Banking on Digital Technology at BBVA

BBVA Compass enhances its digital capabilities to engage with customers in innovative ways

The consumer banking industry relies on maintaining relationships with its customers to earn revenue. Traditionally, banks have done this through local bank branches where staff engaged with clients face-to-face. However, the digital age has diminished the need for consumers to ever set foot inside a bank branch, so maintaining those customer relationships through alternative means has become increasingly important.

BBVA’s Digital Strategy

BBVA’s chairman, Francisco González, described the window of opportunity that the banking sector has to shape the emerging financial technology (fintech) marketplace before both regulators and non-financial technology companies (e.g. Amazon, Google, Facebook) move into the space.[1] He said that banks need to be “knowledge-based information companies,” and change needs to be not only technological, but also organizational and cultural.[2]

1. Organizational Design

In 2014, BBVA created a Digital Banking Division in the US by poaching talent from leading digital banking services.[3] It created BBVA Innovation Centers and BBVAOpen4U.com to encourage innovators to connect their applications to BBVA’s platform via APIs.[4] BBVA also acquired US-based companies Simple and Spring Studio, which specialize in online banking and customer experience design, respectively. By acquiring specialists in these areas, BBVA can integrate their business models into its value chain and deliver a better customer experience.[5] BBVA is also looking toward the future of increased cloud computing by partnering with Amazon Web Services (AWS) for its cloud infrastructure services, recognizing that AWS can provide better security, compliance, and data privacy for its consumers.[6]

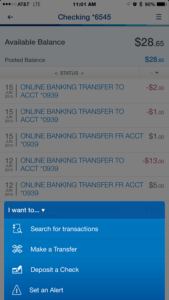

Unlike many banks, whose mobile applications are simply abbreviated versions of services offered on their websites and brick-and-mortar locations, BBVA is using its mobile app to strengthen its relationship with consumers using existing income and expense data. The app is personalized for consumers, greeting them by name when they open the app and providing personalized financial offers based on their profiles and behavior patterns.[7] Other data-driven features of the app include the ability to view and activate rewards on the go, biometric sign-in, and a bank branch and ATM locator, all making customers’ lives easier.[8]

Another digital innovation is the BBVA Hoops app, a basketball game where users can earn points, share their scores on social media, and learn more about BBVA. [9] BBVA is the official bank of the NBA and is using the BBVA Hoops app to engage with basketball fans and a younger demographic. BBVA has also used beacon technology through the app to drive basketball fans to a physical booth to engage with BBVA customer service staff. [10]

Keep on Banking

While BBVA has demonstrated its commitment to the digital age, there are more steps that it can take to enhance its product offering and customer engagement.

1. Integrate service offerings

BBVA currently has a multitude of mobile applications specified for countries, services, games, and information. GooglePlay, alone, returns 29 apps related to BBVA, many of which do not overlap in functionality.[11] BBVA should create a single application with all product offerings on a consolidated platform. This simplifies product use for consumers and creates a centralized database for BBVA where customer data can be synthesized for better engagement.

2. Fintech Partnerships

While BBVA has invested significantly in organic fintech product offerings, BBVA should leverage with other fintech startups to not only engage with its consumers, but also drive better consumer health outcomes. These startups lack BBVA’s financial resources and ability to meet stringent regulatory requirements, but through partnership or acquisition, can help BBVA encourage customer savings (Digit), monitor spending habits (NerdWallet), and assess credit using alternative data (VisualDNA).

Today, BBVA has 16 million digital customers, [12] a 21% increase from 14.8 million in 2015.[13] By continuing to integrate digital strategies into its operating model, BBVA is demonstrating its commitment to continue serving these customers in a digital world.

(791)

[1] “Francisco González shares BBVA’s digital transformation case with Harvard Business School faculty,” BBVA Website, https://www.bbva.com/en/news/science-technology/technologies/francisco-gonzalez-shares-bbvas-digital-transformation-case-with-harvard-business-school-faculty-2/, accessed November 2016.

[2] Ibid.

