Bitcoin and the Blockchain

If you cringe at the idea of Bitcoin because it conjures an image of those smug little Winkelvosse twins, then you and I have a hell of a lot in common…but by employing a new mastery of emotional regulation (thanks Field 1!) I’ve been able to put my distaste aside to try and figure out what this digital currency all about. And I’ll admit, I was blown away…

A brief history of Bitcoin:

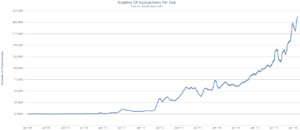

Bitcoin is a ‘cryptocurrency’ – a form of digital cash that uses cryptography to regulate its creation and management. Its origins can be traced to paper posted to the internet in November 2008 entitled: bitcoin: A Peer-to-peer Electronic Cash System. The paper’s author, Satoshi Nakamoto, then created the first 50 bitcoins known as the “genesis block”.1 Fast-forward eight years and nearly 10,000,000 transactions per month are now made with bitcoin.2

While there were several attempts to create a digital currency prior to bitcoin (hashcash, RPOW, and eCash), none of them employed the associated ‘blockchain’ conceptualized by Satoshi Nakamoto. All of bitcoin’s power is derived from the blockchain – in it lies the potential to fundamentally change the way we transfer value.

The Brilliance of the Blockchain:

In essence the blockchain is a digital paper-trail. The blockchain records every transaction ever made with each individual bitcoin in sequential order over the lifetime of the bitcoin, and

this transactional history cannot be overwritten. Each time a transaction is made, it is recorded by linking new block to the original chain. Stephen Armstrong, from Wired Magazine, writes “the blockchain is a decentralized electronic ledger with duplicate copies on thousands of computers around the world. It cannot be altered retrospectively, allowing asset ownership and transfer to be recorded without external verification.”3

Okay. Seems simple enough. But so what? What does the blockchain really do for us?

Ultimately, it is about trust. By decentralizing the data you now have thousands of identical copies of the blockchains throughout the world. This avoids the traditionally vulnerable centralized data hubs that are popular targets for hackers, and the system virtually eliminates fraud as no ‘official’ copy of the data exists. In fact, it turns out that the creator, Satoshi Nakamoto, doesn’t actually exist and the name was simply an alias; while there is plenty of speculation, no one actually knows who created the ‘genesis block’.

According to Alex and Don Tapscott from the Harvard Business Review: “On the blockchain, trust is established, not by powerful intermediaries like banks, governments and technology companies, but through mass collaboration and clever code. Blockchains ensure integrity and trust between strangers. They make it difficult to cheat.”4

What this means for financial transactions:

Disintermediation.

Bitcoin’s technology eliminates the need for central banks and governments oversight of transactions. Instead of complicated transactions between banks, bitcoin creates a simple, digital, transparent, and trustworthy system for transferring money.5

“The history of money transfers teaches one enduring lesson. When you reduce the cost of making a money or currency transfer, you reduce trading costs, hence encourage increased trade. Increased trade brings about increased economic growth, which benefits all involved.”6

Now, while I’m sure the Winklevosses truly wanted to benefit all involved, they certainly saw the opportunity to benefit themselves, and created a bitcoin-based ETF which tracked the exchange rate of bitcoin with the US dollar.

However, we can all take solace in that once again, in true Winklevoss fashion, the twins drastically underestimated the power of the technology that they had in their grasp.

Blockchain as a Blockbuster

I originally thought of writing about bitcoin because I was interested in the concept of using its transactional history in other applications. I wondered, for instance, what if you could track exactly how many times a song is played, and by whom? Consider the possibility of an artist releasing a limited number of digital copies of her song. Instead of needing the record labels to control the IP, she could be payed directly by the consumer of the music (Pandora’s price point of $.001 per stream would be obliterated). Disintermediation.

Well it turns out, I was not the only one considering the extensions of blockchain technology and the impact it could have. Mycela is company in the music industry example doing exactly what I mentioned above (I swear I had that idea independently). From IP, to art, to coding, to manufacturing, the blockchain ledger can be used to track any ‘event’ that occurs in the digital world, and we can mine that data for patterns that further our understanding of human behavior and the universe at large.

“The technology most likely to change the next decade of business is not the social web, big data, the cloud, robotics, or even artificial intelligence. It’s the blockchain…”7

- Don and Alex Tapscott, The Harvard Business Review

1 Wikipedia contributors. History of bitcoin. Wikipedia, The Free Encyclopedia. November 13, 2016, 04:34 UTC. Available at: https://en.wikipedia.org/w/index.php?title=History_of_bitcoin&oldid=749225782. Accessed November 13, 2016.

2 Wikipedia contributors. History of bitcoin. Wikipedia, The Free Encyclopedia. November 13, 2016, 04:34 UTC. Available at: https://en.wikipedia.org/w/index.php?title=History_of_bitcoin&oldid=749225782. Accessed November 13, 2016.

3 Armstrong, Stephen. “Move over Bitcoin, the blockchain is only just getting started.” Wired Magazine. Available at:

http://www.wired.co.uk/article/unlock-the-blockchain. November 7th 2016.

4, 7 Tapscott, Alex. Tapscott, Don. “The Impact of the Blockchain Goes Beyond Financial Services”. The Harvard Business Review. Available at: https://hbr.org/2016/05/the-impact-of-the-blockchain-goes-beyond-financial-services. May 10th 2016.

