thing Tesco can do is to band together with other retailers and lobby, lobby lobby!!!

I wish them luck.

Thanks, Charlie! Great read.

An interesting psychological consequence from Tesco’s reduction in selection from popular brands is consumer’s inclination to “frantically search” [1] on Amazon for things that they need fast and are not able to get in their local grocery store. This, I think, will have some modest and short-lived benefits for Prime Now, however, it’s worth noting the human behavior aspect to out of stocks. I think that it’s a fine line between satisfying the customer promise on availability versus price when you need to trade off one for the other. I see how currently Tesco is eliminating selection from their shelves as they negotiate more favorable terms with suppliers like Unilever, however, if this strategy fails, I wouldn’t be surprised to see these products back with the mark-ups.

[1] http://www.kantarretail.com/brexits-impact-on-the-british-fmcg-retail-landscape/

Thanks for the interesting read Charlie. My first thought is that Tesco has been around for almost 100 years and has been through many fluctuations in currency over that time. I would hope that they have taken advantage of that experience to inform product adjustments and supplier negotiations this time around. I would also think that of the various industries to be affected by currency fluctuations, food retail would be one of the safer places to be. Consider for example the impact to auto retailers or department stores where purchases are more discretionary and there is likely to be an even greater proportion of imported goods. Finally, I suspect that the greatest risk to Tesco is around other impacts of Brexit (as opposed to exchange rate implications). The potential for tariffs and issues accessing the labor market could be even greater challenges for Tesco in the years ahead.

It seems that the overall implication of this protectionist policy will ultimately be detrimental to the end consumer, as shown by the fact that Tesco’s immediate reaction is in fact to stop stocking imported products, as well as to pass increased costs through to the consumer. It will be interesting to see how the pound stabilizes as the terms of Brexit and new trade policies become more clear – no doubt the politicians who lobbied for Brexit did not intend for this to be the long-term outcome? Additionally, if the consumers are left wildly unhappy, could there ever be a path to reverse the Brexit decision, or is it just too late, and this will be the new normal for UK consumers? On the flip side, as the UK market adjusts, I wonder if domestic food production will in fact increase to ease these concerns -and if so, how would the costs of this compare with current costs of food products from the EU?

I am impressed to see that a measure that supposedly leads the UK towards a liberal vision. The Brexit should be a step in the direction of the free market, and the free market should help Tesco supply chain. However, you made great points showing that the practical effect of the Brexit will be the opposite of that.

The Government should take measures to help improve the life of the citizens, but it seems to me that even large companies in the UK will have to rethink how they do business. By doing so, they will force the citizens to change their behaviors. I was surprised that the Brexit would touch the people even on the daily activities. I hope the UK Government finds a better solution for the people.

I really enjoyed this article Charlie! It’s really interesting to see how Brexit is affecting large businesses, and in relation to that, their suppliers as well as customers. As others have mentioned above I thought it was interesting that Tesco attempted to pass on the costs to their suppliers instead of their consumers. In the long run I don’t think this is a sustainable strategy however, as Tesco is in a unique situation where suppliers aren’t competing for their business – Tesco needs to be able to deliver products to their customers. Suppliers may initially be willing to negotiate in order to keep Tesco as a customer, but ultimately if Tesco becomes an unprofitable account they will have to walk away. Given that the UK sources much of their produce from the EU as you mentioned, and because agriculture is not an industry that can be developed in the short-term, it will be interesting to see the policy decisions on the government level and strategic decisions Tesco makes in the future.

Great article! I think this is great illustration of the consumer implications of protectionist policies. I believe the misconceptions of the risks associated with protectionist policies is due to an uninformed public as many citizens fail to realize the interconnection of the global economy. Local citizens in industrial nations rely heavily on global imports for the food, clothing and consumer products which they purchase on a day-to-day basis to maintain their lifestyles. Ex-Sainsbury’s CEO Justin King said Brexit will lead to “higher prices, less choice, and poorer quality” at supermarkets. [1] As a result of these factors, British citizens will have less disposable income and fewer options available. I believe that British citizens would have made a different decision to leave the EU if they were fully aware of the risks associated with their decision and the disruptive implications it would have on their lifestyles.

[1] http://www.businessinsider.com/tesco-ceo-dave-lewis-brexit-supermarkets-food-prices-2017-10

Great article indeed. Tesco is clearly in a rough spot at the present moment. The grocery industry is historically a super razor-thin margin business. Any added margin compression due to currency fluctuation may be catastrophic as it doesn’t take much to flip to negative earnings. What should Tesco do? A couple options include:

1) Roll-out automated technology to reduce labor costs. Tesco can then pass those cost savings to consumers. On the flipside, Tesco would have to consider the externalities of such a plan of action.

2) Reduce fixed costs. Perhaps Tesco can downsize its stores by reducing inventory on hand. Adopting a Justin Time system could be one such model to consider.

Thank you, Charlie, for addressing a very important topic facing us today.