[3] Penny Crosman, “BBVA Poaches Top Digital Bankers from Capital One, SunTrust,” American Banker, May 13, 2014, http://www.americanbanker.com/issues/179_92/bbva-poaches-top-digital-bankers-from-capital-one-suntrust-1067474-1.html, accessed November 2016.

[4] BBVAOpen4U Website, https://bbvaopen4u.com/en, accessed November 2016.

[5] “Innovation and technology: the digital transformation,” BBVA Website, https://accionistaseinversores.bbva.com/TLBB/micros/bbvain2015/en/performance-in-2015/bbva-group/innovation-and-technology-the-digital-transformation/, accessed November 2016.

[6] Scott Thompson, “AWS to accompany BBVA on digital journey,” IBS Intelligence Newsletter, October 21, 2016, https://ibsintelligence.com/ibs-journal/ibs-news/aws-to-accompany-bbva-on-digital-journey/, accessed November 2016.

[7] Michael Barris, “BBVA Compass seeks to shorten customer journey with new banking app,” Mobile Commerce Daily, June 18, 2015, http://www.mobilecommercedaily.com/bbva-compass-seeks-to-shorten-customer-journey-with-new-banking-app, accessed November 2016.

[8] Mobile Banking, BBVA Website, https://www.bbvacompass.com/mobile-banking/, accessed November 2016.

[9] Michael Barris, “BBVA Compass hopes to net new clients via basketball game app,” Mobile Commerce Daily, May 22, 2015, http://www.mobilemarketer.com/cms/news/gaming/20499.html, accessed November 2016.

[10] Ibid.

[11] GooglePlay “BBVA” search results, https://play.google.com/store/apps/developer?id=BBVA&hl=en, accessed November 2016.

[12] “Digitization, a priority for growth,” BBVA Website, September 22, 2016, https://www.bbva.com/en/us/news/science-technology/technologies/internet/digitization-priority-growth/, accessed November 2016.

[13] “Innovation and technology: the digital transformation,” BBVA Website, https://accionistaseinversores.bbva.com/TLBB/micros/bbvain2015/en/performance-in-2015/bbva-group/innovation-and-technology-the-digital-transformation/, accessed November 2016.

Great post Amrita. I actually wrote on the same topic. Digital innovation in the banking industry has been introduced at a slow pace and most of the times not visible to the consumer.

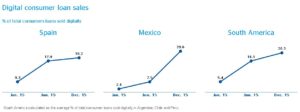

I worked with BBVA on this topic while at my previous consulting job. They are spending a significant amount of money to be the top digital bank in South America, and are studying all sorts of ideas [1].

From their point of view, right now the main point of differentiation that digital innovation brings is data. They believe there is significant value in big data / data mining and that will prove a key advantage versus the competition going forward.

[1] https://www.finextra.com/news/fullstory.aspx?newsitemid=26441

Reets – this was an awesome post. I think you highlighted one of the most essential ways digital technology can differentiate a business product – the ability now for real time and endless customization. The fact that this ap is tailored towards the specific behavior and income level of the end-user must dramatically increase the value it brings to the customer. In general, when I reflect on online banking, its amazing how satisfying of an online experience these banks have created. Depositing checks for instance through your phone is so convenient. A huge benefit of digitization has been convenience. Thanks again for this article.

The part of this that was most awesome to me was how BBVA has delved into gamification. So cool to see how BBVA has moved laterally with its relationship with the NBA to use games to engage its consumers with a far more banal activity. This is a really interesting example to me of how lateral innovation can open up whole new spaces for players in traditional industries. It shows how much room for new ideas there is when a company isn’t beholden to only looking to other banking companies for inspiration!

Thanks for sharing this article! I agree with what you’ve written. The banking sector definitely needs to grab that window of opportunity before the space becomes overly regulated and crowded out by tech firms.

One concern springs to mind. I wonder about the proliferation of digital banking/fintech alternatives, in terms of their overall accessibility for the elderly population segment. For example, how many elderly people do we actually know of that are familiar with using mobile applications in general, and specifically trusting of their mobile phones to execute banking transactions? While digitizing banking is definitely a great outcome for younger generations, the consumer banking industry should ensure their market remains open to all.