5, 6 “The Future of Money Transfer: how bitcoin and block-chain based open ledgers are going to transform the world of money”. FreeMIT. Available at: https://www.freemit.com/blog/the-future-of-money-transfer-how-bitcoin-and-blockchain-technology-will-change-everything/ Accessed Novemeber 17th 2016.

Thank you for this article, J! Interesting to think about how the technology underlying Bitcoin could have other applications.

I didn’t realize that there were several attempts to create a digital currency prior to Bitcoin. It sounds like the power of Bitcoin is linked to the blockchain technology that allows a degree of trust in the digital currency that is critical for adopters. How did the other digital currencies try to develop this trust without the blockchain technology? Does the trust that blockchain technology enables facilitate the adoption of this technology in other applications too?

Gracias Todd. Bitcoin and blockchain are one of those things I have been hearing people talk about all the time, while I just nodded and pretended to understand what they were saying. I appreciate how your blog made it simple to grasp. I can see many positive externalizations for the use of bitcoin. Just think of all the people who send money from the US back to their home countries. Now they depend on expensive services from western union since the majority of people don´t have banks in their home countries, and are locked out of the financial system. With bitcoin, they will have a low barrier to entry way of getting into a digital financial system that is safe. this could change conditions for many families, and facilitate the lives of thousands of people.

Very interesting post, Todd. Thank you for sharing. While Bitcoin certainly has potential to transform the payments industry, I believe that block chain technology more broadly has the potential to transform many other industries. Companies such as Digital Asset Holding are developing block chain technology that will, for example, allow for seamless execution of syndicated loans. The speed of adoption for block chain technology in other industries remains the biggest question in my mind.

This post is fantastic!!

I think you are spot on when you speak about the underlying Blockchain technology as the key disruptor as opposed to the idea of Bitcoin and cryptocurrencies. Curious to get your thoughts on where the future of blockchain adoption is going, and your opinion on how large institutions that mainly act as intermediaries will react to the widespread adoption of a technology like blockchain. Take for example the major financial institutions. A core concept to the idea of a “bank” is to record transactions and serve as a platform to clear transactions between a buyer and seller. In the ideal world, blockchain could do all this work (and without a transaction fee), and it seems from your post do it even better than what current intermediaries can do. Given this, do you think financial institutions will act to prevent this from happening. And if so, what can they realistically do? In reality, I’ve read about the financial institutions currently working on investing in blockchain platforms themselves, if they can’t stop it how do you envision them leveraging a platform like this in their business and how they will justify charging consumers for their services?

I am personally heavily invested in Bitcoin through Coinbase, its been very interesting to watch how these digital currencies have done even though there is technically no real value created here. A close friend of mine (who you actually met in NYC) works now for the Winkelvi (the plural of Winkelvosse?) twins, who have been able to attract top talent to their investment shop. I recently did some research on Ethereum, the new competitor of Bitcoin, when coincidentally they launched this a few months back on Coinbase’s platform. I would love to hear your thoughts on this, and what this could mean going forward for Bitcoin now that they have actual competition in the space?

Great writeup Todd. I’d like to share an essay which I believe to be the best layman’s description of the power of blockchain: https://aeon.co/essays/how-blockchain-will-revolutionise-far-more-than-money.

I’m bullish on the power of the technology to really revolutionize both developed and emerging markets. For me, the power of a decentralized means to record ownership of any physical (or virtual) asset is where the power really lies (and less-so in the ability to make payments over the internet without a middle man). The ability for people to have trust and proof of ownership in emerging markets where infrastructure is sparse will be critical. Like MRP mentioned above, this can be applied to anything from syndicated loans to property deeds. Blockchain technology truly may be the most important innovation to date of the modern web. I’m very excited to see where it goes next!

Todd, thank you! “Research and understand blockchain” has been on my to-do list for months, and you did such a great job explaining the basics clearly! I’d be really interested to understand what other business are popping up around the blockchain technology. I am interested in how it could be used for student data in schools – it looks like some folks are starting to look into this: http://www.cnbc.com/2016/05/09/schools-are-recording-students-results-on-the-blockchain.html.

Todd loved this post. I’m actually a big follower (ok like medium to luke-medium follower) of block chain tech, and spent a bunch of time this summer reading up on it for similar reasons. Also have a few friends heavily involved in it. Most importantly however, like you, Field Foundations dramatically shifted my appreciation for this new technology.

Couple of points of comments/feedback:

1) One industry I’ve looked at this for is energy. One example is this company my friend joined a few months ago – effectively helping UK energy companies use blockchain technology to make pricing contracts more efficient: https://www.linkedin.com/company/7945922?trk=prof-0-ovw-curr_pos (their company description is very wordy and hard to follow there but we can discuss offline…) Website: http://www.electron.org.uk/

2) (Ironically given the fundamental point of blockchain…) security still looks like it could be an issue for the early stage roll out of the technology in different industries. Right after I started looking at blockchain this summer (mid-June) there was one of the biggest hacks in history on the DAO (which sits on Ethereum) https://daohub.org/ and https://etherchain.org/account/0x304a554a310c7e546dfe434669c62820b7d83490. I’m still trying to use FIELD to navigate a bunch of this stuff which can be a little confusing, but do you think it will still take a while for a lot of industries to actually take the plunge and get involved in this technology?