Alexa, Let’s Go Shopping – Voice Shopping on Amazon.com

The Amazon Echo is everywhere, but are people using it to shop?

The advent of voice-controlled assistants has put speech recognition technology into the hands of consumers at impressive rates. Experts estimate that the number of installed smart speakers will more than double from 100 million units in 2018 to 225 million units in 2020, with Amazon’s Alexa powering around 34% of worldwide units [1]. Despite this rapid adoption, many users remain unconvinced of their value, with only around 55% of users claiming that they “wouldn’t like to go back to life without their smart speaker” [2]. One major area of opportunity for Amazon in this space is the application of voice recognition to the shopping process, creating a thoughtful flow that will encourage customers to increasingly rely on their Alexa units as they shop on Amazon.

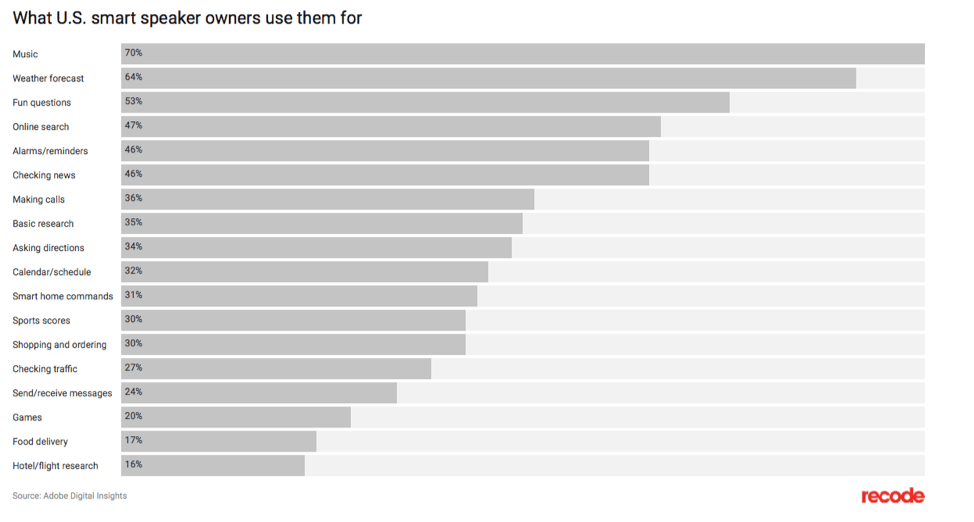

Currently, only 30% of U.S. smart speaker owners use their speakers for shopping – the most common uses are playing music (70%) and checking the weather (64%) [3]. Most speaker owners only shop occasionally, with only 12% of owners shopping once a month or more [4].

Many industry forecasts expect the voice shopping channel to grow in the coming years, with voice projected to account for 5% of Amazon’s revenue in the next three to five years [7].

One of the challenges underlying voice shopping is the complexity of the interaction as compared to some of the more common voice requests. In order to facilitate the back-and-forth conversation necessary for most shopping transactions, algorithms must learn how to link together different spoken inputs to follow the normal logic of a conversation. They must also learn to deal with the ambiguity that often permeates a conversation as the human speaker omits previously established subjects as the conversation progresses [8]. Amazon has created a platform for third party developers, including partner merchants, to create voice applications called “Alexa Skills”. The decision to open the platform up will help accelerate development towards a more robust voice environment, which will help Amazon grow their voice shopping revenue.

Although the shopping experience is still underdeveloped, Amazon has worked hard to establish itself as the dominant player among voice assistants. During the 2017 holiday season, the Echo products were marked down from 20 – 40% and were among the site’s best-selling gifts [9]. This will help Amazon quickly scale their volume as the adoption of voice shopping increases in the coming years.

As the voice recognition technology improves, Amazon has recognized that many shoppers will still rely on some visual information in the shopping process. While customers are more comfortable purchasing familiar products like office supplies through voice shopping, half of customers would not purchase luxury goods, groceries, or furniture through voice shopping [10]. Amazon’s introduction of a paired screen (Echo Show) will help facilitate shopping in additional categories down the road.

In the current state, Amazon’s voice shopping experience looks to integrate voice into a traditional shopping path. By doing so, Amazon has limited most of the usefulness of the voice interface to only the product discovery phase of the shopping path [6]. To succeed in the future, Amazon will need to take a critical eye towards the entire shopping experience, rather than simply allowing for voice input into their traditional shopping path. The current voice environment is difficult to navigate – only 35% of users have enabled a single “Alexa Skill” [12]. While Amazon currently enjoys a strong foothold in this space, rapid improvements in voice recognition technology and increased competition will demand that Amazon differentiates their voice shopping experience and leverage the unique advantages that voice can offer to a customer shopping at home.

Looking forward, there are a couple of key questions that Amazon will need to face:

• How, if at all, should Amazon balance a consistent voice shopping experience across Amazon.com with the specific shopping experiences created by partner merchants?

• What features of voice shopping can Amazon build to add value to the customer outside of a hands-free way to navigate their site?