I find it quite impressive that Tesco, as you mentioned, was able to still pressure suppliers in a post-Brexit scenario. Reflecting on their argument, domestic production doesn’t fully justify price stability – in fact, now it’s significantly more attractive for local producers to sell domestic products elsewhere.

Another point that comes to mind is the flip side of the negative Brexit effects – what industries / products will benefit from a lower GBP? Related to that, should Tesco absorb the price hike by investing more in these industries / products?

Furthermore, what is the role that the government is playing to dampen the negative effects of Brexit? With so many industries affected, is the UK providing incentives and/or penalties to smoothen the effects of Brexit on the local economy?

Finally, are the effects of Brexit pushing for more local efficiency in supply chain management? The argument here being that thinner margins and higher prices put more pressure on local organization to optimize their operations.

Such a good read. Two thoughts which came to mind:

– Do you think TESO would look to vertically integrate and increase local production to reduce their supply on retailers?

– This is extremely relevant to not just Britain and TESCO, but as the world is moving towards exceedingly populist economies, it would be interesting to see how decade old organization react to this threat.

Charlie, thank you for such a thoughtful analysis of the impact of Brexit on Tesco. As I was reading about the decision of not stocking certain Unilever products to avoid paying the 10% price increase, I was wondering if this was a symptom of the delicate situation that Tesco was in, even prior to the Brexit vote. In April 2005, Tesco posted a £6.4 billion loss. Some of the drivers for the disappointing results were the decline in foot traffic in out-of-town stores, as well as as shift in shopper habits, who increasingly bought groceries at Aldi and Lidl.

Tesco’s customer promise is “Every little helps”, alluding to the low prices that the retailer offers. Yet, it seems that scale is not enough to combat the pressure from discount retailers, who might steal part of its customer base. At the same time, Tesco would have a hard time capturing the higher end customers, who shop at Waitrose or M&S. In fact, I would be interested to see if Waitrose has faired better in light of Brexit. Given that customers might be less price sensitive, have they just simply passed the price increase along to the end customer or have they also faced less choice on the number of products that are profitable to carry in store?

Like others in the class, I was also surprised that Tesco allowed stock outs of products to occur for negotiating leverage. For products with few substitutes or for products with strong brand loyalty, passing on higher costs to consumers makes more business sense to me—it is ultimately up to the end consumer to decide if they are willing to pay for a good. In the mid-term, passing along higher costs to the end consumer may result in lower product sales exerting more pressure on manufacturers to adjust their prices. If I were Tesco, I would see this as an opportunity to bolster my private label business, knowing that there could be an opportunity to capture greater market share from price sensitive consumers. In an earlier comment, Juan suggested that in the Tesco could lock in long term contracts to bring down product costs. While in theory this would make sense, I am doubtful that given the uncertainty of what a Brexit agreement will ultimately look like, and the volatility of the GBP that it is in the best interest of the grocer or that of manufacturers to enter into long term agreements.

I thought Daniel brought up an interesting point in response to this article: that Brexit could pose an opportunity–rather than a threat–to Tesco’s sourcing, supply chain, and pricing model by forcing the company to work with international suppliers outside of the EU (and without the constraints of the EU’s stringent standards).

The United States, for example, has been able to produce more food efficiently and cheaply than the UK and EU. In one key area, livestock farming, the US leverages efficiencies by using growth hormone to increase production and yield, a practice that is banned in the EU. As a result, the US supplies only 0.1% of Britain’s beef — in contrast with supplying 20% of the world’s beef. [1] Brexit could drive this number upwards as retailers like Tesco are forced to source cheaper beef and other livestock from suppliers outside of the EU; as a result, consumers may see little to no price change on their end.

Of course, such a change introduces other questions: Is Britain okay trading price for such different (and arguably lower and less stringent) production standards? And will the consumer even be made aware of these tradeoffs?

[1] http://www.bbc.com/news/business-40530700

Thanks Charlie – I thought this was an interesting take on the impacts of Brexit. Frankly, I had not considered the implications Brexit has on the importation of commodity goods such as food, but after reading this I’m anxious to see the outcome.

You mentioned a bit about residents purchasing habits changing, but I’m curious if Tesco will be able to accommodate them. In the long-term, I wonder if it would be viewed as strategically sound for Tesco to start either acquiring or developing close relationships with its local suppliers, mom and pop grocery stores, and small restaurants. With increased importation costs and the rise of the internet, what is stopping locals from simply purchasing Unilever and P&G products through Amazon altogether and skipping Tesco? Amazon’s economies of scale and minimal taxes are the perfect loophole for UK consumers, and I view this as an opportunity prime for Amazon’s dominance.

If Tesco is no longer able to compete on price, they are going to have to shift their strategy to compete on something fundamentally different. For a grocery store, I would say that should be freshness of goods and variety – which they’d be able to obtain through local partnerships. In order to establish a strategy like this, they would need to dramatically increase their regulatory and control teams, sourcing, due diligence and partner relations. Ultimately this change could be viewed as a positive change for the local communities if the consumers are willing to support their decision.