Adidas: Supply Chain as Competitive Advantage

As in the case of Adidas, increasing sales may help reframe the business case for supply chain improvement. Once the fundamentals of inventory accuracy and data abundance have been established, there are many other opportunities for improvement.

“We will become the first true fast sports company,” Adidas Group CEO Herbert Hainer [1]

Retail today: “when can I get it”

Amid buzz around the retail apocalypse and Amazon’s latest conquest, retailers are fighting to find ways to meet customer demands and make a profit doing so. One heralded strategy is supply chain optimization: creating an “omni-channel supply chain that not only optimizes fulfillment of current inventory but predicts and responds to trends that shape and localize future demand” [2].

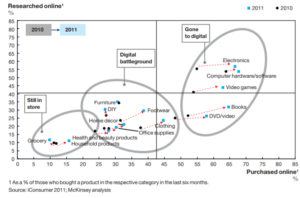

Almost no retailer can avoid innovating. More and more categories are moving into the digital battleground, competing with the endless aisle and 2-day promise offered by Amazon [3].

Supply chain executives largely agree that digital supply chain is the future. In a 2016 survey of supply chain professionals, 80% of respondents believe that the digital supply chain will be the predominant model within the next five years [4]. That implies a fast growth rate given that only 16% say digital supply chain is a reality today [4]. However, the main barriers to adoption are lack of a clear business case to underpin the required investment as well as the challenge of finding and retaining the talent needed to make full use of the technology [4]. Adidas has found a way to overcome implementation challenges to reap the competitive advantage of an increasingly agile supply chain.

Adidas supply chain digitization

Adidas has had considerable success implementing supply chain digitization to improve sales. In Russia, the company enabled its omni-channel strategy through three main initiatives: RFID tracking, “click and collect”, and “ship from store” features [5].

RFID tracking, which Adidas deployed across 450 Russian stores, improved NPS scores by helping store associates accurately inform customers of style and size availability [6]. Adidas’ RFID system also laid the foundation for rigorous inventory management, a precursor to true omni-channel capabilities.

One of these capabilities is “click and collect”, allowing customers to buy online but pick up the product in-store. “Click and collect” volume was so high in early days that it warranted pulling back the feature and building out supply chain functionality to support it [5].

The “ship from store” was likewise a hit with customers because it enabled faster receipt of products than warehouse shipping but without the hassle of a trip to the store [5].

Looking forward

As in the case of Adidas, increasing sales may help reframe the business case for supply chain improvement. Once the fundamentals of inventory accuracy and data abundance have been established, there are many other opportunities for improvement.

The first step, which Adidas seems to have begun, is to consolidate inventories between online and in-store. Full implementation will help Adidas rationalize their distribution centers.

Another idea is to use data analytics to further optimize product portfolio, distributors, and logistics. Understanding which SKUs are more likely to be returned or stagnate in inventory could inform design-related and purchase decisions. One step further is to integrate customer information, RFID tracking, and location beacons to track which products are catching the interest of which potential customers. Those products could then be pushed through the supply chain more quickly to deliver hot items to places where demand is highest. Finally, overlaying sales and interest data with distributor stores could help Adidas in negotiations and intelligent distribution design.

Another response to the digitization of retail supply chains is to invest in 3D printing. Adidas has already partnered with Carbon Inc, a 3D printing startup [7]. Together they are piloting a process to mass produce highly customized FutureCraft 4D shoe. In the future, the production process would enable bespoke product production in a short period of time, revolutionizing the supply chain. (725 words)

Open questions

The retail industry will likely be pushed to digitize supply chains, much like Adidas. It remains to be seen whether supply chain competitiveness will be the key driver of success in the future retail landscape. Will low delivery and inventory costs determine which retailers win or lose? As Adidas continues to innovate, how will it turn new data sources into better products for its customers?

Sources:

[1] Strategy Overview. (n.d.). Retrieved November 14, 2017, from https://www.adidas-group.com/en/group/strategy-overview/

[2] McDivitt, C. (n.d.). 2016 Retail Trend 4: Optimized and Predictive Supply Chains. Retrieved November 15, 2017, from https://www.capgemini.com/2016/01/2016-retail-trend-4-optimized-and-predictive-supply-chains/

[3] Chaturvedi, N., Martich, M., Ruwadi, B., Ulker, N. McKinsey The Future of Retail Supply Chains

[4] Deloitte. The 2016 MHI Annual Industry Report. Accelerating change: How innovation is driving digital, always-on supply chains.

[5] Benton, D. (2017, March 29). Dale Benton. Retrieved November 15, 2017, from http://www.supplychaindigital.com/scm/supply-chain-40-adidas-and-amazon-re-write-rules-supply-chain-management

[6] How Lululemon and Adidas Use RFID to Set the Stage for Omnichannel. (n.d.). Retrieved November 15, 2017, from https://apparelmag.com/how-lululemon-and-adidas-use-rfid-set-stage-omnichannel.

[7] The Perfect Fit: Carbon Adidas Collaborate to Upend Athletic Footwear. (n.d.). Retrieved November 15, 2017, from https://www.carbon3d.com/stories/adidas/

Thanks for posting such an interesting article.

You pose an interesting question about what will be the key driver of success in the future retail landscape. In the short term, digitization may be quite a differentiating factor. Companies that integrate technology into their supply chain might gain share, as they serve their customers new and innovative designs quicker than their competitors.

In the long term, however, I don’t believe the competitive advantage will persist. For example, it is possible that 3D printing will become the primary method of manufacturing retail products. If this is the case, there might be a short period during which the companies that are best capitalized and can most afford investing in the new technology will have a competitive advantage. However, in steady state, as the 3D printing technology proliferates and becomes cheaper, all competitors will likely adopt it, which will level the playing field once again. At that point, I believe it will be innovative design and customer experience that will primarily determine which companies gain share.

Ultimately, I believe we are at a turning point where supply chain digitization is becoming a requirement to continue to compete in the market, but once the majority of players adopt it, it may no longer be a differentiating factor of success.

Thank you for writing this awesome article!

I liked what you wrote about Adidas’s ability to start to identify which SKUs are selling, which might be returned, etc. to do a better job of inventory planning. There are many obvious ways to improve the supply chain reactively. I wonder how much of Adidas’s product development might start being proactive – can they start actually DEVELOPING products based on user data/analytics, etc. Can they get ahead of the curve with making new products and start dictating user demand?

Omnichannel inventory visibility has been all the rage in the retail space over the past decade. Companies such as Nordstrom’s, Dick’s Sporting Goods, Nike, and Adidas have invested millions of dollars in both creating inventory visibility across their marketplaces and leveraging their brick and mortar presence as “mini distribution centers”. The interesting question going forward will be how much further brands and retailers will need to take this capability. Consumers are increasingly brand disloyal and value convenience and cost above all else. With that in mind, does it make sense for brands like Adidas to partner with some their retailers (Foot Locker, Nordstrom, etc) to expand the reach of their inventory visibility. And to an even more extreme degree, is there a world in which they might pool inventory in an effort to reduce aggregate inventory carrying costs across the marketplace? These questions become all the more relevant in the face of Amazon and its push into the apparel / footwear space with its private label and branded product offerings.