(768 words)

[1] “Smart speaker installed base to hit 100 million by the end of 2018”, Canalys, July 8, 2018, https://www.canalys.com/static/press_release/2018/090718%20Media%20alert%20Smart%20speaker%20installed%20base%20to%20hit%20100%20million%20by%20end%20of%202018.pdf, accessed November 2018.

[2] “The Smart Audio Report”, NPR and Edison Research, July 2018, https://www.nationalpublicmedia.com/wp-content/uploads/2018/07/Smart-Audio-Report-from-NPR-and-Edison-Research-Spring-2018_Downloadable-PDF.pdf, accessed November 2018.

[3] Molla, Rani. “Voice tech like Alexa and Siri hasn’t’ found its true calling yet: Inside the voice assistant ‘revolution’”, Recode, November 2018, https://www.recode.net/2018/11/12/17765390/voice-alexa-siri-assistant-amazon-echo-google-assistant, accessed November 2018.

[4] Source: More Smart Speaker Owners are Becoming Habitual Voice Buyers, Business Insider Intelligence, accessed November 2018

[5] Marchick, Adam. “Strong Signals that the Amazon Echo is changing purchase behavior”, Alpine.AI, May 2018, https://alpine.ai/amazon-echo-changing-purchase-behavior/, accessed November 2018.

[6] Source: Voice as a Channel of Commerce, Business Insider Intelligence, accessed November 2018.

[7] Gonzalez, Angel. “Amazon’s Alexa could become $10 billion business by 2020, RBC analysts estimate” Seattle Times, March 10, 2017, https://www.seattletimes.com/business/amazon/amazons-alexa-could-become-10-billion-business-by-2020-rbc-analysts-estimate/, accessed November 2018.

[8] Collins, Keith, and Cade Metz. “Alexa vs. Siri vs. Google: Which Can Carry on a Conversation Best?” The New York Times, August 17, 2018, https://www.nytimes.com/interactive/2018/08/17/technology/alexa-siri-conversation.html, accessed November 2018.

[9] Source: Echo Dot Leads the Way for Amazon’s Holiday Push, Business Insider Intelligence, accessed November 2018

[10] Source: Visual Displays will Help Voice Reach its Retail Potential, Business Insider Intelligence, accessed November 2018

[11] Source: Voice as a Channel of Commerce, Business Insider Intelligence, accessed November 2018.

[12] Source: Amazon Seeks to Boost User Retention for Alexa Skills, Business Insider Intelligence, accessed November 2018.

As voice recognition improves, I do believe its integration into consumer purchasing will increase marginally but certainly not compete with the standard methods like a phone or computer. It is simply the nature of speaking that one can not vocally output data faster than typing and clicking on items on their phone. Also the fact that people are potentially willing to buy office supplies via Alexa but not basically everything else is disconcerting. Additionally, adding a screen to Alexa would basically just turn it into a clunky iphone and I am very suspicious that 38% of people would want more ads in their life. Overall, I am bearish on voice to shop technology in the near term; maybe Alexa should stick with trivia questions and weather for now.

This is a really interesting article. Personally, I have significant reservations about using voice to order online products. I spend a lot of time online to find the best of each product, even if it is something as trivial as sponges. I think one way that Alexa could be used is to replace those instant replenishment buttons. You can preset certain commands like “Alexa order me more paper towels” and it automatically orders the product that you selected.

An article well poised to illustrate Amazon’s ever expanding go-to-market. In the case of Alexa, I think its biggest functional opportunities lie in going from simply an Amazon alternative, to an interactive shopping assistant that helps the user identify and recommend which products to go after. In the veins of the IBM Watson, if it could be programmed to more subtly understand human speech it could eventually be an in home shopping assistant that replaces the in store experience. For example if it could interpret consumer “pain points”, such as “My hair looks like a mess and I have a dinner soon” it could recommend product to actually help tackle that issue, and then effectively cross-sell (ie, offer do it yourself hair kits, followed by hair gel and treatment products).

Great topic. I had a slightly different take on the impetus behind Amazon’s decision to move into voice. To me, it was more a play on the Internet of Things and the connected home of the future than related to voice shopping directly. I think they were trying to build the central hub from which other products would interact with the customer, and if Echo really becomes that hub over the next few years, they can start charging other developers fees to have products work with their platform (i.e. create a closed ecosystem) since they’ll already have so much market share. On the voice side, I think a great leap for the application of machine learning here will be when Alexa links up with sensors to figure out when certain supplies are low and proactively reach out saying: “Hey, your orange juice is running low. Would you like me to order more from Whole Foods?” instead of customers having to ask it to do so.

A really interesting piece on Alexa. While initially pessimistic about the future of voice shopping, I do think there are a number of features that can address customer pain points when it comes to voice shopping. One could be a feature where the AI behind Alexa could identify the most consistent themes across reviews of the product and list them out to the user. This, combined with Amazon’s 30 day return policy, could be a useful offering for consumers, especially with lower cost purchases. With regards to the first question you raised, I believe it is important for the voice shopping experience to be as consistent as possible across all merchants. Any differences would frustrate users, especially given Alexa’s limited ability to respond to a user’s questions if any confusion arises.